Friday, October 16th 2015

AMD Reports 2015 Third Quarter Results

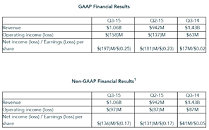

AMD today announced revenue for the third quarter of 2015 of $1.06 billion, operating loss of $158 million, and net loss of $197 million, or $0.25 per share. Non-GAAP operating loss was $97 million and non-GAAP net loss was $136 million, or $0.17 per share. GAAP and non-GAAP results include a $65 million inventory write-down and the impact of this charge to loss per share was $0.08.

"AMD delivered double-digit percentage sequential revenue growth in both of our segments in the third quarter," said Dr. Lisa Su, AMD president and CEO. "We continue to take targeted actions to improve long-term financial performance, build great products and simplify our business model. The formation of a joint venture of our back-end manufacturing assets is a significant step towards achieving these goals and strengthening our balance sheet."Q3 2015 Results

As a part of AMD's ongoing strategic plan to sharpen its focus on designing high-performance technologies and products that drive profitable growth, AMD today announced the signing of a definitive agreement to create a joint venture with Nantong Fujitsu Microelectronics (NFME) that combines AMD's high-volume ATMP facilities and experienced workforce in Penang, Malaysia and Suzhou, China with NFME's established outsourced semiconductor assembly and test (OSAT) expertise to offer differentiated capabilities and scale to service a broad range of customers.

The value of the transaction is $436 million and NFME will take an 85 percent ownership of the joint venture. AMD will receive $371 million in cash and expects net proceeds of approximately $320 million, net of taxes and other charges at close. This transaction is expected to close in the first half of 2016, pending successful completion of regulatory approvals.

Recent Highlights

AMD's outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

For Q4 2015, AMD expects revenue to decrease 10 percent, plus or minus 3 percent, sequentially.

For additional details regarding AMD's results and outlook please see the CFO commentary posted here.

"AMD delivered double-digit percentage sequential revenue growth in both of our segments in the third quarter," said Dr. Lisa Su, AMD president and CEO. "We continue to take targeted actions to improve long-term financial performance, build great products and simplify our business model. The formation of a joint venture of our back-end manufacturing assets is a significant step towards achieving these goals and strengthening our balance sheet."Q3 2015 Results

- Revenue of $1.06 billion, up 13 percent sequentially and down 26 percent year-over-year. The sequential increase was due to solid seasonal semi-custom and strong desktop processor and GPU sales. The year-over-year decline was primarily due to decreased sales in the Computing and Graphics segment.

- Gross margin of 23 percent, down 2 percentage points sequentially, due to an inventory write-down of $65 million. Non-GAAP(1) gross margin, including the impact of the inventory write-down was 23 percent, down 5 percentage points sequentially. The inventory write-down was due to lower anticipated future demand for older-generation APUs. The gross margin impact of the inventory write-down was 6 percentage points.

- Operating loss of $158 million, compared to an operating loss of $137 million for the prior quarter. Non-GAAP(1) operating loss of $97 million, compared to non-GAAP(1) operating loss of $87 million in Q2 2015, primarily due to lower gross margin.

- Net loss of $197 million, loss per share of $0.25, and non-GAAP(1) net loss of $136 million, non-GAAP(1) loss per share of $0.17, compared to a net loss of $181 million, loss per share of $0.23 and non-GAAP(1) net loss of $131 million, non-GAAP(1) loss per share of $0.17 in Q2 2015. The impact of the inventory write-down to EPS was $0.08.

- Cash and cash equivalents were $755 million at the end of the quarter, down $74 million from the end of the prior quarter, due primarily to a $69 million debt interest payment.

- Total debt at the end of the quarter was $2.26 billion, flat from the prior quarter.

