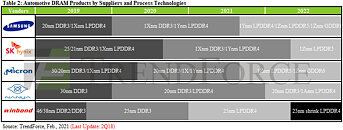

Samsung Begins Mass Production of Comprehensive Automotive Memory Solutions for Next-Generation Autonomous Electric Vehicles

Samsung Electronics Co., Ltd., the world leader in advanced memory technology, today unveiled an extensive lineup of cutting-edge automotive memory solutions designed for next-generation autonomous electric vehicles. The new lineup includes a 256-gigabyte (GB) PCIe Gen3 NVMe ball grid array (BGA) SSD, 2 GB GDDR6 DRAM and 2 GB DDR4 DRAM for high-performance infotainment systems, as well as 2 GB GDDR6 DRAM and 128 GB Universal Flash Storage (UFS) for autonomous driving systems.

"With the recent proliferation of electric vehicles and the rapid advancement of infotainment and autonomous driving systems, the semiconductor automotive platform is facing a paradigm shift. What used to be a seven to eight-year replacement cycle is now being compressed into a three to four-year cycle, and at the same time, performance and capacity requirements are advancing to levels commonly found in servers," said Jinman Han, executive vice president and head of Memory Global Sales & Marketing at Samsung Electronics. "Samsung's reinforced lineup of memory solutions will act as a major catalyst in further accelerating the shift toward the 'Server on Wheels' era."

"With the recent proliferation of electric vehicles and the rapid advancement of infotainment and autonomous driving systems, the semiconductor automotive platform is facing a paradigm shift. What used to be a seven to eight-year replacement cycle is now being compressed into a three to four-year cycle, and at the same time, performance and capacity requirements are advancing to levels commonly found in servers," said Jinman Han, executive vice president and head of Memory Global Sales & Marketing at Samsung Electronics. "Samsung's reinforced lineup of memory solutions will act as a major catalyst in further accelerating the shift toward the 'Server on Wheels' era."