Thursday, January 19th 2012

Intel Reports Record Year $54 Billion in Annual Revenue Up 24 Percent

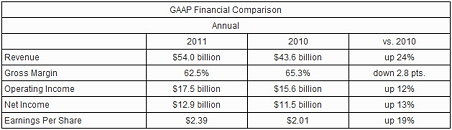

Intel Corporation today reported full-year revenue of $54 billion, operating income of $17.5 billion, net income of $12.9 billion and EPS of $2.39 - all records. The company generated approximately $21 billion in cash from operations, paid dividends of $4.1 billion and used $14.1 billion to repurchase 642 million shares of stock.

For the fourth quarter, Intel posted revenue of $13.9 billion, operating income of $4.6 billion, net income of $3.4 billion and EPS of 64 cents. The company generated approximately $6.6 billion in cash from operations, paid dividends of $1.1 billion and used $4.1 billion to repurchase 174 million shares of stock."2011 was an exceptional year for Intel," said Paul Otellini, Intel president and CEO. "With outstanding execution the company performed superbly, growing revenue by more than $10 billion and eclipsing all annual revenue and earnings records. With a tremendous product and technology pipeline for 2012, we're excited about the global growth opportunities presented by Ultrabook systems, the data center, security and the introduction of Intel-powered smartphones and tablets."

Business Outlook

Intel's Business Outlook does not include the potential impact of any mergers, acquisitions, divestitures or other business combinations that may be completed after Jan. 19.

Q1 2012 (GAAP, unless otherwise stated)

- Revenue: $12.8 billion, plus or minus $500 million.

- Gross margin percentage: 63 percent and 64 percent Non-GAAP (excluding amortization of acquisition-related intangibles), both plus or minus a couple percentage points.

- R&D plus MG&A spending: approximately $4.4 billion.

- Amortization of acquisition-related intangibles: approximately $75 million.

- Impact of equity investments and interest and other: approximately zero.

- Depreciation: approximately $1.5 billion.

Full-Year 2012 (GAAP, unless otherwise stated)

- Gross margin percentage: 64 percent and 65 percent Non-GAAP (excluding amortization of acquisition-related intangibles), both plus or minus a few percentage points.

- Spending (R&D plus MG&A): $18.3 billion, plus or minus $200 million.

- R&D spending: approximately $10.1 billion.

- Amortization of acquisition-related intangibles: approximately $300 million.

- Depreciation: $6.5 billion, plus or minus $100 million.

- Tax Rate: approximately 29 percent.

- Full-year capital spending: $12.5 billion, plus or minus $400 million.

For the fourth quarter, Intel posted revenue of $13.9 billion, operating income of $4.6 billion, net income of $3.4 billion and EPS of 64 cents. The company generated approximately $6.6 billion in cash from operations, paid dividends of $1.1 billion and used $4.1 billion to repurchase 174 million shares of stock."2011 was an exceptional year for Intel," said Paul Otellini, Intel president and CEO. "With outstanding execution the company performed superbly, growing revenue by more than $10 billion and eclipsing all annual revenue and earnings records. With a tremendous product and technology pipeline for 2012, we're excited about the global growth opportunities presented by Ultrabook systems, the data center, security and the introduction of Intel-powered smartphones and tablets."

Business Outlook

Intel's Business Outlook does not include the potential impact of any mergers, acquisitions, divestitures or other business combinations that may be completed after Jan. 19.

Q1 2012 (GAAP, unless otherwise stated)

- Revenue: $12.8 billion, plus or minus $500 million.

- Gross margin percentage: 63 percent and 64 percent Non-GAAP (excluding amortization of acquisition-related intangibles), both plus or minus a couple percentage points.

- R&D plus MG&A spending: approximately $4.4 billion.

- Amortization of acquisition-related intangibles: approximately $75 million.

- Impact of equity investments and interest and other: approximately zero.

- Depreciation: approximately $1.5 billion.

Full-Year 2012 (GAAP, unless otherwise stated)

- Gross margin percentage: 64 percent and 65 percent Non-GAAP (excluding amortization of acquisition-related intangibles), both plus or minus a few percentage points.

- Spending (R&D plus MG&A): $18.3 billion, plus or minus $200 million.

- R&D spending: approximately $10.1 billion.

- Amortization of acquisition-related intangibles: approximately $300 million.

- Depreciation: $6.5 billion, plus or minus $100 million.

- Tax Rate: approximately 29 percent.

- Full-year capital spending: $12.5 billion, plus or minus $400 million.

20 Comments on Intel Reports Record Year $54 Billion in Annual Revenue Up 24 Percent

Great avitar, BTW.

most chips used to be under $250 but now most are $200 and up

The official poverty measure is published by the United States Census Bureau and shows that:

In 2010, 46.9 million people were in poverty, up from 37.3 million in 2007 -- the fourth consecutive annual increase in the number of people in poverty . This is the largest number in the 52 years for which poverty rates have been published (DeNavas-Walt 2011, p. 14).

source: www.worldhunger.org/articles/Learn/us_hunger_facts.htm

just guessing GPUs saving their budget.

People wonder whats wrong with America.Some have lost all touch with what poverty is or means......... :shadedshu