Friday, November 6th 2009

NVIDIA Reports Financial Results for Third Quarter Fiscal Year 2010

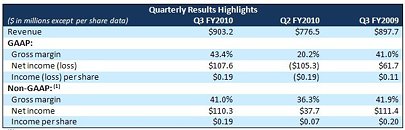

NVIDIA Corp. today reported revenue of $903.2 million for the third quarter of fiscal 2010 ended Oct. 25, 2009, up 16 percent from the previous quarter and up slightly from $897.7 million reported in the same period a year earlier.

On a GAAP basis, the company recorded net income of $107.6 million, or $0.19 per diluted share, compared with net income of $61.7 million, or $0.11 per diluted share a year ago. Third quarter GAAP results included a benefit to operating income of $25.1 million related to insurance reimbursements received during the quarter. On a non-GAAP basis - excluding the insurance reimbursements and stock-based compensation, as well as their associated tax impact − net income was $110.3 million, or $0.19 per diluted share, compared with $111.4 million, or $0.20 per diluted share, a year earlier."We continued to make progress in the third quarter with healthy market demand across the board," said Jen-Hsun Huang, president and chief executive officer, NVIDIA. "Revenue was up from a year ago, with improvement in each of our PC, professional solutions and consumer businesses. It's great to see us shipping orders with our Tegra mobile-computing solution, and growing enthusiasm for our Tesla platform for parallel computing in the server and cloud-computing markets."

Gross margin, on a GAAP basis, increased to 43.4 percent from 20.2 percent in the previous quarter and 41.0 percent a year earlier. On a non-GAAP basis, gross margin was 41.0 percent, up 4.7 points from the 36.3 percent reported in the previous quarter but slightly off from 41.9 percent a year earlier.

GAAP net loss for the nine months ended Oct. 25, 2009 was $199.1 million, or $0.36 per share, compared to a net income of $117.6 million, or $0.20 per diluted share for the nine months ended Oct. 26, 2008. Non-GAAP net income for the nine months ended Oct. 25, 2009, which excludes a $93.9 million net charge related to the weak die/packaging material set that was used in certain versions of our previous generation chips, a non-recurring charge of $140.2 million in connection with a cash tender offer to purchase employee stock options, stock-based compensation charges, and their associated tax impact, was $101.4 million, or $0.18 per diluted share, compared to a net income of $397.7 million, or $0.68 per diluted share for the nine months ended Oct. 26, 2008.

Outlook

The outlook for the fourth quarter of fiscal 2010 is as follows:

To supplement NVIDIA's Condensed Consolidated Statements of Operations and Condensed Consolidated Balance Sheets presented in accordance with GAAP, the company uses non-GAAP measures of certain components of financial performance. These non-GAAP measures include non-GAAP cost of revenue, non-GAAP gross profit, non-GAAP gross margin, non-GAAP net income, non-GAAP net income per share, free cash flow and days sales in inventory. In order for NVIDIA's investors to be better able to compare its current results with those of previous periods, the company has shown a reconciliation of GAAP to non-GAAP financial measures. These reconciliations adjust the related GAAP financial measures to exclude a charge related to the weak die/packaging material set that was used in certain versions of NVIDIA's previous generation chips, net of insurance reimbursements, a non-recurring charge related to a tender offer purchase, a non-recurring charge against cost of revenue related to a royalty dispute, a non-recurring restructuring charge against operating expenses, recurring stock-based compensation charges, and the associated tax impact of these items, where applicable. Free cash flow is calculated as GAAP net cash provided by operating activities less purchases of property and equipment and intangible assets. Days sales in inventory is computed using GAAP ending inventory multiply by the number of days in the period divided by the non-GAAP cost of revenue. NVIDIA believes the presentation of its non-GAAP financial measures enhances the user's overall understanding of the company's historical financial performance. The presentation of the company's non-GAAP financial measures is not meant to be considered in isolation or as a substitute for the company's financial results prepared in accordance with GAAP, and our non-GAAP measures may be different from non-GAAP measures used by other companies.

On a GAAP basis, the company recorded net income of $107.6 million, or $0.19 per diluted share, compared with net income of $61.7 million, or $0.11 per diluted share a year ago. Third quarter GAAP results included a benefit to operating income of $25.1 million related to insurance reimbursements received during the quarter. On a non-GAAP basis - excluding the insurance reimbursements and stock-based compensation, as well as their associated tax impact − net income was $110.3 million, or $0.19 per diluted share, compared with $111.4 million, or $0.20 per diluted share, a year earlier."We continued to make progress in the third quarter with healthy market demand across the board," said Jen-Hsun Huang, president and chief executive officer, NVIDIA. "Revenue was up from a year ago, with improvement in each of our PC, professional solutions and consumer businesses. It's great to see us shipping orders with our Tegra mobile-computing solution, and growing enthusiasm for our Tesla platform for parallel computing in the server and cloud-computing markets."

Gross margin, on a GAAP basis, increased to 43.4 percent from 20.2 percent in the previous quarter and 41.0 percent a year earlier. On a non-GAAP basis, gross margin was 41.0 percent, up 4.7 points from the 36.3 percent reported in the previous quarter but slightly off from 41.9 percent a year earlier.

