Thursday, July 17th 2014

AMD Reports 2014 Second Quarter Results

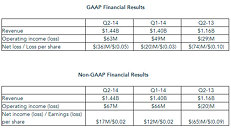

AMD today announced revenue for the second quarter of 2014 of $1.44 billion, operating income of $63 million and net loss of $36 million, or $0.05 per share. Non-GAAP operating income was $67 million and non-GAAP net income, which primarily excludes $49 million of loss from debt redemption in the quarter, was $17 million, or $0.02 per share.

"The second quarter capped off a solid first half of the year for AMD with strong revenue growth and improved financial performance," said Rory Read, AMD president and CEO. "Our transformation strategy is on track and we expect to deliver full year non-GAAP profitability and year-over-year revenue growth. We continue to strengthen our business model and shape AMD into a more agile company offering differentiated solutions for a diverse set of markets."Quarterly Financial Summary

For the third quarter of 2014, AMD expects revenue to increase 2 percent, plus or minus 3 percent, sequentially.

"The second quarter capped off a solid first half of the year for AMD with strong revenue growth and improved financial performance," said Rory Read, AMD president and CEO. "Our transformation strategy is on track and we expect to deliver full year non-GAAP profitability and year-over-year revenue growth. We continue to strengthen our business model and shape AMD into a more agile company offering differentiated solutions for a diverse set of markets."Quarterly Financial Summary

- Gross margin was 35 percent in Q2 2014.

Gross margin was flat sequentially. - Cash, cash equivalents and marketable securities were $948 million at the end of the quarter, significantly higher than the target minimum of $600 million and close to the optimal zone of $1 billion.

- Total debt at the end of the quarter was $2.21 billion, an increase from $2.14 billion at the end of Q1 2014.

During Q2 2014, the company continued re-profiling its near-term debt maturities, issuing $500 million in aggregate principal amount of 7.00% Senior Notes due 2024 and repurchasing all $452 million aggregate principal amount of the company's outstanding 8.125% Senior Notes due 2017. - Computing Solutions segment revenue increased 1 percent sequentially and decreased 20 percent year-over-year. The year-over-year decline was due to decreased microprocessor unit shipments.

Operating income was $9 million, an improvement from an operating loss of $3 million in Q1 2014 and operating income of $2 million in Q2 2013. The sequential increase was primarily driven by improved gross margin due to a richer mix of notebook products while the year-over-year increase was primarily driven by lower operating expenses.

Microprocessor average selling price (ASP) increased sequentially and year-over-year. - Graphics and Visual Solutions segment revenue increased 5 percent sequentially and 141 percent year-over-year driven largely by increased semi-custom SoC shipments. Graphics processor unit (GPU) revenue decreased sequentially and year-over-year, primarily due to a decrease in AIB channel sales, partially offset by increased sales of professional graphics and desktop OEM GPUs.

Operating income was $82 million compared with $91 million in Q1 2014 and breakeven in Q2 2013. The sequential decline was primarily due to lower GPU revenue, while the year-over-year increase was driven by increased sales of semi-custom SoCs.

GPU ASP decreased sequentially and year-over-year, primarily driven by lower AIB channel sales.

- AMD unveiled further details on its ambidextrous computing roadmap, including a 64-bit ARM architecture license and plans to develop custom high-performance ARM and x86 processor cores for 2016. The company's differentiated x86 and ARM strategy is designed to deliver unmatched computing and graphics performance using a shared, flexible infrastructure to drive new innovations.

- AMD appointed Dr. Lisa Su to Chief Operating Officer, responsible for overseeing the company's previously separate global operations, operating segments and sales organization to drive growth in both traditional PC and adjacent markets.

- AMD realigned its organization structure to deliver unmatched customer value in both traditional PC markets and adjacent high-growth markets. Effective July 1, 2014, AMD's two new reportable segments are as follows:

Computing and Graphics segment, which will primarily include desktop and notebook processors and chipsets, discrete GPUs and professional graphics;

Enterprise, Embedded and Semi-Custom segment, which will primarily include server and embedded processors, dense servers, semi-custom SoC products, development services and technology for game consoles.

AMD's Quarterly Report on Form 10-Q for the quarter ended September 27, 2014 will reflect this new segment reporting structure. - AMD detailed its plans to accelerate the energy efficiency of its accelerated processing units (APUs) delivering 25x efficiency improvements by 2020 through design optimizations, intelligent power management and Heterogeneous System Architecture advances that are expected to enable AMD to outpace the industry's historical energy efficiency trend by at least 70 percent.

