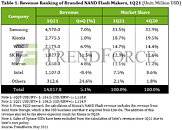

Bloated Inventory and Manufacturers Sacrificing Pricing for Sales, Consumer DRAM Price Decline Expands to 13~18%, Says TrendForce

According to TrendForce investigations into the DRAM market, under pressure from ever-increasing output, Korean manufacturers have significantly increased their willingness to compromise on pricing in order to stimulate buying from distributors and customers, leading to a steady expansion of falling prices. In addition to Korean manufacturers enthusiastically slashing prices, low-priced chips from the spot market are also circulating in the market. Other suppliers have no choice but to follow suit and fervently reduce pricing for sales, rapidly exacerbating the 3Q consumer DRAM price drop from the original estimate of 8~13% to a quarterly decline of 13-18%.

Looking forward to Q4, it will be difficult for stocking momentum to recover before terminal inventories have been completely depleted. TrendForce expects the price of consumer DRAM to continue to fall until oversupply in the market is alleviated. Thus, consumer DRAM pricing will carry on moving lower by another 3~8% in Q4 and the possibility of sustained decline cannot be ruled out.

Looking forward to Q4, it will be difficult for stocking momentum to recover before terminal inventories have been completely depleted. TrendForce expects the price of consumer DRAM to continue to fall until oversupply in the market is alleviated. Thus, consumer DRAM pricing will carry on moving lower by another 3~8% in Q4 and the possibility of sustained decline cannot be ruled out.