Tuesday, May 21st 2019

AMD Takes a Bigger Revenue Hit than Microsoft from Huawei Ban: Goldman Sachs

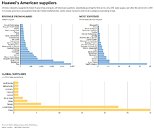

The trade ban imposed on Chinese tech giant Huawei by the U.S. Department of Commerce, and ratified through an Executive Order by President Donald Trump, is cutting both ways. Not only are U.S. entities banned from importing products and services from Huawei, but also engaging in trade with them (i.e. selling to them). U.S. tech firms stare at a $11 billion revenue loss by early estimates. Wall Street firm Goldman Sachs compiled a list of companies impacted by the ban, and the extent of their revenue loss. It turns out that AMD isn't a small player, and in fact, stands to lose more revenue in absolute terms than even Microsoft. It earns RMB 268 million (USD $38.79 million) from Huawei, compared to Microsoft's RMB 198 million ($28.66 million). Intel's revenue loss is a little over double that of AMD at RMB 589 million ($84 million), despite its market-share dominance.

That's not all, AMD's exposure is higher than that of Intel, since sales to Huawei make up a greater percentage of AMD's revenues than it does Intel's. AMD exports not just client-segment products such as Ryzen processors and Radeon graphics, but possibly also EPYC enterprise processors for Huawei's server and SMB product businesses. NVIDIA is affected to a far lesser extent than Intel, AMD, and Microsoft. Qualcomm-Broadcom take the biggest hit in absolute revenue terms at RMB 3.5 billion ($508 million), even if their exposure isn't the highest. The duo export SoCs and cellular modems to Huawei, both as bare-metal and licenses. Storage hardware makers aren't far behind, with the likes of Micron, Seagate, and Western Digital taking big hits. Micron exports DRAM and SSDs, while Seagate and WDC export hard drives.

Source:

Reuters

That's not all, AMD's exposure is higher than that of Intel, since sales to Huawei make up a greater percentage of AMD's revenues than it does Intel's. AMD exports not just client-segment products such as Ryzen processors and Radeon graphics, but possibly also EPYC enterprise processors for Huawei's server and SMB product businesses. NVIDIA is affected to a far lesser extent than Intel, AMD, and Microsoft. Qualcomm-Broadcom take the biggest hit in absolute revenue terms at RMB 3.5 billion ($508 million), even if their exposure isn't the highest. The duo export SoCs and cellular modems to Huawei, both as bare-metal and licenses. Storage hardware makers aren't far behind, with the likes of Micron, Seagate, and Western Digital taking big hits. Micron exports DRAM and SSDs, while Seagate and WDC export hard drives.

33 Comments on AMD Takes a Bigger Revenue Hit than Microsoft from Huawei Ban: Goldman Sachs

I could say Intel took a bigger hit than AMD in the revenue section, and more exposure than Microsoft.

What is the point of this title?

Rather take the hit than use compromised hardware

markets.businessinsider.com/currencies/news/nvidia-stock-price-all-time-high-gaming-cards-big-opportunity-goldman-sachs-2018-10-1027580717

Then Nvidia took a major hit

www.bloomberg.com/news/articles/2018-11-16/nvidia-results-prompt-mea-culpa-at-clearly-wrong-goldman-sachs

But at least we don't have to fear the red boogeyman spying on us, right?

Fact is Huawei is gone from the market. Who will supply those products to customers now? Who will supply the hardware? For example, If Samsung's sales rise 20% and AMD supplies Samsung they lose nothing.

Click-bait at it's finest.So naive and flameworthy. EVERY tech company sold Huawei hardware . Are you that blind? They made no deal except to sell their products to someone.

How much % is that in their budget? Like a small fries portion of my personal budget?Please China, give me cheap stuff, I am willing to give you evertying I don't care about, like my privacy and even freedom.Oh, gosh, I cannot buy anymore those great Huawei CPU, GPU and HDD's? OMG, I am devastated!Nailed it. It's a demand and supply world...Why? Do you think that the Chinese will retaliate and don't get the free technology from AMD? Never! That's how they raised from a failed agrarian state of the 80's to the superpower that they are now.

en.wikipedia.org/wiki/Four_Modernizations

The new idea was that all workers should not be paid the same, but rather, paid according to their productivity.

Fun fact: "On December 5, 1978 in Beijing, former red guard Wei Jingsheng posted on the Democracy Wall the Fifth Modernization as being "democracy". He was arrested a few months later and jailed for 15 years."

Revenue 110.3 billion dollars

Gross Margin 72 billion dollars

Net Profit 16.5 billion dollars

and they are sitting on 133.7 billion dollars in cash and equivalents

I think MS will be just fine.

www.tomshardware.com/news/china-zen-x86-processor-dryhana,37417.html

I'm assuming AMD was planning for this vehicle to be used for sales into China. This should allow it to avoid Tariff affecting revenue, at least on EPYC parts and hopefully displace Intel server CPUs in the China Server market. Another well placed chess move by AMD.

If other parties have any objection, they have been too late onto the scene. Retrospective laws don't break contracts.

So many obvious interpretations can be derived from those 2 graphs, something like

" Broadcom / Qualcomm lost trillions of dollars with serious exposure."

" Flex, the ultimate victim behind the Huawei ban with 5% of its revenues being exposed "

would better suit the graphs more since they are the huge bars underneath.

Yet the OP chose to focus on AMD, which barely made it through the top half of the chart.

#gottapissonamd