- AMD continued to gain momentum with its embedded products in the second quarter.

The company introduced the 2nd-generation embedded R-Series APU as well as the AMD embedded G-Series SoC and CPU solutions, which will power HP thin clients and Advantech's new embedded industrial solution and are ideally suited for ATMs, kiosks and medical equipment applications.

AMD embedded Radeon graphics were selected by Boeing for its next-generation advanced cockpit display systems. - AMD publicly demonstrated for the first time its 64-bit ARM-based AMD Opteron A-Series processor, codenamed "Seattle," a significant step forward in expanding the footprint of ultra-efficient 64-bit ARM solutions for cloud computing and the Internet of Things.

- AMD expanded its mobile APU offerings in the quarter:

Acer, Dell, HP and Lenovo have all introduced notebooks powered by AMD's newest 3rd-generation mainstream mobile APUs, which combine category-leading compute performance with unique features and rich user interactions.

AMD also launched its most advanced mobile APUs for consumer and commercial notebooks. The new 2014 performance mobile APUs include AMD's first FX-branded enthusiast class APU for notebooks as well as AMD Pro A-Series APUs. HP is offering the AMD PRO A-Series APUs across its Elite 700-Series notebooks, desktops and all-in-ones, with additional OEMs expected to introduce systems later this year. - AMD expanded its 2nd-generation Graphics Core Next-based professional graphics solutions with the introduction of the AMD FirePro W8100 professional graphics card, which delivers 38x more performance than the closest competitive offerings based on double precision testing. Dell, HP and more than 10 workstation system integrators have all announced systems featuring the new card.

- AMD's groundbreaking Mantle API, which creates more immersive experiences that take fuller advantage of modern APUs and GPUs to deliver console-like experiences, will be used by Electronic Arts in the upcoming Battlefield Hardline, Dragon Age: Inquisition and Plants vs. Zombies: Garden Warfare games. More than 40 game titles supporting Mantle are in development with more than 50 developers actively working with the API for future titles.

For the third quarter of 2014, AMD expects revenue to increase 2 percent, plus or minus 3 percent, sequentially.

30 Comments on AMD Reports 2014 Second Quarter Results

only 1.44 billion...

Someone is pocketing money.

More than likely its for tax reasons, build more infrastructure and expand. Then sell your product at lower margins so you artificially create a loss or a break even on paper.

Also, the previous years AMD made huge losses which are deducted from their profit in the fore-coming years. So the total will be smaller artificially on paper.

- New tech next gen coming late 2016 (CPU/APU/GPU on 20nm) Probably talking about K12 and GCN 3.0

- Currently using 50% of GlobalFoundry wafers

- Seattle to enter production in Q4

They are blaming the Q slow down on the crypto currency dry up and flood of second hand sales of those CPU/GPU into the market.If anything it seems to be contracting. In recent times it has divested itself of its foundry business, it's mobile, baseband, and set top business to Qualcomm and Broadcom, sold its property assets, and just recently made the decision to axe a substantial part of its datacenter infrastructure. It might be expanding into the fast-turnabout ASIC trade, but it is certainly contracting from high margin markets and asset base.A bit of a double edged sword then. Tax breaks aren't guaranteed in perpetuity, and manipulating the P&L to reflect null growth isn't a great incentive to investors. Any idea what the money houses think of this?

- New tech next gen coming late 2016 (CPU/APU/GPU on 20nm) Probably talking about K12 and GCN 3.0

WOW! :eek:What about 16 nm? I thought they shoould have developed something by then. :(

Very long time (at least two more years) until the moment when I will upgrade my PC with new AMD processors and next-gen GPU. :)

I believe they were referring to this^. Since he did name the check list but also said CPU & GPU and mentioned they will be 20nm.

Maybe someone will post the Q&A transcript of the conference call somewhere.

All vendors are working on Skylake platforms right now, past Broadwell. Broadwell was not delayed, or any such thing. The desktop drop in chips (socket) for Z97 and the Z107 chipset were pushed forward to Computex 2015, but the mobile and embedded Broadwell parts were brought in closer than originally planned. It was INTEL's partners who wanted Broadwell delayed so they could clear Z87 and Z97 products. Z97 as well was released ahead of schedule.

There is no production issue here, do not write that as it is just plain untrue.