- Computing and Graphics segment revenue increased 12 percent sequentially and decreased 46 percent from Q3 2014. The sequential increase was primarily due to higher sales of desktop processors and GPUs and the annual decrease was driven primarily by lower client processor sales.

o Operating loss was $181 million, compared with an operating loss of $147 million in Q2 2015 and an operating loss of $17 million in Q3 2014. The sequential change was primarily driven by an inventory write-down of older-generation products partially offset by higher revenue. The year-over-year change was primarily driven by lower sales.

o Client processor average selling price (ASP) decreased sequentially and year-over-year primarily driven by lower notebook processor ASP.

o GPU ASP was flat sequentially and increased year-over-year. The year-over-year change was due to new GPU product offerings and improved AIB ASP. - Enterprise, Embedded and Semi-Custom segment revenue increased 13 percent sequentially, primarily driven by seasonally higher sales of our semi-custom SoCs. The year-over-year decrease of 2 percent was primarily driven by lower embedded product and server processor sales.

o Operating income was $84 million compared with $27 million in Q2 2015 and $108 million in Q3 2014. The sequential increase was primarily due to the absence of the $33 million charge associated with a technology node transition in Q2 2015 and higher sales. The year-over-year decrease was primarily driven by a portion of the Q3 2015 inventory write-down and product mix. - All Other category operating loss was $61 million compared with operating losses of $17 million in Q2 2015 and $28 million in Q3 2014. The sequential and year-over-year increases were due to restructuring charges recorded in Q3 2015.

As a part of AMD's ongoing strategic plan to sharpen its focus on designing high-performance technologies and products that drive profitable growth, AMD today announced the signing of a definitive agreement to create a joint venture with Nantong Fujitsu Microelectronics (NFME) that combines AMD's high-volume ATMP facilities and experienced workforce in Penang, Malaysia and Suzhou, China with NFME's established outsourced semiconductor assembly and test (OSAT) expertise to offer differentiated capabilities and scale to service a broad range of customers.

The value of the transaction is $436 million and NFME will take an 85 percent ownership of the joint venture. AMD will receive $371 million in cash and expects net proceeds of approximately $320 million, net of taxes and other charges at close. This transaction is expected to close in the first half of 2016, pending successful completion of regulatory approvals.

Recent Highlights

- AMD expanded its offerings for the commercial client market with new product announcements and security-focused technology partnerships that address the needs of business users and IT decision makers:

o For the first time, AMD was the exclusive launch processor partner for HP's newest EliteBook commercial client systems featuring the latest AMD PRO A-Series mobile and desktop processors (formerly codenamed "Carrizo PRO" and "Godavari PRO"). AMD's new commercial processors deliver exceptional performance and dependability to meet the evolving budget and IT needs of businesses today and tomorrow. AMD PRO mobile processors power some of the first-to-market commercial notebook systems running the Microsoft Windows 10 operating system and are the industry's first commercial processors designed to be compliant with the Heterogeneous Systems Architecture (HSA) 1.0 specification. - AMD demonstrated innovation leadership with the introduction of the AMD Radeon R9 Nano, the fastest Mini ITX graphics card2 ever created and the world's smallest enthusiast GPU, featuring High-Bandwidth Memory (HBM) to deliver up to 30 percent more performance3 and up to 30 percent lower power4 than AMD's previous generation graphics cards.

- AMD announced the AMD A8-7670K APU delivering an excellent experience and value for today's mainstream workloads, eSports online gaming, and Microsoft Windows 10.

- AMD delivered seamless and intuitive support for Windows 10 and DirectX 12 across AMD APU and GPU solutions with its new AMD Catalyst 15.7 Driver update and continued to out-perform its competitors in DirectX 12 performance, including in the Ashes of the Singularity and Fable Legends benchmarks.

