Monday, January 15th 2018

The Balloon Falls: Memory Chip Price Decrease in Q4 2017 Prompts Investor Fear

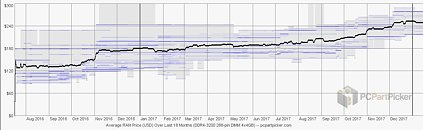

Reuters reports that a sudden (if ridiculous) 5% drop in memory chip prices in Q4 2017 has brought revenue expectations and investors' profit measurements to a teetering halt. 5% may not look like much - it certainly isn't much when we look at the historic price increases that almost doubled the cost of DDR4 memory kits, as you can see in the PC Part Picker chart below. This memory module price chart doesn't include the 5% drop yet, probably because it takes time for memory chip pricing to materialize in end-user module pricing. But for investors, it's like a spark in a paper archive - it could signal an impending price decrease that would push all profit estimates out the window.

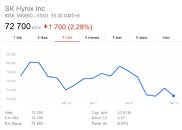

This 5% drop in pricing has prompted industry analysts to review their profit estimates for 2018, and expect that the memory industry's growth rate will fall by more than half this year to 30 percent. You read that right - investors are scared because growth rates will be 30 percent instead of 60 percent. Oh the joys of inflated pricing, and slower-than-usual ramp-up to keep demand higher than supply. The joys of economic capitalism, where prices for consumers go up, and an industries' value skyrockets by more than 70$ in a single year (2017).This news led to a knee-jerk reaction from investors and the stock market for memory manufacturers as a whole, though; Samsung shares dipped 7.5 percent last week, while SK Hynix's fell 6.2 percent (January 6th seems to be the tipping point). But analysts say that there is unlikely to be a sudden crash, and that 2018 should still be a relatively stable year for chipmakers. This is due to the ever increasing memory demands of smartphones - average DRAM memory of new smartphone models launched last quarter increased by 38 percent from the second quarter of 2016, while NAND content measured by gigabyte jumped a staggering 84 percent, according to an analysis by BNP Paribas, as reported by Reuters.Analyst firm Macquarie estimates Samsung's chip division's operating profit margin jumped to 47 percent last year from 26.5 percent in 2016, and will rise further to 55.5 percent this year. DRAM manufacturers' rush to ramp up production - quadrupling manufacturing investment for 2017 and 2018 combined to $38 billion from 2016's $10 billion - prices may decline as much as 18 percent next year, according to brokerage firm Nomura.

Such solid demand will keep the industry's margin healthy this year, and chipmakers' investment in more advanced technology will help them cut production costs and stay profitable even as prices ease, analysts say.

Sources:

Reuters, PC Part Picker

This 5% drop in pricing has prompted industry analysts to review their profit estimates for 2018, and expect that the memory industry's growth rate will fall by more than half this year to 30 percent. You read that right - investors are scared because growth rates will be 30 percent instead of 60 percent. Oh the joys of inflated pricing, and slower-than-usual ramp-up to keep demand higher than supply. The joys of economic capitalism, where prices for consumers go up, and an industries' value skyrockets by more than 70$ in a single year (2017).This news led to a knee-jerk reaction from investors and the stock market for memory manufacturers as a whole, though; Samsung shares dipped 7.5 percent last week, while SK Hynix's fell 6.2 percent (January 6th seems to be the tipping point). But analysts say that there is unlikely to be a sudden crash, and that 2018 should still be a relatively stable year for chipmakers. This is due to the ever increasing memory demands of smartphones - average DRAM memory of new smartphone models launched last quarter increased by 38 percent from the second quarter of 2016, while NAND content measured by gigabyte jumped a staggering 84 percent, according to an analysis by BNP Paribas, as reported by Reuters.Analyst firm Macquarie estimates Samsung's chip division's operating profit margin jumped to 47 percent last year from 26.5 percent in 2016, and will rise further to 55.5 percent this year. DRAM manufacturers' rush to ramp up production - quadrupling manufacturing investment for 2017 and 2018 combined to $38 billion from 2016's $10 billion - prices may decline as much as 18 percent next year, according to brokerage firm Nomura.

Such solid demand will keep the industry's margin healthy this year, and chipmakers' investment in more advanced technology will help them cut production costs and stay profitable even as prices ease, analysts say.

39 Comments on The Balloon Falls: Memory Chip Price Decrease in Q4 2017 Prompts Investor Fear

Anyway, I'm more inclined to think manufacturers are colluding again. My initial post was more of reaction to the OP which seemed to imply that's capitalism at work. At that's not the case, if it's indeed collusion, it's an illegal side effect.Unlike socialism, in capitalism investing in order to make a profit is actually a legit goal. You'd be doing it as well, except judging by your comment, you lack the resources.

