Tuesday, April 19th 2016

Intel Reports First Quarter 2016 Revenue of $13.7 Billion

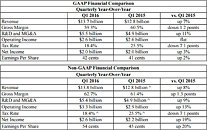

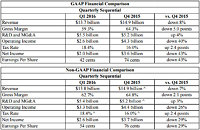

Intel Corporation today reported first-quarter GAAP revenue of $13.7 billion, operating income of $2.6 billion, net income of $2.0 billion and EPS of 42 cents. Intel reported non-GAAP revenue of $13.8 billion, operating income of $3.3 billion, net income of $2.6 billion and EPS of 54 cents. The company generated approximately $4.0 billion in cash from operations, paid dividends of $1.2 billion, and used $793 million to repurchase 27 million shares of stock.

"Our first-quarter results tell the story of Intel's ongoing strategic transformation, which is progressing well and will accelerate in 2016," said Brian Krzanich, Intel CEO. "We are evolving from a PC company to one that powers the cloud and billions of smart, connected computing devices."Intel also today announced a CFO succession plan. The current CFO, Smith, will transition to a new role at the company, leading sales, manufacturing and operations once his successor is in place. The company is beginning a formal search process for a new CFO that will assess both internal and external candidates. Smith will remain firmly focused on his CFO role and duties throughout the search and transition process.

"We are excited to have Stacy take on this new role, leveraging the deep expertise and strong leadership skills that he has developed over his 28-year career at Intel," said Krzanich.

Q1 Key Business Unit Trends

"Our first-quarter results tell the story of Intel's ongoing strategic transformation, which is progressing well and will accelerate in 2016," said Brian Krzanich, Intel CEO. "We are evolving from a PC company to one that powers the cloud and billions of smart, connected computing devices."Intel also today announced a CFO succession plan. The current CFO, Smith, will transition to a new role at the company, leading sales, manufacturing and operations once his successor is in place. The company is beginning a formal search process for a new CFO that will assess both internal and external candidates. Smith will remain firmly focused on his CFO role and duties throughout the search and transition process.

"We are excited to have Stacy take on this new role, leveraging the deep expertise and strong leadership skills that he has developed over his 28-year career at Intel," said Krzanich.

Q1 Key Business Unit Trends

- Client Computing Group revenue of $7.5 billion, down 14 percent sequentially and up 2 percent year-over-year

- Data Center Group revenue of $4.0 billion, down 7 percent sequentially and up 9 percent year-over-year

- Internet of Things Group revenue of $651 million, up 4 percent sequentially and up 22 percent year-over-year

- Non-Volatile Memory Solutions Group revenue of $557 million, down 15 percent sequentially and down 6 percent year-over-year

- Intel Security Group revenue of $537 million, up 5 percent sequentially and up 12 percent year-over-year

- Programmable Solutions Group revenue of $359 million, which does not include $99 million of revenue as a result of acquisition-related adjustments.

- Revenue: $13.5 billion, plus or minus $500 million, returning to a typical 13-week quarter.

- Non-GAAP gross margin percentage: 61 percent, plus or minus a couple percentage points.

- R&D plus MG&A spending: approximately $5.1 billion.

- Restructuring charges: approximately $1.2 billion. Non-GAAP restructuring charges: zero.

- Impact of equity investments and interest and other: approximately $150 million net gain.

- Depreciation: approximately $1.5 billion

- Revenue: up mid-single digits, down from prior outlook of mid- to high-single digits.

- Non-GAAP gross margin: 62 percent, plus or minus a couple percentage points, down from prior outlook of 63 percent, plus or minus a couple percentage points.

- Non-GAAP R&D plus MG&A spending: approximately $20.6 billion, plus or minus $400 million, down from prior outlook of $21.3 billion.

- Restructuring charges: approximately $1.2 billion. Non-GAAP restructuring charges: zero.

- Depreciation: approximately $6.3 billion, plus or minus $200 million, down from prior outlook of $6.5 billion, plus or minus $200 million.

- Tax rate: approximately 22 percent, for each of the remaining quarters of the year, down from prior outlook of approximately 25 percent.

- Full-year capital spending: $9.5 billion, plus or minus $500 million, is unchanged from prior outlook

5 Comments on Intel Reports First Quarter 2016 Revenue of $13.7 Billion

Edit: also today: Intel to cut 12,000 jobs, 11% of workforce

+$2 billion net income -> -12,000 jobs =

www.techpowerup.com/221840/intel-announces-restructuring-initiative-to-accelerate-transformation

Even so, those 12,000 employees laid off aren't going to be able to improve their capability in terms of delivering cloud products.

The only way this makes sense to me is if they're preempting Zen. The pie is undeniably shrinking and that shrinking will accelerate with the launch of Zen which means they don't need to produce as many chips in the next few years. 12,000 is still a lot of jobs and you'd think they'd be hiring people to research new substrates/technology.