Don't confuse taxable profit with growth. Although taxable profit is a single measure of growth, growth isn't solely taxable profit. For example, if AMD managed to secure an exclusive contract selling processors for Apple iPhone. Their market share would grow significantly in the handheld market, even if they declared a loss financially. The media attention would be huge online and in publications, confidence would be initially so strong there would be a spike increase in AMD share price, thus generating them huge profit just from inking the deal alone. A small decimal share price increase could be more profitable and demonstrate more growth than actually selling the processors.

I don't think money houses care, as long as the interest and capitol on the loan is paid within schedule. They trust AMD knows more about generating profit in their sector than them.

With the datacenter, there is no good reason to have 18 datacenters scattered around the world. They will have 1 huge datacenter in Atlanta with the same capabilities. Thus creating efficiency i.e. Having staff in one location, not having to hire bilingual staff, language issues, logistic issues from transporting hardware etc. This is actually a very good thing long term. The money saved can go back into the business to expand further.

You talk about AMD being an expanding business, when even AMD themselves are talking about trimming the company into a leaner business.

By what definition does this qualify as an expanding company?

Expanding companies also don't see revenue fall by a quarter of a billion dollars in less than three years ($US1.691bn in Q3 2011), don't axe infrastructure, generally don't axe their workforce, or sell off their IP for peanuts.

BTW: AMD providing the processor for the iPhone? Yeah, I think Rory has his R&D rainbow-hued unicorn working on that as we speak.

All companies trim their business to make it efficient.

If there is a way to do more with less overheads wouldn't you?

Microsoft is about to fire 18,000 employees. Could Microsoft afford to keep them. Yes, but its inefficient to have ex Nokia employees on payroll for no good reason. The cash flow can be redirected elsewhere.

That chart doesn't tell us enough, it doesn't explain any of the business decisions which could have lead to those figures, or explain the internal or external economical influences that caused those figures. This is why looking at revenue or assets isn't enough to measure growth.

MS gobbling up Nokia has no bearing on AMD's situation. Acquisitions usually mean redundancies or moving of staff unless the newly acquired company is to be operated as a wholly independent division - but even at its most basic, you wouldn't expect the acquired company to keep its board of directors and any positions already extant in the parent company.Well, company growth is measured by Assets (and asset vs debt), revenue, debt-to-asset and debt-to-equity ratios, market share+ ASPs, capitalization ratio, judicious financing, and increased investment.

What you seem to be saying is none of that matters, and AMD's position as an expanding company (aside from their own managements proclamation that the company is downsizing) should be taken as an article of faith. Because of what? Potential ? A complicated, unlikely, and highly subjective combinations of "Ifs"?Well, no it won't have the same capabilities. The article clearly states that on a pure hardware basis it's a four-to-one nodal increase, but 18 down to 2 does not equal that. There is also the issues of job queues and workload sharing - although I have no idea how fully utilised the present datacenters are (and nor would anyone else outside AMD I'm guessing), so I wouldn't hazard a guess about overall efficiency, or time-sensitive workloads.

With any hardware upgrade or migration there is advantages and disadvantages. I guess job sharing and work queues is on the surface is a disadvantage, but perhaps the money saved, cash flow generated far outweighs that in the long term?It's also based on current perceived value as well as an future estimated value, this is one of many external factor you're not considering.

Also, for all we know, the physical building and land plot of those 18 datacenters could have depreciated year on year, AMD could align the depreciation value against profits, but perhaps they did that for a while and are cutting their losses. Who knows? Neither of us was in the meeting.

2. And this is the important one...AMD HAD to consolidate their datacenters - their main one was housed at the Austin Campus they just sold.Yup. Georgia residents are picking up half of AMD's electricity bill....but you still seem to be pounding that efficiency hobbyhorse. No one is debating that AMD aren't getting more efficient. The argument is whether AMD are an expanding company as you attest. Apart from adding to their APU lineup (big deal, they also EOL the previous models) you really haven't made a case that they are. Full disclosure - I used to be part of a team that put together a weekly financial result for a ten-figure yearly revenue company. I'm well aware how to interpret a companies books, and estimate goodwill.

I'd like to take that course. How many hours is it and where can I find it online ?

I did find this though.

eWEEK - AMD's New Atlanta Data Center Showcases Chip Maker's TechnologyI'll let you get back to you usual grandiose AMD thread trolling or should I say culinary trolling now.:roll:

None trolling related.. PC Perspective also picked up on the tid bits I posted above about the conference call.

PC Perspective - AMD Posts Financial Results for Q2 2014