Thursday, October 17th 2013

AMD Reports 2013 Third Quarter Results

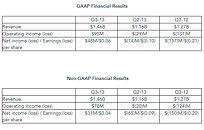

AMD today announced revenue for the third quarter of 2013 of $1.46 billion, operating income of $95 million and net income of $48 million, or $0.06 per share. The company reported non-GAAP operating income of $78 million and non-GAAP net income of $31 million, or $0.04 per share.

"AMD returned to profitability and generated free cash flow in the third quarter as we continued to successfully execute the strategic transformation plan we outlined a year ago," said Rory Read, AMD president and CEO. "We achieved 26 percent sequential revenue growth driven by our semi-custom business and remain committed to generating approximately 50 percent of revenue from high-growth markets over the next two years. Developing industry-leading technology remains at our core, and we are in the middle of a multi-year journey to redefine AMD as a leader across a more diverse set of growth markets."Quarterly Financial Summary

For the fourth quarter of 2013, AMD expects revenue to increase 5 percent, plus or minus 3 percent, sequentially.

"AMD returned to profitability and generated free cash flow in the third quarter as we continued to successfully execute the strategic transformation plan we outlined a year ago," said Rory Read, AMD president and CEO. "We achieved 26 percent sequential revenue growth driven by our semi-custom business and remain committed to generating approximately 50 percent of revenue from high-growth markets over the next two years. Developing industry-leading technology remains at our core, and we are in the middle of a multi-year journey to redefine AMD as a leader across a more diverse set of growth markets."Quarterly Financial Summary

- Gross margin was 36 percent in Q3 2013.

Gross margin decreased sequentially. Q3 2013 gross margin included a $19 million benefit, approximately 1 percentage point, from the sale of inventory that had been previously reserved in Q3 2012 as compared to a similar $11 million benefit, approximately 1 percentage point, in Q2 2013. - Cash, cash equivalents and marketable securities balance, including long-term marketable securities, was $1.2 billion at the end of the quarter, slightly above our targeted optimal level of $1.1 billion.

- Computing Solutions segment revenue decreased 6 percent sequentially and decreased 15 percent year-over-year. The sequential and year-over-year declines were due to decreased notebook and chipset unit shipments, partially offset by an increase in desktop unit shipments.

Operating income was $22 million, compared with operating income of $2 million in Q2 2013 and an operating loss of $114 million in Q3 2012. The Q3 2012 operating loss included an inventory write-down of approximately $100 million primarily consisting of first generation A-Series accelerated processing units (APUs).

Microprocessor Average Selling Price (ASP) was flat sequentially and decreased year-over-year. - Graphics and Visual Solutions (GVS) is comprised of graphics processing units (GPUs), including professional graphics, as well as semi-custom products and development and game console royalties.

GVS segment revenue increased 110 percent sequentially and increased 96 percent year-over-year driven largely by our semi-custom business. GPU revenue declined sequentially and year-over-year. In the third quarter customers began transitioning to our new products late in the quarter.

Operating income was $79 million compared with breakeven in Q2 2013 and $18 million in Q3 2012.

GPU ASP decreased sequentially and year-over-year.

- AMD announced the AMD Radeon R7 and R9 Series graphics cards. Based on the award-winning Graphics Core Next (GCN) architecture, the AMD Radeon R7 Series graphics cards support AMD's "Mantle" technology which enables game developers to more easily harness the full capabilities of the GCN cores across both PCs and consoles to offer an unmatched level of hardware optimization, revolutionary performance and image quality. AMD's newest graphics chips also include AMD TrueAudio Technology, the world's first fully programmable audio pipeline on a graphics card.

- Verizon announced that its high-performance public cloud with best-in-class reliability is powered by AMD's SeaMicro SM15000 servers.

- As a part of driving the company's growth in embedded markets, AMD extended its embedded System-on-a-Chip (SoC) product portfolio with the launch of a new low-power AMD Embedded G-Series SOC for fanless designs at approximately 3-watts average power. AMD also detailed its plans to become the first and only company to offer both 64-bit ARM and x86 embedded solutions starting in 2014.

- Toshiba and HP announced new 2-in-1 PCs based on the 2013 AMD Elite Mobility APU. These innovative designs offer the full Windows 8 touch PC experience in a notebook that performs equally well as a tablet when desired.

