Tuesday, October 2nd 2018

Intel Stocks Jump 5% With First Piece of Good News on 10 nm

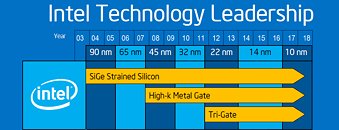

The tides at Intel have been blacker than they have been blue due to woes in silicon production - and the slow, sure steps of their rival AMD. It's been a rough, domino-powered ride: Intel has faced delay after delay of their 10 nm fabrication process technology. This, in turn, has constrained their production capacity, leading top shortages and increasing prices of Intel processors, and expensive chipset redesigns, moving them up from Intel's top-of-the-line 14 nm process back to 22 nm. So, yeah, after such a stream of lows, the first high note to be struck leaves a much lasting impact - and this has happened on Intel's stock pricing.

A research report from Steve Mullane, analyst at BlueFin Research Partners, says that Intel could be looking on sooner-than-expected ramp-up of their 10 nm process - slated for a June 2019 timeframe. "Intel's second-half production levels suggest upside to analyst revenue estimates for the fourth quarter and first quarter of 2019," further stating that suppliers believe production of new 10 nm silicon could be pulled forward from the June 2019 timeline by four to six weeks. This news brought about a jump in Intel share price up by 5%, while simultaneously reducing AMD's stock price by some 3.6%. At the end of trade day, these highs and lows converted to a 3.55% increase for Intel and a 7.65% drop for AMD.

Source:

markets.BusinessInsider

A research report from Steve Mullane, analyst at BlueFin Research Partners, says that Intel could be looking on sooner-than-expected ramp-up of their 10 nm process - slated for a June 2019 timeframe. "Intel's second-half production levels suggest upside to analyst revenue estimates for the fourth quarter and first quarter of 2019," further stating that suppliers believe production of new 10 nm silicon could be pulled forward from the June 2019 timeline by four to six weeks. This news brought about a jump in Intel share price up by 5%, while simultaneously reducing AMD's stock price by some 3.6%. At the end of trade day, these highs and lows converted to a 3.55% increase for Intel and a 7.65% drop for AMD.

23 Comments on Intel Stocks Jump 5% With First Piece of Good News on 10 nm

Zen 2 and amd 64 will nailed down next year intel and amd cpu sales numbers will show true ...

Soros sell all stock from intel.. he unfortunately dont make mistakes ...)))))))))) its now just mainstream game for plebs in medias

Titanic-intelic )))

Investor : meh

AMD : as you can see on this sales we slowly gaining market share from Intel

Investor : meh

AMD : we planning to launch 7nm in less than a year

Investor : meh

Intel : I am so sorry dear investors, we having delay for 10nm not to mention 7nm

Investor : WHAT?!!? QUICKLY RUSH B, WE MEAN AMD !!

AMD: wow guys, my stock all time high since decades

Investor : YES AMD, we believe (sort of) in you

Intel : GOOD NEWS, 10nm CPU launch faster by... few weeks

Investor : THAT WILL DO, NOW RUSH BACK TO INTEL !!!

In stores May 2019

I love how you made a mistake and quoted the wrong figure for AMD (after-hours). Good job.

The correct final values are:

Intel: +3.55% (after-hours: +0.62%)

AMD: -7.64% (after-hours: -1.76%)

Oh well, someone just made a buck out of this, as usual.

I kind of stopped caring. ;-)

BTW: AMD today already -7%.

"As the chart is updated daily, but data points are for the quarter, the first few days of a new quarter will only have a few samples. i.e. The first few days of a new quarter are less accurate compared to the end of a quarter. "

Th way it works is that the algorithm notes the daily increase and projects the rate oif change out 90 days to predict end of quarter values. So either millions of folks waited till after Septemeber 30th to build test their new AMD systems or someone is manipulating the graph by botting submissions to push an agenda.

Q2 2018 =-> Q3 2018 = +0.20% (end of quarter)

Q3 2018 =-> Q4 2018 = +4.80 % (2 days in)

So whaddya think...

a) is everyone suddenly "getting it" and AMD market share will increase 24 times last quarter's increase ? ... or

b) is there some kind of data manipulation going on here ?

If it's b), the "pump and dump" crowd is going to clean up.