Tuesday, October 31st 2017

AMD Stock Plunges Due to Forecast of Slowing Cryptocurrency, Console Markets

AMD's stock on Monday took a relatively steep dive in value, following a report by Morgan Stanley that pegs cryptocurrency-fueled graphics shipments to decline by 50% next year (a $250 million decline in revenue). "We believe that AMD's graphics surge has been caused by a sharp increase in sales of graphics chips to cryptocurrency miners. We expect this to meaningfully decelerate next year," Morgan Stanley analyst Joseph Moore said. At the same time, the report expects video game console demand to decline by 5.5% in 2018, which led Moore towards lowering his price target for AMD shares to $8 from $11, a 32% decline from Friday's close.

As a consequence of the report, Morgan Stanley reduced its rating on AMD shares from equal-weight to underweight, which reduced confidence in the market, and triggered a sell-off - and following the mechanism of availability and demand, a descent in stock pricing was already painted on the wall. A 9% fall isn't something to scoff at - especially when the economics surrounding it are attributed to a single - as of yet - report. AMD stock fluctuations aren't new; the company's stock has been particularly volatile in recent times - especially when compared to its peers (and competitors) Intel and NVIDIA."We expect cryptocurrency to gradually fade from here, consoles to decline, and graphics to be flattish," Moore wrote. "To be clear, we admire what the company has accomplished on a fraction of its competitors' budgets in both microprocessors and graphics - our cautious view is based entirely on the current stock price, and the limited potential for upside in 2018 and beyond."

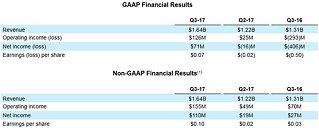

To put things in perspective, though, AMD's stock is up 64% in the past 12 months through last Friday, compared with S&P 500's 21% gain in the same time-frame. This new decline comes in the wake of AMD's last week stock plunge after the announcement of the latest Q3 results, proving that more than the fact that AMD returned to profitability after years in the red, expectation is the main driver of stock market pricing.

Sources:

CNBC, via Ars Technica

As a consequence of the report, Morgan Stanley reduced its rating on AMD shares from equal-weight to underweight, which reduced confidence in the market, and triggered a sell-off - and following the mechanism of availability and demand, a descent in stock pricing was already painted on the wall. A 9% fall isn't something to scoff at - especially when the economics surrounding it are attributed to a single - as of yet - report. AMD stock fluctuations aren't new; the company's stock has been particularly volatile in recent times - especially when compared to its peers (and competitors) Intel and NVIDIA."We expect cryptocurrency to gradually fade from here, consoles to decline, and graphics to be flattish," Moore wrote. "To be clear, we admire what the company has accomplished on a fraction of its competitors' budgets in both microprocessors and graphics - our cautious view is based entirely on the current stock price, and the limited potential for upside in 2018 and beyond."

To put things in perspective, though, AMD's stock is up 64% in the past 12 months through last Friday, compared with S&P 500's 21% gain in the same time-frame. This new decline comes in the wake of AMD's last week stock plunge after the announcement of the latest Q3 results, proving that more than the fact that AMD returned to profitability after years in the red, expectation is the main driver of stock market pricing.

45 Comments on AMD Stock Plunges Due to Forecast of Slowing Cryptocurrency, Console Markets

I think you are just mad at something you don't understand

I guess this... speculation makes someone else money...

Gotta buy low.

I can still find good prices on 1070s over at ebay.

I think this is pretty good

www.ebay.com/itm/Asus-NVIDIA-GeForce-GTX-1070-dual/263290066924?epid=233753822&hash=item3d4d4f97ec:g:kBUAAOSwaSZZ-LPI

GPU Division is only a part of AMD and doesn't made that much money this year either. Vega disaster rang the bell?

Stock manipulation... I smelled! /sniff /sniff

BTW, just added 3k shares :)

Cheer!

Here's my question... When this "euphoric" Stock rise finally turns (which it has that feel) will mining Ethereum be on that same downward spiral, or will it maintain/increase as a hedge against the norms of standard currency (Yuan, Euro, Dollar, Yen etc)?

www.techpowerup.com/238000/graphics-cards-vendors-increase-orders-in-wake-of-expected-mining-sales-increase

They might fall back into the mid 9's then some excitement around mobile/zen 2 / navi will come out and they will peak back up to 16 then crater again.

I held on too long thinking there would be a pop after earnings LOL...

But we are definitely closer to PC/Console convergence than we ever were. So ultimately it's not gonna be bad for the GPU market. It just means PC gaming become king (yay!).. it's not like anyone will stop buying games in general.