Wednesday, February 15th 2017

TrendForce Reports Global DRAM Revenue Jumped 18.2% Sequentially in Q4 2016

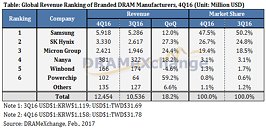

Peak season demand and surging prices for DRAM products across different applications resulted in an 18.2% sequential growth in the global DRAM revenue for the final quarter of 2016, reports DRAMeXchange, a division of TrendForce.

Smartphone shipments peaked in the fourth quarter on account of the traditional busy season. Chinese smartphone brands continued to post strong sales while Apple benefitted from the release of iPhone 7. "Rising demand for mobile DRAM kept squeezing the industry's production capacity for PC DRAM," said Avril Wu, research director of DRAMeXchange. "Contract prices of PC DRAM modules increased by more than 30% sequentially on average in the fourth quarter due to insufficient market supply. Server DRAM lagged behind PC and mobile DRAM in terms of price hike during the same period, but it is expected to catch up in the first quarter of this year."Looking ahead, memory content for various devices will continue to increase. Also, the current capacity expansion efforts undertaken by suppliers will not start to affect the market until the second half of 2017. In the meantime, the general undersupply problem will worsen, and contract prices of PC DRAM modules in this first quarter may see an even larger sequential increase of nearly 40% on average. Rising prices are expected for the second quarter as well.

Top three DRAM suppliers saw significant increase in their operating margins

There was no change in the revenue rankings of the top three DRAM suppliers in the 2016 fourth quarter. Samsung, SK Hynix and Micron were respectively first, second and third. With the exceptional third-quarter result as the base, Samsung managed to achieve a 12% sequential growth in the fourth quarter, totaling US$5.9 billion and taking 47.5% of the global DRAM market. SK Hynix also did well revenue-wise in the same period, posting a 27.3% increase compared with the prior quarter to reach US$3.3 billion. SK Hynix's global market share was around 26.7%. Third-place Micron registered a sequential growth of 24.4% and captured 19.4% of the global market. Together, the global market share of the two leading South Korean suppliers came to 74.2% in the fourth quarter.

Upswing of prices pushed up suppliers' fourth-quarter operating margins as well. Samsung's operating margin went up to 45%, while SK Hynix saw an increase from 25% in the prior quarter to 36%. Micron's operating margin made a huge leap from 3.7% in the third quarter to 14.9% in the fourth. Going forward, the continuing price uptrend means that suppliers will enjoy rising profit in the first quarter of 2017.

Regarding technology migration, Samsung aims for the 18nm process this year as to satisfy growing demand from clients and keep a comfortable lead over competitors. Samsung has designated its fab Line 17 for the deployment of the 18nm process and is also considering to have other fabs to adopt the technology. The supplier's target is to have at least 40% of its total DRAM output coming from the 18nm process by the end of 2017.

SK Hynix this year will be focusing on raising the yield for its 21 process so the technology will have a larger share of the overall DRAM output. SK Hynix will also begin to migrate to the 18nm process in the second half of 2017. The supplier wants to have the technology ready for mass production as soon as possible.

As for Micron, its subsidiary Micron Memory Taiwan has already begun mass production for its 18nm process this January. Micron Memory Taiwan plans to transition most of its production capacity to the technology by the end of this year. If this process goes well, Micron may also have the newly acquired Inotera to adopt the 18nm production in the second half of 2017.

Looking at the revenue results of Taiwan-based suppliers for the final quarter of 2016, Nanya registered a sequential increase of 18.2% due to strong demand from clients and rising prices of specialty DRAM products. Nanya is accelerating the transition to the 20nm production to further reduce cost. The supplier will try to achieve a capacity of 30,000 wafers per month for its 20nm process by the end of 2017.

Winbond's fourth-quarter DRAM revenue fell slightly by 4.6% compared with the prior quarter. This was mainly attributed to the supplier adjusting its product mix and shifting more capacity to NOR Flash production because of the high demand for the product. In terms of technology, Winbond will keep expanding the share of its 46nm process within its DRAM output and gradually increase its 38nm output. Winbond has scheduled to begin mass production for its 38nm process in the second half of 2017. The transition to the advanced technology will be reflected in the supplier's revenue performance by then.