- HP announced the new thin and light HP ZBook 14 mobile workstations that rely on AMD FirePro professional graphics.

- AMD selected SAPPHIRE Technology to be the exclusive global distribution partner for AMD FirePro professional graphics, driving stronger support for AMD FirePro professional graphics by delivering new distribution resources to AMD's channel ecosystem companies worldwide.

- AMD and Mixamo introduced the world's first real-time facial capture technology for the Unity game development platform, enabling developers to capture their facial expressions through standard webcams and transfer them in real time onto a 3D character.

- AMD announced senior leaders from ARM, DICE/Electronic Arts, Imagination Technologies, Mediatek USA, Oracle, Sony and Unity Technologies will keynote APU13, the company's third annual developer conference.

- Adobe announced further enhancements to its Adobe Creative Cloud suite to accelerate the performance and improve the quality of its applications when running on AMD APUs and discrete GPUs.

- AMD was recognized for its excellence in corporate responsibility, making the Dow Jones Sustainability Index for the ninth consecutive year.

For the fourth quarter of 2013, AMD expects revenue to increase 5 percent, plus or minus 3 percent, sequentially.

15 Comments on AMD Reports 2013 Third Quarter Results

The Singapore sell/lease back is included in the Q3 financials. From the second TPU link:

Go out their and pick up an AMD product, and support the little guy :rockout:

Who said Consoles weren't profitable ?

They were expecting a single digit mid to high (7-8 est) % and ended up with a mid 10s (15% est)

Interesting is they plan to sustain that and possibly increase from that 15% as yields improve and wafer prices drop.

People have a certain amount of money to spend regardless of the number of vendors in the marketplace...and FWIW, when AMD and Intel were going toe-to-toe in CPUs (Athlon v Pentium) all that happened was they price matched each other. Have a grand in your pocket? If you were looking at the top bin from either company you might have got $1 change. Likewise the second tier CPU was around $500-700 on average - again, from both vendors.

The AMD Athlon (T-bird) launched at $850 in June '99, the 1GHz version at $1299 eight months later. In between Intel launched the Coppermine P3 at the same $850 price point. The pricing of both AMD and Intel was pegged pretty much equal up until Conroe launched.

GPUs? Yeah, heaps of competition. Nvidia price the GTX 690 at $999, AMD price the HD 7990 at $999. Equal performance and feature set usually equates to equal MSRP give or take 10-15% in general. Where it doesn't equate it becomes more a function of brand perception, and slashing prices, while attractive to the consumer, does little to enforce the perception of a strong brand. Neither AMD or Nvidia (or Intel for that matter) sell for any less than the sucker holding the wallet is willing to cough over, and why market shares have stayed pretty much static over the years.Time to slash your wrists then. A duopoly of AMD and Nvidia seem to have reached an "understanding". Both content to wage war on bullet points rather than get into a price war. I doubt that situation will change unless inventory starts to back up.Says the guy with the Ivy Bridge CPU and Z77 board :roll:

Good luck, and please find it in yourself to be less negative.

What I see is billion dollar companies acting like billion dollar companies. That's how they become...billion dollar companies. I could, I suppose, believe that some enlightened and fair world would exist if it were only for a fair marketplace....but then I remember (yes, remember) when we had not one, two, or three vendors competing but dozens...and you know what? when it came to prices they all charged like a wounded bull if the performance was there. At one time in the mid-90's $350-450 would get you the base memory capacity S3 Vision968, or Matrox Milennium, or ATI 3D Rage, Number Nine Revolution 3D, STM (Nvidia) Edge 2200, or 3dfx Voodoo Graphics...and more than a few others. Competition and lower prices is generally only applicable when one or more companies is chasing market share due to either lower performance and/or adverse sales from a brand under pressure.

In 808 posts here I don't think I've ever denigrated a hardware product regardless of vendor, nor any user for their choice of hardware...I am, however a realist when it comes to the companies that sell that hardware.

BTW, selling their real property assets and then leasing them back has nothing at all to do with sales revenues and profits. It does offer a long term tax advantage and improves cash for R&D which is a far better use of the capital.

Consoles sales to date are included in these financials but console production has just started to ramp so they don't have a big influence on these financials.