Silicon Motion Announces Results for the Period Ended March 31, 2021

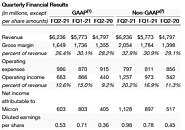

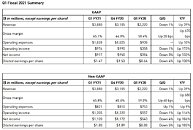

Silicon Motion Technology Corporation today announced its financial results for the quarter ended March 31, 2021. For the first quarter, net sales (GAAP) increased sequentially to $182.4 million from $143.9 million in fourth quarter 2020. Net income (GAAP) increased to $34.4 million or $0.98 per diluted ADS (GAAP) from net income (GAAP) of $1.4 million or $0.04 per diluted ADS (GAAP) in fourth quarter 2020. For the first quarter, net income (non-GAAP) increased to $38.7 million or $1.11 per diluted ADS (non-GAAP) from a net income (non-GAAP) of $29.9 million or $0.86 per diluted ADS (non-GAAP) in fourth quarter 2020.

"As we had previously communicated, we are seeing very strong demand for our SSD and eMMC+UFS controllers," said Wallace Kou, President and CEO of Silicon Motion. "Customer demand was well in excess of our ability to supply as both our foundry supply and inventory on hand are limited."

"As we had previously communicated, we are seeing very strong demand for our SSD and eMMC+UFS controllers," said Wallace Kou, President and CEO of Silicon Motion. "Customer demand was well in excess of our ability to supply as both our foundry supply and inventory on hand are limited."