Despite Estimates Cuts, Analyst Bets on Haswell Success

Following last Friday's Q3 outlook lowering by Intel, market punters such as Merrill Lynch cut estimates. Vivek Arya, an analyst with the firm, cut its Q3 and Q4 estimates for Intel, while remaining optimistic about upcoming processes in the company's pitched battle with ARM in the lightweight SoC segment. Arya believes that with upcoming technologies, Intel has a fighting chance against ARM heavyweights. Said Arya in his report:

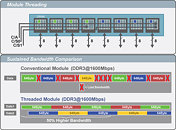

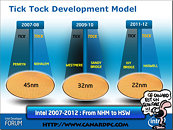

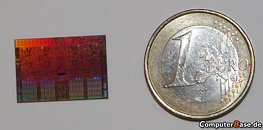

Next-gen chip manufacturing has become a 3-horse race between Intel, TSMC and Samsung, with Intel holding a 1 to 4 year lead, in our view. As we saw in 1H12, foundries were unable to ramp 28nm capacity, leading to product delays. Rising costs/ complexity (tri-gate) could further widen this gap. We believe this could enable Intel to gain a foothold (vs. zero today) in mobile over the next 2 years, as smartphone/tablet vendors look to Intel as a second or even primary source […] We firmly believe in Intel's ability to reliably produce the lowest cost and highest performance silicon can help it maintain a dominant position in servers/data centers (20% of sales, 10-15% CAGR), and transition from legacy PCs to next-gen smartphones, tablets, Ultrabooks and other converged devices in the next 1-2 years. Investors, meanwhile, benefit from a 3.6% div yield, $7.5bn in available buybacks (6% of mkt cap) and <10x PE.