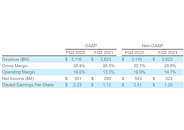

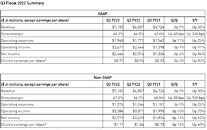

Corsair Gaming Reports Third Quarter 2022 Financial Results

Corsair Gaming, Inc. ("Corsair" or the "Company"), a leading global provider and innovator of high-performance gear for gamers and content creators, today announced financial results for the quarter ended September 30, 2022. Andy Paul, Chief Executive Officer of Corsair, stated, "We achieved 10% sequential revenue growth from Q2 2022 to Q3 2022, while significantly reducing our channel inventory in what remains a challenging environment. Sales out levels from our Channel to Consumers were significantly above pre-pandemic levels in almost all product lines and were above the year ago level in many of our product categories.

As we mentioned in previous quarters, the self-built PC market has been held back over the past 2 years, as high demand for GPU cards from crypto miners caused GPU prices to rise and in some cases double. Now that Crypto mining can no longer utilize graphics cards as they used to, GPU demand has since normalized resulting in a decline in prices back to standard MSRP or below. We are already seeing the positive effects of this on the market.

As we mentioned in previous quarters, the self-built PC market has been held back over the past 2 years, as high demand for GPU cards from crypto miners caused GPU prices to rise and in some cases double. Now that Crypto mining can no longer utilize graphics cards as they used to, GPU demand has since normalized resulting in a decline in prices back to standard MSRP or below. We are already seeing the positive effects of this on the market.