Tuesday, April 30th 2019

AMD Reports First Quarter 2019 Financial Results- Gross margin expands to 41%, up 5 percentage points year-over-year

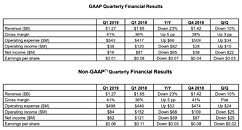

AMD today announced revenue for the first quarter of 2019 of $1.27 billion, operating income of $38 million, net income of $16 million and diluted

earnings per share of $0.01. On a non-GAAP(*) basis, operating income was $84 million, net income was $62 million and diluted earnings per share was $0.06.

"We delivered solid first quarter results with significant gross margin expansion as Ryzen and EPYC processor and datacenter GPU revenue more than doubled year-over-year," said Dr. Lisa Su, AMD president and CEO. "We look forward to the upcoming launches of our next-generation 7nm PC, gaming

and datacenter products which we expect to drive further market share gains and financial growth."Q1 2019 Results

AMD's outlook statements are based on current expectations. The following statements are forward looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below. For the second quarter of 2019, AMD expects revenue to be approximately $1.52 billion, plus or minus $50 million, an increase of approximately 19 percent sequentially and a decrease of approximately 13 percent year-over-year. The sequential increase is expected to be driven by growth across all businesses. The year-over-year decrease is expected to be primarily driven by lower graphics channel sales, negligible blockchain-related GPU revenue and lower semi-custom revenue. AMD expects nonGAAP gross margin to be approximately 41 percent in the second quarter of 2019.

earnings per share of $0.01. On a non-GAAP(*) basis, operating income was $84 million, net income was $62 million and diluted earnings per share was $0.06.

"We delivered solid first quarter results with significant gross margin expansion as Ryzen and EPYC processor and datacenter GPU revenue more than doubled year-over-year," said Dr. Lisa Su, AMD president and CEO. "We look forward to the upcoming launches of our next-generation 7nm PC, gaming

and datacenter products which we expect to drive further market share gains and financial growth."Q1 2019 Results

- Revenue was $1.27 billion, down 23 percent year-over-year primarily due to lower revenue in the Computing and Graphics segment. Revenue was down 10 percent quarter-over-quarter primarily due to lower client processor sales.

- Gross margin was 41 percent, up 5 percentage points year-over-year, primarily driven by the ramp of Ryzen and EPYC processor and datacenter GPU sales. Gross margin was up 3 percentage points quarter-over-quarter primarily due to a charge in the fourth quarter of 2018 related to older technology licenses. Non-GAAP gross margin was flat quarter-over-quarter.

- Operating income was $38 million compared to operating income of $120 million a year ago and $28 million in the prior quarter. Non-GAAP operating income was $84 million compared to operating income of $152 million a year ago and $109 million in the prior quarter. The year-over-year decline was primarily due to lower revenue and operating income in the Computing and Graphics segment.

- Net income was $16 million compared to net income of $81 million a year ago and $38 million in the prior quarter. Non-GAAP net income was $62 million compared to net income of $121 million a year ago and $87 million in the prior quarter.

- Diluted earnings per share was $0.01, compared to diluted earnings per share of $0.08 a year ago and $0.04 in the prior quarter. Non-GAAP diluted earnings per share was $0.06, compared to diluted earnings per share of $0.11 a year ago and $0.08 in the prior quarter.

- Cash, cash equivalents and marketable securities were $1.2 billion at the end of the quarter.

- Computing and Graphics segment revenue was $831 million, down 26 percent year-over-year and 16 percent quarter-over-quarter. Revenue was lower year-over-year primarily due to lower graphics channel sales, partially offset by increased client processor and datacenter GPU sales. The quarter-over-quarter decline was primarily due to lower client processor sales.

- Client processor average selling price (ASP) was up year-over-year driven by Ryzen processor sales. Client ASP was down slightly quarter-over-quarter due to a decrease in mobile processor ASP

- GPU ASP increased year-over-year primarily driven by datacenter GPU sales. GPU ASP was up sequentially driven by improved product mix.

- Operating income was $16 million, compared to operating income of $138 million a year ago and operating income of $115 million in the prior quarter. The year-over-year and quarter-over-quarter operating income decreases were primarily due to lower revenue.

- Enterprise, Embedded and Semi-Custom segment revenue was $441 million, down 17 percent yearover-year and up 2 percent sequentially. The year-over-year revenue decrease was primarily due to lower semi-custom product revenue, partially offset by higher server sales. The quarter-over-quarter increase was primarily driven by higher semi-custom revenue.

- Operating income was $68 million, compared to operating income of $14 million a year ago and an operating loss of $6 million in the prior quarter. The year-over-year and sequential improvements were primarily driven by a $60 million licensing gain associated with the company's joint venture with THATIC.

- All Other operating loss was $46 million compared with operating losses of $32 million a year ago and $81 million in the prior quarter. The prior quarter included a $45 million charge related to older technology licenses.

- Google announced at the Game Developers Conference that it has selected high-performance, custom AMD RadeonTM datacenter GPUs and AMD software developer tools for its Stadia nextgeneration game streaming platform. Also at the conference, AMD announced a number of updates to its software tools to help game developers accelerate game design and foster innovation.

