HP Reports Fiscal 2025 Second Quarter Results

HP Inc. and its subsidiaries ("HP") announced fiscal 2025 second quarter net revenue of $13.2 billion, up 3.3% (up 4.5% in constant currency) from the prior-year period. "In Q2, we delivered solid revenue growth, led by strong Commercial performance in Personal Systems and continued momentum behind our future of work strategy," said Enrique Lores, President and CEO, HP Inc. "While results in the quarter were impacted by a dynamic regulatory environment, we responded quickly to accelerate the expansion of our manufacturing footprint and further reduce our cost structure. These decisive actions strengthen our foundation and position us to deliver long-term sustainable growth."

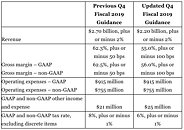

"In light of the increased macroeconomic uncertainty, we have adjusted our outlook to reflect moderated demand and the net impact of trade-related costs," said Karen Parkhill, CFO, HP Inc. "We are executing targeted mitigation strategies, and assuming current conditions remain, we expect to fully offset these costs by Q4."

"In light of the increased macroeconomic uncertainty, we have adjusted our outlook to reflect moderated demand and the net impact of trade-related costs," said Karen Parkhill, CFO, HP Inc. "We are executing targeted mitigation strategies, and assuming current conditions remain, we expect to fully offset these costs by Q4."