- AMD further solidified itself as a leader in the embedded market with new product introductions and design wins:

o Announced multiple new discrete AMD Embedded Radeon graphics options specifically designed to advance the visual and parallel processing capabilities of embedded applications.

o Bolstered its No. 1 position in the thin client space with the announcement that the new FUJITSU FUTRO S920, S720 and S520 are powered by AMD Embedded G-Series SOCs, which couple high-performance computing and graphics capability in a highly-integrated, low-power design. - AMD released a carbon footprint analysis of the 6th Generation AMD A-Series APU, formerly codenamed "Carrizo", showing that using the new processor can result in up to a 50 percent reduction in greenhouse gas emissions compared to AMD's previous generation APU.

- AMD displayed the versatility of its FirePro professional graphics to address a variety of markets:

o Introduced the world's first server GPU with 32GB of memory for high performance compute (HPC).

o Announced new professional graphics design wins with the Dell Precision 3510, 7510, and 7710 mobile workstations powered by AMD FirePro mobile GPUs to address the mobile performance needs of engineers and design pros.

o Showcased the power of FirePro professional graphics technologies to create stunning visual effects for global film productions such as Baahubali: The Beginning and Golden Drops.

o Unveiled the world's first hardware-based virtualized GPU solution. With the AMD Multiuser GPU, IT pros can easily configure solutions to allow up to 15 users on a single AMD GPU. - AMD formed the Radeon Technologies Group to bring a vertical focus on graphics and immersive computing development. With this strategic alignment, AMD is well-positioned to expand its role as the graphics industry leader, recapturing share across traditional graphics markets, and staking leadership positions in new markets such as virtual and augmented reality.

AMD's outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

For Q4 2015, AMD expects revenue to decrease 10 percent, plus or minus 3 percent, sequentially.

For additional details regarding AMD's results and outlook please see the CFO commentary posted here.

62 Comments on AMD Reports 2015 Third Quarter Results

1. GPU. Nobody wants a business which does not produces money. Why would you get into it? If they manage to spin off the GPU division and prove that the GPU division produces money, then yes its worth something maybe even more than 50% of the competitor, otherwise its worth nothing, absolute 0.

2. x86 license. There were long discussions about it but I think its not transferable. Even if it would be ... who is crazy enough to invest tens of billions to fight with Intel? And why would you do that, the lion share is in the ARM technology nowadays, so if Apple/Qualcomm will buy something from AMD related to CPU is patents or maybe some know how, but the x86 license itself is not worth much.

3. Who will want to do business and strategic partnership with a company which tomorrow might go bankrupt? Typical enterprise server clients want support 5-10 years at least. Typical OEM also want support for the products with AMD tech which they sell to their customers and they want to know, that products will be supplied and contracts fulfilled. If an OEM will take the risk it will want to be worth it, which means AMD has to offer very agresive prices which will lead to less profit for AMD.

4. General perception of the AMD products is that they are not very good, neither the CPU, nor the GPU and it will be very hard fighting against that. Market share also tanked, lower than 25 % for both, which means 75% of the people choose and will recommend something else. Basically now people buy AMD only to support the underdog, or because the price is very low for what it offers, which means they have to sell cheap, and again not make profit. Also because of this shops will bring in what they can sell, they don't want to get stuck with stocks they cannot sell. As a result also manufacturers are producing goods people want as they also don't want stocks they cannot sell. Its a tough loop to get out from. And to prove my point, just look in your favorite online shop. I just checked mine, there are about 200 laptop models in their direct stock, only 6 of them with AMD cpu (3%). On the GPU side things are a bit better 40 have AMD GPU (20%)

I think, if someone BIG will backup AMD no matter what and they will be able to prove that their business is strong, if they will be extremely customer oriented and will jump immediately to resolve even the smallest complain they will be in a much better position.

www.techpowerup.com/reviews/AMD/R9_Fury_X/19.html

Baow baow baow baow--- baowm baowm baowm baowm, ...Baow baow baow baow--- baowm baowm baowm baowm , do do superstition -- do-do do do-do doooooooNo, sorry, my card runs 20% faster than that (1500Mhz, it's a 980ti thing).