- Amazon Web Services announced broader availability of AMD EPYC processor-based service and launched three new EPYC processor-powered EC2 instance families, including the first T3-series instances.

- Sony Interactive Entertainment released new details about its upcoming next-generation game console, which will be powered by a custom AMD chip based on the "Zen 2" CPU and "Navi" GPU architectures.

- Apple announced updates to its 21.5-inch iMac and 27-inch iMac computers, which for the first time offer "Radeon Pro Vega" graphics cards. The 21.5-inch iMac with Radeon Vega 12 GPUs delivers up to 80 percent faster graphics performance than the previous generation. The 27-inch iMac with

- Radeon Vega 10 GPUs delivers up to 50 percent faster graphics performance.

- OEMs announced new systems based on the expanded lineup of consumer and commercial mobile processors from AMD.

- HP and Lenovo announced commercial PCs powered by the 2nd Gen AMD Ryzen PRO mobile processors with Radeon Vega Graphics and AMD AthlonTM PRO mobile processors with Radeon Vega Graphics. At HP Reinvent, the company announced the HP ProBook 445R G6 and HP ProBook 455R G6, powered by 2nd Gen Ryzen mobile processors, and the HP ProDesk 405 G4 Desktop Mini powered by 2nd Gen Ryzen PRO processors. For consumers, HP announced the latest HP ENYY x360 13 and 15, both featuring 2nd Gen Ryzen mobile processors.

- Lenovo announced the IdeaPad S540 and IdeaPad S340 powered by 2nd Gen Ryzen mobile processors.

- Multiple customers began shipping new 2nd Gen AMD Ryzen mobile-powered laptops, including the new ASUS FX505 and 705DY TUF Gaming notebooks, with additional systems coming throughout 2019.

- AMD announced the new AMD Ryzen Embedded R1000 SoC, growing the AMD Ryzen embedded family of processors. The SoC will be used in numerous embedded applications from customers like Advantech, IBASE, ASRock, Kontron, MEN and others. It will also power the upcoming Atari VCS entertainment system.

- Demonstrating its commitment to workplace equality, AMD was included in the 2019 Bloomberg Gender-Equality Index and received a perfect score of 100 on the Human Rights Campaign Foundation's 2019 Corporate Equality Index.

AMD's outlook statements are based on current expectations. The following statements are forward looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below. For the second quarter of 2019, AMD expects revenue to be approximately $1.52 billion, plus or minus $50 million, an increase of approximately 19 percent sequentially and a decrease of approximately 13 percent year-over-year. The sequential increase is expected to be driven by growth across all businesses. The year-over-year decrease is expected to be primarily driven by lower graphics channel sales, negligible blockchain-related GPU revenue and lower semi-custom revenue. AMD expects nonGAAP gross margin to be approximately 41 percent in the second quarter of 2019.

42 Comments on AMD Reports First Quarter 2019 Financial Results- Gross margin expands to 41%, up 5 percentage points year-over-year

AMDs growth happens in datacenters.

Looking at just a single CPU, moving the <=8C variants to 7nm makes little sense (slightly lower power consumption, not a big deal if everyone accepts/likes how much Zen+ pulls).

So it's down to the issue of yields and using bad chiplets for low-core SKUs. Does it save them enough money to cover whatever TSMC asks? Only AMD knows this.

Given how expensive 7nm is, my guess is that they would make more by keeping the Zen+ lineup for everything that doesn't need chiplets. They could add PCIe4.0 and call it Zen++.

>8C Ryzen (this year) and >4C APU (next year?) would be Zen2.

And as 7nm gets cheaper, AMD will start fresh on a new socket (late 2020 or 2021).When you look at cloud, peak power consumption is not the statistic you want to see.

Xeon CPUs use more power, but are faster. The key information is how much time and energy is needed to complete a task ("time to solve" and "energy to solve").

There's no clear winner in this. In many scenarios EPYC has 10% advantage. In some Intel pulls ahead thanks to lower latency and more robust instruction set.

There are way to many variables to say that one server CPU is better than another in general.

Also, I think we focus on power draw way to much. Over 3 years a typical server will consume energy worth 10% of the hardware.

Remember that some server-specific software is licensed per core (databases being the most significant). We don't think about it often, but simple fact is: if you need 32C EPYC to match a 28C Xeon, the license cost stemming from 4 extra cores may eat all savings an EPYC may provide.

It's been rocky for HBM, not completely necessary for consumer product/markets when first envisioned. Though as GDDR5 going longer than anticipated it made some sense, knowing a DDR6 spec was only somewhat "agreed" at that point(2014-15). I see that AMD/RGT wanted to maintain development (HBM) being big for emerging AI and Data Centers; selling idea as "gaming" was a help internally to keep the engineering movement/funds flowing, all while graphic budgets were scrutinized and cut.

Perhaps when a new Radeon Pro Series Graphics card comes in a new architecture, and they can offer it as both do (Vega 7 or Titan V) we will again see a true AMD "Halo" product for consumers.

Xeons with integrated GPUs are for workstations that don't utilize GPGPU computing. It's only there for video output.

Apart from saving money, it makes it possible to do this:

Heres more info