Wednesday, January 4th 2012

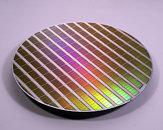

Barclays Capital Downgrades Intel, Freescale, Spansion; Upgrades Micron Technology

Investment firm Barclays Capital lowered its ratings on semiconductor majors Intel, Applied Materials Inc, Freescale Semiconductor Holdings Ltd, Microchip Technology Inc., and Spansion Inc., from "equal weight" from "overweight", meaning that these companies are no longer outperforming, and are doing average, with negligible growth. Towards the end of 2011, Intel adjusted its Q4 forecast, lowering it by $1 billion, blaming factors beyond its control such as HDD supply problems. Weakened PC sales growth is another major factor. On the other hand, DRAM and NAND flash memory maker Micron Technology got its rating upgraded to "overweight", as Barclays notes that the industries Micron is in, are on the verge of a boom. Reacting to this, Micron's shares shot up by 11 percent during trading early this week, sending its shares' valuation from $6.2 billion, up 9 percent to $6.88 billion.

Source:

Reuters

2 Comments on Barclays Capital Downgrades Intel, Freescale, Spansion; Upgrades Micron Technology