Powerchip registered a phenomenal 59.2% sequential revenue growth in the fourth quarter of last year as the company regained lost customers and benefitted from high contract manufacturing prices that are the result of the booming DRAM market.

Smartphone shipments peaked in the fourth quarter on account of the traditional busy season. Chinese smartphone brands continued to post strong sales while Apple benefitted from the release of iPhone 7. "Rising demand for mobile DRAM kept squeezing the industry's production capacity for PC DRAM," said Avril Wu, research director of DRAMeXchange. "Contract prices of PC DRAM modules increased by more than 30% sequentially on average in the fourth quarter due to insufficient market supply. Server DRAM lagged behind PC and mobile DRAM in terms of price hike during the same period, but it is expected to catch up in the first quarter of this year."Looking ahead, memory content for various devices will continue to increase. Also, the current capacity expansion efforts undertaken by suppliers will not start to affect the market until the second half of 2017. In the meantime, the general undersupply problem will worsen, and contract prices of PC DRAM modules in this first quarter may see an even larger sequential increase of nearly 40% on average. Rising prices are expected for the second quarter as well.

Top three DRAM suppliers saw significant increase in their operating margins

There was no change in the revenue rankings of the top three DRAM suppliers in the 2016 fourth quarter. Samsung, SK Hynix and Micron were respectively first, second and third. With the exceptional third-quarter result as the base, Samsung managed to achieve a 12% sequential growth in the fourth quarter, totaling US$5.9 billion and taking 47.5% of the global DRAM market. SK Hynix also did well revenue-wise in the same period, posting a 27.3% increase compared with the prior quarter to reach US$3.3 billion. SK Hynix's global market share was around 26.7%. Third-place Micron registered a sequential growth of 24.4% and captured 19.4% of the global market. Together, the global market share of the two leading South Korean suppliers came to 74.2% in the fourth quarter.

Upswing of prices pushed up suppliers' fourth-quarter operating margins as well. Samsung's operating margin went up to 45%, while SK Hynix saw an increase from 25% in the prior quarter to 36%. Micron's operating margin made a huge leap from 3.7% in the third quarter to 14.9% in the fourth. Going forward, the continuing price uptrend means that suppliers will enjoy rising profit in the first quarter of 2017.

Regarding technology migration, Samsung aims for the 18nm process this year as to satisfy growing demand from clients and keep a comfortable lead over competitors. Samsung has designated its fab Line 17 for the deployment of the 18nm process and is also considering to have other fabs to adopt the technology. The supplier's target is to have at least 40% of its total DRAM output coming from the 18nm process by the end of 2017.

SK Hynix this year will be focusing on raising the yield for its 21 process so the technology will have a larger share of the overall DRAM output. SK Hynix will also begin to migrate to the 18nm process in the second half of 2017. The supplier wants to have the technology ready for mass production as soon as possible.

As for Micron, its subsidiary Micron Memory Taiwan has already begun mass production for its 18nm process this January. Micron Memory Taiwan plans to transition most of its production capacity to the technology by the end of this year. If this process goes well, Micron may also have the newly acquired Inotera to adopt the 18nm production in the second half of 2017.

Looking at the revenue results of Taiwan-based suppliers for the final quarter of 2016, Nanya registered a sequential increase of 18.2% due to strong demand from clients and rising prices of specialty DRAM products. Nanya is accelerating the transition to the 20nm production to further reduce cost. The supplier will try to achieve a capacity of 30,000 wafers per month for its 20nm process by the end of 2017.

Winbond's fourth-quarter DRAM revenue fell slightly by 4.6% compared with the prior quarter. This was mainly attributed to the supplier adjusting its product mix and shifting more capacity to NOR Flash production because of the high demand for the product. In terms of technology, Winbond will keep expanding the share of its 46nm process within its DRAM output and gradually increase its 38nm output. Winbond has scheduled to begin mass production for its 38nm process in the second half of 2017. The transition to the advanced technology will be reflected in the supplier's revenue performance by then.

Powerchip registered a phenomenal 59.2% sequential revenue growth in the fourth quarter of last year as the company regained lost customers and benefitted from high contract manufacturing prices that are the result of the booming DRAM market.

Comments on TrendForce Reports Global DRAM Revenue Jumped 18.2% Sequentially in Q4 2016

There are no comments yet.