Thursday, July 17th 2014

Seagate Technology Reports Fiscal Fourth Quarter and Fiscal Year 2014 Results

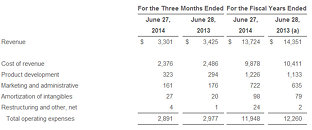

Seagate Technology plc today reported financial results for the quarter and fiscal year ended June 27, 2014. For the fourth quarter, the Company reported revenue of approximately $3.3 billion, gross margin of 28.0%, net income of $320 million and diluted earnings per share of $0.95. On a non-GAAP basis, which excludes the net impact of certain items, Seagate reported gross margin of 28.5%, net income of $370 million and diluted earnings per share of $1.10.

During the fourth quarter, the Company generated approximately $577 million in operating cash flow and returned $166 million to shareholders in the form of dividends and share redemptions.For the fiscal year ended June 27, 2014, the Company reported revenue of $13.7 billion, gross margin of 28.0%, net income of $1.6 billion and diluted earnings per share of $4.52. On a non-GAAP basis, Seagate reported gross margin of 28.5%, net income of $1.8 billion and diluted earnings per share of $5.04.

In fiscal year 2014, the Company returned $2.5 billion to shareholders in the form of dividends and share redemptions. The Company also successfully raised $1.8 billion in investment grade debt in fiscal 2014, extending its weighted average maturity to approximately 7 years and decreasing its weighted average interest to approximately 5%. Cash, cash equivalents, restricted cash, and short-term investments totaled approximately $2.7 billion at the end of the fiscal year. There were 327 million ordinary shares issued and outstanding as of the end of the fiscal year.

"Throughout fiscal year 2014, Seagate delivered strong financial and operational performance and returned significant value to shareholders. We made strategic investments in our technology portfolio, which enabled us to continue to innovate into higher capacity and power efficient storage solutions, and expanding our capabilities to serve a broader storage customer base in the future through new cloud systems and solutions and flash technology for connected storage," said Steve Luczo, Seagate's chairman and chief executive officer.

"The shifting information technology market dynamics are disrupting the traditional storage industry in meaningful ways and continue to create more opportunities for Seagate. As we plan for our next fiscal year, we remain focused on investing in our storage technology product portfolio to deliver high quality storage products and solutions for our customers, as well as continuing to create long-term value for our shareholders."

During the fourth quarter, the Company generated approximately $577 million in operating cash flow and returned $166 million to shareholders in the form of dividends and share redemptions.For the fiscal year ended June 27, 2014, the Company reported revenue of $13.7 billion, gross margin of 28.0%, net income of $1.6 billion and diluted earnings per share of $4.52. On a non-GAAP basis, Seagate reported gross margin of 28.5%, net income of $1.8 billion and diluted earnings per share of $5.04.

In fiscal year 2014, the Company returned $2.5 billion to shareholders in the form of dividends and share redemptions. The Company also successfully raised $1.8 billion in investment grade debt in fiscal 2014, extending its weighted average maturity to approximately 7 years and decreasing its weighted average interest to approximately 5%. Cash, cash equivalents, restricted cash, and short-term investments totaled approximately $2.7 billion at the end of the fiscal year. There were 327 million ordinary shares issued and outstanding as of the end of the fiscal year.

"Throughout fiscal year 2014, Seagate delivered strong financial and operational performance and returned significant value to shareholders. We made strategic investments in our technology portfolio, which enabled us to continue to innovate into higher capacity and power efficient storage solutions, and expanding our capabilities to serve a broader storage customer base in the future through new cloud systems and solutions and flash technology for connected storage," said Steve Luczo, Seagate's chairman and chief executive officer.

"The shifting information technology market dynamics are disrupting the traditional storage industry in meaningful ways and continue to create more opportunities for Seagate. As we plan for our next fiscal year, we remain focused on investing in our storage technology product portfolio to deliver high quality storage products and solutions for our customers, as well as continuing to create long-term value for our shareholders."

Comments on Seagate Technology Reports Fiscal Fourth Quarter and Fiscal Year 2014 Results

There are no comments yet.