2) All 4 cards will be running volt mods and unlike Nvidia AMD cards scale with voltage even on ambient cooling. 24/7 clocks will be somewhere between 1100 and 1200mhz but for benching I can probably push 1300mhz and then I can crush the 4 way firestrike leader boards on HWbot.

3) Freesync is cheaper than Gsync

4) I hate Nvidia drivers

5) 4 way pretty much requires water cooling to run at a reasonable temp and the cheapest water cooled 980 Ti is more expensive than a Fury X when you buy 4 cards this small price difference stacks.

This is always AMD's issue - great (fantastic even) software and hardware engineers but with the wrong people driving the wagon. And don't confuse shrewd business practices (Nvidia or Intel) with decency but fact is, AMD's CEO's for years have been lacking in 'prowess'.

I wasn't try'n to be fair. I was just pointing to the fact that AMD sponsored Schumi. I wasn't adding to his analogy. His reference to F1 and AMD reminded me of Schumi. You guys seem to be filling in the rest.

As far as fair goes.

Didn't you just finish comparing your water blocked KINGPIN to a reference debate between the double D's.:lovetpu:

Essentially, what's going on is that AMD's x86-64 is built into every 64 bit Intel CPU. If you don't believe me, and you're running a 64 bit version of any Windows OS, go to your "C:\Windows\WinSxS" folder and have a look at the folder names in there. Whether you're running an AMD or Intel CPU, those folders are still labelled: "amd64_*" Why? Because the 64bit extensions INSIDE your Intel CPU were written by... Advanced Micro Devices. Really, the truthful Intel marketing slogan would be "AMD Inside!" (every one of our CPUs!)

If Intel were to try to refuse an x86 license in the event of a merger/buyout, AMD can refuse to renew the x86-64 cross-license with Intel, too. AMD could get a court injunction against the sale of any Intel CPUs with their micro-code, which means essentially all of them. Do you STILL think Intel would simply refuse to negotiate the x86 license with AMD or an acquirer of AMD's intellectual property?Again, this is a spurious argument. If AMD, with its universally acknowledged limited resources, has been in business for 45 years, and been making x86-compatible CPUs that are competitive with Intel since 1982, do you REALLY think a company with the financial resources like Microsoft ($92 billion in cash on hand), Apple (~$200 billion in cash on hand) or even Qualcomm (~$35 billion in cash on hand) will be daunted in an effort to acquire AMD and inject enormous investments into their x86 business? "Hey, there's only ONE competitor in this extremely lucrative computing market! I'll take it!" would be the more likely response.This is the silliest statement you've made so far. So who's perceptions are you talking about, exactly? You and a few friends? Because Sony and Microsoft are currently all-AMD inside for their high volume game consoles. There's no Intel or nVidia in there, period. And Hewlett Packard's, Dell's, and IBM's (now Lenovo) server units were all building AMD-powered servers for their customers, and selling them quite handily back when AMD had the Athlon 64-based Opterons. Seems to me that these companies and their customers didn't think AMD products were 'not very good'! And all that has to happen for history to repeat itself is for the Zen processor to start coming out of the Fab, and be good. And it will be. Intelligent people will look at benchmarks, and if AMD's chips are faster than Intel, or even pretty darn close, AMD will be able to charge the same price or more than Intel charges for their competing chip. This was proven back in 2002-2005, when Opterons were selling for $1,000+/chip, and AMD had over 10% of the server market:

www.theregister.co.uk/2005/07/25/amd_ten_percent/

so please don't bother to argue the point.Finally, you said something I can agree with. However, I happen to think AMD could pull this off, even without 'someone BIG' buying them out. As an AMD shareholder right now, however, such a buyout, at the price per share I projected, would be icing on the cake.

And your fairness retort to me? I was comparing most 980ti's to be honest. It's only fair to compare the overclock on Maxwell to the 'overclockers dream'.

Which is relevant to AMD's current situation where the company promises too much and delivers under expectation.

