Friday, August 11th 2017

Intel and Microsoft Collaborate to Deliver Industry-First Enterprise Blockchain

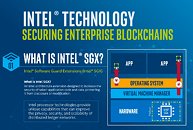

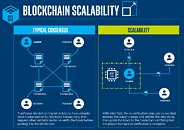

Today, Microsoft announced a new framework that enables businesses to adopt blockchain technology for increased enterprise privacy and security, and named Intel as a key hardware and software development partner. As part of this collaboration, Microsoft, Intel and other blockchain technology leaders will build a new enterprise-targeted blockchain framework - called the Coco Framework - that integrates Intel Software Guard Extensions (Intel SGX) to deliver improved transaction speed, scale and data confidentiality to enterprises. This first-of-its-kind innovation accelerates the enterprise readiness of blockchain technology, allowing developers to create flexible and more secure enterprise blockchain applications that can be easily managed by businesses.Blockchain is a digital record-keeping system where digital transactions are executed, validated and recorded chronologically and publicly. Because it's decentralized and transparent, it increases the efficiency and security of financial transactions - and does so at a significantly lower cost than traditional ledgers. The technology can be used for everything from simple file sharing to complex global payment processing and has the potential to transform the way companies operate.Intel, Microsoft and other blockchain technology leaders are working together to deliver security-enhanced, scalable capabilities in blockchain services. The Coco Framework uses Intel SGX to add new levels of privacy and confidentiality to blockchain transactions. Intel SGX is a hardware-based security technology that can help improve blockchain solutions by providing a trusted execution environment that isolates key portions of a blockchain program. Intel SGX consists of a set of CPU instructions and platform enhancements that create private areas in the CPU and memory that can protect code and data during execution. Intel SGX helps the Coco Framework provide confidential data and accelerated transaction throughput. The data confidentiality is achieved by encrypting sensitive blockchain data until it is opened in an Intel SGX enclave by a permitted program. The accelerated throughput is achieved by isolating the transaction verification process to speed network consensus.

Intel is an active participant in the blockchain revolution, participating in developing standards, actively contributing technology and providing expert insight. Intel is actively engaged with industry leaders to improve performance, reliability and scalability of blockchain technologies.Intel Xeon processors provide unique capabilities that can improve the privacy, security and scalability of distributed ledger networks. For example, the recently-announced Intel Xeon Scalable processors include a range of hardware-based trust, key protection and crypto-acceleration features that increase blockchain security and performance.

Source:

Intel Newsroom

Intel is an active participant in the blockchain revolution, participating in developing standards, actively contributing technology and providing expert insight. Intel is actively engaged with industry leaders to improve performance, reliability and scalability of blockchain technologies.Intel Xeon processors provide unique capabilities that can improve the privacy, security and scalability of distributed ledger networks. For example, the recently-announced Intel Xeon Scalable processors include a range of hardware-based trust, key protection and crypto-acceleration features that increase blockchain security and performance.

16 Comments on Intel and Microsoft Collaborate to Deliver Industry-First Enterprise Blockchain

Isn't the security of the blockchain in the network itself? Why would a client require this at all?

But at the same time blockchain is too "open", so you have to provide other levels of security - including different privileges for different users. And a lot more.

Think about your bank account. All bank accounts. To make them "secure" in the way blockchain is secure, banks could simply make everything public: personal data, account balance, transaction history etc. From that point onward there would be hardly any risk of fraud.

But this is not how banks provide security. And I don't think clients would like that either...

Also, if I understand correctly, this venture is not just to make a blockchain-based technology for licensing. It's also to make a market-ready product that Microsoft will be able to sell.

Though it does prove somewhat that blockchains do not have to be inefficient, ala my discussions with Ford.

AMT and the like is a whole 'nother ball of wax. All sorts of problems.

You mean public elections? They organized and supervised by government agencies, so not exactly at the edge of IT innovation. I would not count on them as leaders of blockchain implementation. The companies that have the money and needs are large financial institutions. But here the security requirements are enormous (even larger than for elections)

Just to give you an example: financial authority in my country has started a FinTech project last year. The goal is to correct the legislation - making implementation of new technologies easier / possible. They're currently analyzing the possibility of using cloud computing in banks. Think about it. :-)I don't think the open source choice is as big as you might think. And how is it even relevant here? MS is making a product that will have an open source competition (to some extent...). It's pretty normal.

Not much better honestly. Occasionally it even farts and gives us things like Trump, which is utterly terrifying.

If there is performance improvements, it has to come from the Microsoft (software) side.Most are open source because they're intended to generate profits off the people that use them. As a function of that, they need to be public about how they work to create trust.

Microsoft/Intel isn't going to collect transaction fees off this tech and they're already trusted organizations so there's no reason why they can't keep it closed source. In fact, I doubt many corporations would even consider it if it was open source.

But I can give you a few examples of "private" blockchains already in operation. For the "one", this is something we discussed at work lately:

www.artemis.bm/blog/2017/08/04/first-blockchain-settlement-for-cat-bond-completed-by-solidum/

But there are examples of blockchain used in logistics and trade as well. It's already happening.I don't fully understand what you mean by "financial voting board". General meeting of shareholders? If yes, there's hardly any need. Blockchain makes sense when a significant volume of operations has to be completed in short time. By "significant volume" I would mean numbers much higher than number of participants of the blockchain.

In other words: if you have a 10 million population voting for a president, you have 10 million votes... you can support that with a much simpler technology.

But if you have a 10 million population sharing files, paying for things, being tracked by marketing engines etc - they are creating billions of transactions. That's where a new, efficient database system could be useful.

Again, while blockchain is well suited for voting, there's no need. A centralized system will be just as good, just as fast and very easy to implement.

Nowadays voting is often digital anyway - even when you're physically in the meeting room.