Thursday, August 8th 2013

NVIDIA Reports Financial Results for Second Quarter Fiscal 2014

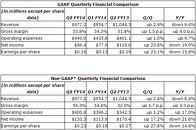

NVIDIA today reported revenue for the second quarter of fiscal 2014, ended July 28, 2013, of $977.2 million, up 2.4 percent from $954.7 million in the previous quarter. GAAP earnings per diluted share were $0.16, up 23.1 percent from $0.13 in the previous quarter. Non-GAAP earnings per diluted share were $0.23, up 27.8 percent from $0.18 in the previous quarter.

"The GPU business continued to grow, driving our fourth consecutive quarter of record margins," said Jen-Hsun Huang, president and chief executive officer of NVIDIA. "We also began shipping GRID virtualized graphics, which puts the power of NVIDIA GPUs into the datacenter. We look forward to a strong second half, with new Tegra 4 devices coming to market, SHIELD moving beyond the U.S. and broader sampling of Project Logan, our next-generation Tegra processor, which brings Kepler, the world's most advanced GPU, to mobile."On May 14, 2013, NVIDIA executed an accelerated share repurchase (ASR) agreement with Goldman, Sachs & Co. such that NVIDIA paid Goldman Sachs $750 million and Goldman Sachs delivered 36.9 million shares on May 16, 2013. These shares were accounted for as treasury share repurchases that reduced the outstanding common shares used to calculate EPS. Upon final settlement of the ASR, Goldman Sachs may be required to deliver additional shares of common stock to NVIDIA or NVIDIA may be required to deliver shares of its common stock, or elect to make a cash payment, to Goldman Sachs, based on the terms and conditions under the ASR. NVIDIA currently expects that, at the time of settlement, Goldman Sachs will be required to deliver additional shares of common stock to NVIDIA.

NVIDIA's outlook for the third quarter of fiscal 2014 is as follows:

Among highlights of the second quarter of fiscal 2014, NVIDIA:

NVIDIA will pay its next quarterly cash dividend of $0.075 cents per share on September 13, 2013, to all stockholders of record on August 22, 2013.

CFO Commentary and Earnings Presentation

Commentary on the quarter by Karen Burns, NVIDIA interim chief financial officer, and a presentation, are available at www.nvidia.com/ir.

"The GPU business continued to grow, driving our fourth consecutive quarter of record margins," said Jen-Hsun Huang, president and chief executive officer of NVIDIA. "We also began shipping GRID virtualized graphics, which puts the power of NVIDIA GPUs into the datacenter. We look forward to a strong second half, with new Tegra 4 devices coming to market, SHIELD moving beyond the U.S. and broader sampling of Project Logan, our next-generation Tegra processor, which brings Kepler, the world's most advanced GPU, to mobile."On May 14, 2013, NVIDIA executed an accelerated share repurchase (ASR) agreement with Goldman, Sachs & Co. such that NVIDIA paid Goldman Sachs $750 million and Goldman Sachs delivered 36.9 million shares on May 16, 2013. These shares were accounted for as treasury share repurchases that reduced the outstanding common shares used to calculate EPS. Upon final settlement of the ASR, Goldman Sachs may be required to deliver additional shares of common stock to NVIDIA or NVIDIA may be required to deliver shares of its common stock, or elect to make a cash payment, to Goldman Sachs, based on the terms and conditions under the ASR. NVIDIA currently expects that, at the time of settlement, Goldman Sachs will be required to deliver additional shares of common stock to NVIDIA.

NVIDIA's outlook for the third quarter of fiscal 2014 is as follows:

- Revenue is expected to be $1.050 billion, plus or minus two percent.

- GAAP and non-GAAP gross margins are expected to be approximately flat relative to the prior quarter at 56.0 percent and 56.3 percent, respectively.

- GAAP operating expenses are expected to be approximately $460 million. Non-GAAP operating expenses are expected to be approximately $418 million.

- GAAP and non-GAAP tax rates for the remaining half of fiscal 2014 are expected to be 16 percent, plus or minus one percent. This estimate excludes any discrete tax events that may occur during a quarter, which, if realized, may increase or decrease our actual effective tax rates in such quarter.

Among highlights of the second quarter of fiscal 2014, NVIDIA:

- Demonstrated the capabilities of the Kepler-based GPU in Project Logan, its next-generation mobile processor, and announced an IP licensing initiative that will bring this technology to new markets.

- Shipped NVIDIA SHIELD, its open-platform gaming and entertainment portable (July 31, after quarter end).

- Demonstrated NVIDIA Tegra 4i phone calls on AT&T's network, and showed support of LTE Cat 4 data rates.

- Launched a new family of high-end gaming GPUs, the GeForce GTX 760, GeForce GTX 770 and GeForce GTX 780.

- Appeared on stage with the CEO of Citrix to announce that XenDesktop 7 has now fully integrated NVIDIA GRID vGPU technology to share GPUs across virtual machines.

- Appointed Dawn Hudson, former CEO of PepsiCo's North American operations, to its board of directors.

NVIDIA will pay its next quarterly cash dividend of $0.075 cents per share on September 13, 2013, to all stockholders of record on August 22, 2013.

CFO Commentary and Earnings Presentation

Commentary on the quarter by Karen Burns, NVIDIA interim chief financial officer, and a presentation, are available at www.nvidia.com/ir.

9 Comments on NVIDIA Reports Financial Results for Second Quarter Fiscal 2014

They need to ditch there Tegra division. 3rd Quarter in a row its drop rate % of half.

Last quarters effort to Licence off Kepler IP didn't do anything to stop the downward trend.

Whats the point for manufactures to include a Tegra 4i in there phone which isn't Voice certified ?

Tablets maybe but its still not Data certified either. Tegra 4 would be only be able to be sold as Wi-Fi tablet.

What they have now is a iPod Touch rival.

That's why Shield was released first and Tegra 4 (Wayne) and a cut back version of the original specs and are still iffy due to that aswell as other hiccups that companies didn't want to deal with and passed on for Qualcomm chips.

Nvidia could have done themselves a favor by using a +1 chip modem that was already proven and certified but they wouldn't make as much money selling the SoC then needing a +1 modem. Tegra 4i (Grey) has i500 integrated and Nvidia wants to get this hurtle over with and take the hit now.

Quote: "...our next-generation Tegra processor, which brings Kepler, the world's most advanced GPU, to mobile."

Unless Nvidia's definition of "most advanced" means under-performing and over-prices, they must be on drugs or figure they can B.S. the investment community who may be technically clueless?

Must suck to be you Jorge...going through life perpetually disappointed that your washpowder didn't lift 99% of household stain in cold water, that your car doesn't achieve the quoted highway fuel consumption, and the latest movie you saw wasn't the advertised Biggest Blockbuster of the Year...or maybe its just filler supplied by marketing. Here's another example. AMD would have you believe that the HD 7990 is quieter than a "quiet library" (as well as markedly quieter than the other two cards featured). So much for truth in advertising.

Tegra 4 (Wayne) cant even compete with Qualcomm 800 phone variant. How do you expect the smaller version of Tegra 4i (Grey) the one that is actually going to be in phone to fair ?

Nvidias best bet is to get i500 certified slap it on Logan rush it out and hope Samsung and Qualcomm don't come out with anything faster in 2014.

GCN is faster in synthetic benchmarks in 3...2...1...

It looks like they tried apply their traditional approach to arm cpus , probably they did not understand market demand much.