As for referencing my Kingpin, you should know they don't overclock any better than most 980ti cards unless using LN2. But it is so much prettier.

I love TPU too.

Now comparing overclock ability is relevant.

All because of Schumis helmet. :laugh:

In fact I'm a big AMD fan and the Haswell that i now have is the first Intel CPU I have in my desktop since 98 when i bought my first x86 computer (had Z80 before).

Even this one I wouldn't have as despite the bad press, I initially bought the FX 8300, in very good price, overclocked it to 8350 levels and returned it the next day, due to low performance.

Single thread was abysmal, lower than my old phenom 2, FPU abysmal, lower than my 4 years old phenom 2. Multi-thread performance was great, but I couldn't accept that some tasks will work poorly on the new CPU. Intel gave me a good 40% flat performance increase both in single and multi-thread.

On the GPU side, I still went AMD, again against popular opinion, which was placing competing nvidia product with better time-frames, better power consumption and so on.

I did it partly to support them, partly because I couldn't understand how nv can work so well with the small bus, I was sure there is a trade off somewhere which nobody saw so far. And guess what, I'm a bit disappointed with this as well. I did not return it this time, as I got my 30% increase in all applications but ... I have a problem with the VRMs which most of the time go to 90 - 100 degrees C in gaming, 125+throtling in furmark. I contacted Asus and they told me its perfectly fine ... don't worry, just don't use furmark for long periods. This is not necessarily AMD fault, but a poor design on Asus side. VRMs should have touched a heat pipe from the big cooler. From another perspective this is a side effect of the fact that AMD GPUs consume a lot of power.

1- You can't assume that ATi/Radeon worth 50% of Nvidia because Radeon's share is 20% and Nvidia's is 80% that mean 1 to 4. Second Nvidia has 75% of severs GPGPU and 24% for intel. Third Nvidia controlling most of workstation graphics. Fourth Nvidia has about 70% of computer graphics IP. Fifth Nvidia has real estates like their new campus which cost them about 340 M$. Sixth Nvidia has small projects like ARM, Tablets, Settop boxes, Power Foundation, Cars information systems. Seventh Nvidia's big R&D team. Eighth History of stable profit in the last five years.

2- You can't put value for company more than what its assets worth because that is what you get when liquidize the company and I couldn't find AMD's brand value, The x86 IP doesn't worth that much because: First the licensing agreement with Intel is to tight, Second the PC market shrink, Third the big variety of CPU IP's other than x86 like ARM, MIPS, Power PC and the ease to get licence for any of these IP's.

I can tell you what is the most valuable asset AMD has. It is their loyal fans who kept defending the brand for the last five years and kept buying their products, but AMD forgot about that and kept wasting their money on PR monkeys and over paid management, they loose key R&D people every day. with out AMD loyal fans AMD worth -2.2 B$.

FTR, I merely indicated how far ahead the 980ti actually is (yes with overclock). Which is really relevant to the thread because had Lisa Su been correct and the Fury X was an overclockers dream, I'd own one right now.

I waited for the Fury X release, baited on false promises. As good as it is, it was not what they said it would be.

All relevant to the thread topic of falling earnings due to underperforming (compared to stated marketing or conferences) products.

Even going off topic, if they had released the Fury X with good air cooler and then Nano, it would have made a more desirable stack. And they gambled too much on component availability.

So yeah, comparing the merits of the abilities (over clocking) of the Fury X's rival is actually pretty relevant in a thread about diminishing revenue.

Why do you feel AMD is suffering? What factors do you think play a role?

As far as Schumacher's helmet goes, my initial response was understandable from a logical point of view. @HumanSmoke compares BoD to blind guy driving but you reply, more like Schumacher driving. I miss your AMD meaning and think instead you feel BoD are aces like Schumacher. QED.

Edit: Obviously the gfx wing is only part of the problem...

ZENARMNintendo NXT ?GPUsNow I've posted more info from earnings call then everyone else combined. Exclude BT..

:p