GAAP net loss for the nine months ended Oct. 25, 2009 was $199.1 million, or $0.36 per share, compared to a net income of $117.6 million, or $0.20 per diluted share for the nine months ended Oct. 26, 2008. Non-GAAP net income for the nine months ended Oct. 25, 2009, which excludes a $93.9 million net charge related to the weak die/packaging material set that was used in certain versions of our previous generation chips, a non-recurring charge of $140.2 million in connection with a cash tender offer to purchase employee stock options, stock-based compensation charges, and their associated tax impact, was $101.4 million, or $0.18 per diluted share, compared to a net income of $397.7 million, or $0.68 per diluted share for the nine months ended Oct. 26, 2008.

Outlook

The outlook for the fourth quarter of fiscal 2010 is as follows:

- Revenue is expected to be up slightly, approximately 2 percent, from the third quarter.

- GAAP gross margin is expected to be in the range of 40 to 42 percent.

- GAAP operating expenses are expected to be approximately $305 million.

- First major Tegra devices shipped: Microsoft's Zune HD and the Samsung M1.

- Held first ever GPU Technology Conference, which was 50% oversubscribed, with 1,500 attendees from 40 countries. More than 200 technical sessions were conducted, and presentations were made by 60 emerging companies that utilize the graphics processing unit (GPU).

- Introduced the next generation CUDA GPU architecture, codenamed "Fermi." The Fermi architecture is the foundation for the world's first computational GPUs, delivering breakthroughs in both graphics and parallel computing.

- Oak Ridge National Laboratory announced plans to use Fermi to build a new supercomputer, which is designed to be the world's fastest.

- Launched the industry's first development environment for massively parallel computing. The tool, code-named "Nexus", is integrated into Microsoft Visual Studio, so that developers will be able to use Visual Studio and C++ to write applications that leverage Fermi GPUs.

- Launched NVIDIA RealityServer, a powerful combination of GPUs and software that streams interactive, photorealistic 3D applications to any web connected PC, laptop, netbook or smart phone.

- Adobe's new Flash Player 10.1 will be accelerated by GeForce, NVIDIA ION and Tegra products, helping to bring uncompromised browsing of rich Web content to netbooks, smartphones and smartbooks.

To supplement NVIDIA's Condensed Consolidated Statements of Operations and Condensed Consolidated Balance Sheets presented in accordance with GAAP, the company uses non-GAAP measures of certain components of financial performance. These non-GAAP measures include non-GAAP cost of revenue, non-GAAP gross profit, non-GAAP gross margin, non-GAAP net income, non-GAAP net income per share, free cash flow and days sales in inventory. In order for NVIDIA's investors to be better able to compare its current results with those of previous periods, the company has shown a reconciliation of GAAP to non-GAAP financial measures. These reconciliations adjust the related GAAP financial measures to exclude a charge related to the weak die/packaging material set that was used in certain versions of NVIDIA's previous generation chips, net of insurance reimbursements, a non-recurring charge related to a tender offer purchase, a non-recurring charge against cost of revenue related to a royalty dispute, a non-recurring restructuring charge against operating expenses, recurring stock-based compensation charges, and the associated tax impact of these items, where applicable. Free cash flow is calculated as GAAP net cash provided by operating activities less purchases of property and equipment and intangible assets. Days sales in inventory is computed using GAAP ending inventory multiply by the number of days in the period divided by the non-GAAP cost of revenue. NVIDIA believes the presentation of its non-GAAP financial measures enhances the user's overall understanding of the company's historical financial performance. The presentation of the company's non-GAAP financial measures is not meant to be considered in isolation or as a substitute for the company's financial results prepared in accordance with GAAP, and our non-GAAP measures may be different from non-GAAP measures used by other companies.

48 Comments on NVIDIA Reports Financial Results for Third Quarter Fiscal Year 2010

There are plenty of reasons not to buy a ATi DX11 card, just like there are plenty of reasons to buy one. you can have your opinion but I severely doubt Nvidia are going under the table to TSMC to effectively sabotage the mass production of ATi's 40nm lineup, I just don't.

If you have genuinely made no modifications or overclocks at all that you could attribute to your cards death, and used only WHQL drivers, RMA the card.

anyone else had their card fried by 191.07 drivers?

forums.nvidia.com/index.php?showtopic=149983&st=0&gopid=946729&#entry946729

Never overclocked or modified my card.

RMA your card.

The problem is 40nm isn't perfected yet, but ATi pushed too quickly to get cards out. RV740 was a test for 40nm, and it showed that TSMC couldn't keep up with demand. Things have improved with 40nm, but not to the point where TSMC can supply 40nm parts for an entire line-up of cards. Maybe one or two cards, but not the entirely line-up ATi is trying to push through, along with nVidia's new cards.

Still Nvidia has its fingers in many butters now. Won't be surprised if in a few years their SoC solutions overtakes their dedicated graphics in profit, considering where the consumer market is heading now.

And the GTS250 is a better buy than both...

I find that in dicussions like this the ATi side tend to not consider rebates, I wonder if that is because most ATi manufacturers don't offer rebates and the rebates on nVidia cards makes them better buys...:laugh: