Wednesday, June 30th 2021

UK Competition Regulator Greenlights AMD's Xilinx Acquisition

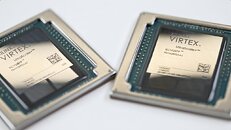

AMD's ambitious acquisition of Xilinx, makers of cutting-edge FPGAs, has been approved by the UK Competition and Markets Authority. This would go down as AMD's biggest tech acquisition, as the company is forking out USD $35 billion in stock. If it goes through, the AMD-Xilinix combine will see current AMD shareholders own 74% of the company, and current Xilinx shareholders with the other 26%. Both companies announced in April 2021 that their shareholders "overwhelmingly" approved of the deal. The Xilinx buyout by AMD isn't too far behind in terms of value, to NVIDIA's ambitious $40 billion bid to acquire Arm Holdings.Many Thanks to DeathtoGnomes for the tip

Source:

Tom's Hardware

12 Comments on UK Competition Regulator Greenlights AMD's Xilinx Acquisition

Nvidia could become huge if it buys ARM and doesn't mess up like what it did with Ageia, PPUs and PhysX.

Apple is making really powerful ARM SOCs.

TSMC is investing 100 billions in manufacturing.

Samsung is investing over 30 billions in manufacturing.

And the company that was considered the biggest in the world, keeps looking at it's past, with a bottle of whisky in it's hands, unable to find a solution to it's problems. Right Intel?

It's amazing how much change we witnessed these last 10 years.

The Vanguard Group, Capital Research & Management and SSgA Funds Management for example are shareholders of both companies, so they just combine their 2 stocks in one

www.marketscreener.com/quote/stock/XILINX-INC-4917/company/

www.marketscreener.com/quote/stock/ADVANCED-MICRO-DEVICES-I-19475876/company/