The problem is that "investors" sell themselves as "innovators" and "creators of growth", which is absolute BS. The only growth they create is in their own net worth. The vast majority of economic growth (and technological improvement, and so on and so on) in the world ultimately stems from public spending - education, research (specific grants and university funding both), public loans, tax breaks and other public incentives - and the actual effect of venture capitalism and for-profit investment funds is negligible. If it wasn't for public funds, there'd be barely anything at all for investors to invest in. Investors' belief in their own self-image comes from the thoroughly disproved doctrine of trickle-down economics, which is ultimately an excuse for self-enrichment through capitalist/economic libertarian ideology. The financial elites love to portray themselves as the saviours of mankind, as the people who lead mankind forward. If this was indeed the case, given how "successful" these branches of society have been lately, we wouldn't have the explosive growth of income inequality and wealth inequality that we've seen in recent years.Not quite. The "game the system and utilize every trick available, legality and human consequences be damned" part of their brains is quite overdeveloped. Sense of community, interest in furthering society, or other rather fundamentally human brain-functions seem to be underdeveloped, though.Don't be daft. If the only alternative you can see to unregulated, free-for-all predatory capitalism is "give stuff away for free", your imagination is what's lacking, not my argumentation. I'm simply arguing that profit-only/profit at all costs-motivated investment is ultimately detrimental to humanity (seeing how we can't eat money and so on - money is a means to an end, not an end in itself). There are plenty of other possible motivations to invest in companies, ideas, start-ups, research and so on, most of which don't at all stand in the way of making a profit. For example, investors could be motivated by making [insert whatever you'd like to invest in] cheap and accessible to all, improving the environmental impact of [X], ensuring fair working conditions in poor parts of the world/countries without good worker protection laws, and a whole host of other motivations that actually make the world a better place while not at all precluding profits (sure, they might be a bit lower or harder to come by, but how does that matter?). I'm simply arguing against the logic that says (in its ultimate form) that shutting down a factory might be more profitable than selling low-margin products - which is not at all an uncommon logic in financial circles.

Lead by example , right ? You've all seen enough of these theoretical economists proposing miraculous alternatives to being a "capitalist scum".

Is this some kind capitalist vs populism discussion.

Apparently. It happens quite often here whenever things get too expensive for what some people feel they should cost.

*ok, the forum features appear to have gone crazy, judging by the way two posts in a row were quoted.

Is there a tendency that a****le companies grow huge? Absolutely. Assuming that's because they're the "best" companies is hopelessly naive, however. They grow large because they game the system, use any and all tricks available to them, and are constantly looking for growth opportunities (including driving competitors to bankruptcy through illegal or semi-illegal business practices). Companies with idealistic or non-profit goals are less expansionist, more focused on whatever problem they seek to solve, and as such don't expand in the same way. It's a fundamental, ideological difference, which is why we don't see massive non-profit companies. I don't see the need for idealist companies to adopt more predatory capitalist trappings to grow larger, but there's definitely a need for predatory capitalists to adopt more ideals across the board.

Also, where did I use the term "capitalist scum"? I said "predatory capitalist swine". That's a pretty clear distinction.

Still, as you seemingly need to be spoon-fed this, here's a list of possible things large multinational corporations could do to not be predatory capitalist swine:

-stop dodging taxes; stop using tax havens; stop demanding tax breaks to relocate or open new sites

-accept whatever negative consequences (environmental, social, economical, so on) your activity might have and do what you can to alleviate this in all stages of your product's lifetime

-if you have tons of money left over - don't hoard it. Money hoards are objectively bad for local and international economies. Give them to charities, give your employees (no, not executives) bonuses, invest in start-ups, give to charity - the list of possibilities here are pretty much endless, and all of them would have more of a positive effect than hoarding money.

-promote and live by transparency as an ideal

-stop thinking that "MOAR MONEY === BETTAR". See above.

All of the above apply just as much to investors, really. Sure, they have more reason to keep heaps of money lying around. But ultimately, if their goal is only to increase the size of that heap, not only is it a hopelessly shallow and empty goal, but one that does absolutely nothing to make the world a better place for anyone except yourself. If something like that happens, it's purely a happy coincidence.

You can whine all you want about it , it's your choice , but if such things were to be enforced it would clash with the very fundamentals of freedom.