TSMC Reports Record January Revenues

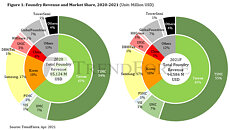

Based on TSMC's official January 2022 revenue report, it looks like the company is set for another great year. Month-on-month revenues are up by 10.8 percent compared to December of last year and year-on-year revenues are up a whopping 35.8 percent. In actual money, that corresponds to a revenue of NT$172.18 billion, or roughly US$6.18 billion, so we're not talking about small potatoes here.

TSMC is forecasting a growth in sales of between 25 to 29 percent this year, assuming they can continue to deliver as expected to their customers. The first quarter sales are expected to land between US$16.6 and 17.2 billion, or around a 7.4 percent increase compared to last quarter. Its closest competitor in Taiwan also announced record profits, although at a mere NT$20.47 billion or about US$735 million. This is a month-to-month increase of a mere 0.95 percent, but an annual increase of a healthy 31.83 percent. UMC is expecting to be operating at full capacity for the remainder of this year, although no additional production capacity is expected. The company is said to be increasing its prices by five percent this year.

TSMC is forecasting a growth in sales of between 25 to 29 percent this year, assuming they can continue to deliver as expected to their customers. The first quarter sales are expected to land between US$16.6 and 17.2 billion, or around a 7.4 percent increase compared to last quarter. Its closest competitor in Taiwan also announced record profits, although at a mere NT$20.47 billion or about US$735 million. This is a month-to-month increase of a mere 0.95 percent, but an annual increase of a healthy 31.83 percent. UMC is expecting to be operating at full capacity for the remainder of this year, although no additional production capacity is expected. The company is said to be increasing its prices by five percent this year.