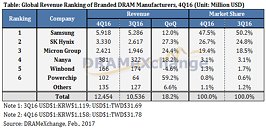

TrendForce Reports Global DRAM Revenue Jumped 18.2% Sequentially in Q4 2016

Peak season demand and surging prices for DRAM products across different applications resulted in an 18.2% sequential growth in the global DRAM revenue for the final quarter of 2016, reports DRAMeXchange, a division of TrendForce.

Smartphone shipments peaked in the fourth quarter on account of the traditional busy season. Chinese smartphone brands continued to post strong sales while Apple benefitted from the release of iPhone 7. "Rising demand for mobile DRAM kept squeezing the industry's production capacity for PC DRAM," said Avril Wu, research director of DRAMeXchange. "Contract prices of PC DRAM modules increased by more than 30% sequentially on average in the fourth quarter due to insufficient market supply. Server DRAM lagged behind PC and mobile DRAM in terms of price hike during the same period, but it is expected to catch up in the first quarter of this year."

Smartphone shipments peaked in the fourth quarter on account of the traditional busy season. Chinese smartphone brands continued to post strong sales while Apple benefitted from the release of iPhone 7. "Rising demand for mobile DRAM kept squeezing the industry's production capacity for PC DRAM," said Avril Wu, research director of DRAMeXchange. "Contract prices of PC DRAM modules increased by more than 30% sequentially on average in the fourth quarter due to insufficient market supply. Server DRAM lagged behind PC and mobile DRAM in terms of price hike during the same period, but it is expected to catch up in the first quarter of this year."