Tuesday, May 2nd 2017

AMD Reports First Quarter 2017 Financial Results - 18% Increased Revenue

AMD (NASDAQ:AMD) today announced revenue for the first quarter of 2017 of $984 million, operating loss of $29 million, and net loss of $73 million, or $0.08 per share. On a non-GAAP basis, operating loss was $6 million, net loss was $38 million, and loss per share was $0.04. "We achieved 18 percent year-over-year revenue growth driven by strong demand for our high performance Ryzen CPUs as well as graphics processors," said Dr. Lisa Su, AMD president and CEO. "We are positioned for solid revenue growth and margin expansion opportunities across the business in the year ahead as we bring innovation, performance, and choice to an expanding set of markets."Q1 2017 Results

AMD's outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

For the second quarter of 2017, AMD expects revenue to increase approximately 17 percent sequentially, plus or minus 3 percent. The midpoint of guidance would result in second quarter 2017 revenue increasing approximately 12 percent year-over-year. For additional details regarding AMD's results and outlook please see the CFO commentary posted at quarterlyearnings.amd.com.

- Revenue of $984 million was up 18 percent year-over-year, driven by higher revenue in both the Computing and Graphics and Enterprise, Embedded, and Semi-Custom business segments. Revenue was down 11 percent sequentially, due primarily to seasonality in both segments. However, Computing and Graphics segment revenue decline was better than seasonal due to the initial sales from high performance Ryzen desktop processors.

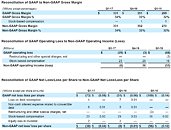

- On a GAAP basis, gross margin was 34 percent, up 2 percentage points year-over-year and sequentially due to a higher percentage of revenue from the Computing and Graphics segment, as well as a richer product mix within that segment. Operating loss of $29 million compared to operating losses of $68 million a year ago and $3 million in the prior quarter. Net loss of $73 million compared to net losses of $109 million a year ago and $51 million in the prior quarter. Loss per share of $0.08 compared to a loss per share of $0.14 a year ago and a loss per share of $0.06 in the prior quarter.

- On a non-GAAP basis, gross margin was 34 percent, up 2 percentage points year-over-year and sequentially. Operating loss of $6 million compared to an operating loss of $55 million a year ago and operating income of $26 million in the prior quarter. Net loss of $38 million compared to net losses of $96 million a year ago and $8 million in the prior quarter. Loss per share of $0.04 compared to a loss per share of $0.12 a year ago and a loss per share of $0.01 in the prior quarter.

- Cash, cash equivalents, and marketable securities were $943 million at the end of the quarter, down $321 million from the end of the prior quarter primarily due to the timing of sales and cash collections, debt interest payments, and increased inventory.

- Computing and Graphics segment revenue was $593 million, up 29 percent year-over-year and down 1 percent sequentially. The year-over-year increase was driven primarily by higher desktop and graphics processor sales. The sequential decrease was primarily due to a decrease in mobile and graphics processor sales largely offset by initial revenue from high performance Ryzen desktop processors.

o Operating loss was $15 million, compared to operating losses of $70 million in Q1 2016 and $21 million in Q4 2016. The year-over-year improvement was driven primarily by higher revenue. The sequential improvement was driven primarily by lower operating expenses.

o Client average selling price (ASP) increased year-over-year and sequentially driven by desktop processor ASP.

o GPU ASP increased year-over-year and sequentially due primarily to higher desktop GPU ASP. - Enterprise, Embedded, and Semi-Custom segment revenue was $391 million, up 5 percent year over-year driven primarily by higher semi-custom SoC sales. Sequentially, revenue decreased 23 percent primarily due to seasonally lower sales of semi-custom SoCs.

o Operating income was $9 million, compared to an operating income of $16 million in Q1 2016 and an operating income of $47 million in Q4 2016. The year-over-year decrease was primarily due to higher server related R&D investments, partially offset by an increase in the THATIC JV licensing gain. The sequential decrease was primarily due to seasonally lower sales of semi-custom SoCs. - All Other operating loss was $23 million compared with operating losses of $14 million in Q1 2016 and $29 million in Q4 2016. The year-over-year and sequential differences in operating loss were related to stock-based compensation charges.

- AMD launched its first high-performance x86 Ryzen desktop processor based on the entirely new "Zen" core microarchitecture, bringing leadership multi-core performance to PC gamers, creators, and hardware enthusiasts worldwide.

o AMD Ryzen 7: These 8-core, 16-thread processors bring innovation and choice back to the enthusiast PC market and include the world's highest performing, and lowest powered 8-core desktop PC processors.

o AMD Ryzen 5: Mainstream processors designed to bring innovation to the high-volume, sub-$300 CPU market with a disruptive price-to-performance ratio for gamers and creators. - AMD shared new details about its upcoming server and high-end graphics solutions:

o Launching in Q2 2017, AMD's high-performance x86 server CPU, codenamed "Naples", exceeds today's top competitive offering on critical parameters, with 45 percent more cores, 60 percent more input / output capacity (I/O), and 122 percent more memory bandwidth. AMD also announced a collaboration with Microsoft to incorporate the cloud delivery features of "Naples" with Microsoft's "Project Olympus" server platform.

o AMD's "Vega" GPU architecture is on track to launch in Q2, and has been designed from scratch to address the most data- and visually-intensive next-generation workloads with key architecture advancements including: a differentiated memory subsystem, next-generation geometry pipeline, new compute engine, and a new pixel engine. - AMD further strengthened its consumer and professional graphics offerings with new hardware and software solutions for gamers and creators:

o Introduced the Radeon RX 500 series line of GPUs based on a refined, second-generation "Polaris" architecture to deliver an up to 57 percent performance improvement and higher clock speeds for modern games, smooth VR experiences, and the latest display technologies.

o Announced the Radeon Pro Duo, the first "Polaris" architecture based dual-GPU graphics card, designed to excel at media and entertainment, broadcast, design, and manufacturing workflows. Slated for availability in late May 2017, the Radeon Pro Duo delivers up to 2 times faster performance than the closest competing professional graphics card on select professional applications and increased VR performance over single GPU solutions by up to 50%. - Demonstrated its continued focus on ensuring consumers and enterprise users have the software tools they need to get the most from their Radeon and Radeon Pro GPUs with regular updates to its Radeon Software Crimson ReLive Edition and Radeon Pro Software Enterprise Edition drivers, incorporating new features, performance and stability improvements.

- AMD continued its close collaboration with game developers to help them leverage the full potential of AMD compute and graphics solutions and deliver breakthrough experiences for gamers.

o AMD announced, in conjunction with game developers Stardock and Oxide Games, the completion of initial optimization of "Ashes of the Singularity" for AMD Ryzen desktop processors resulting in enhanced game play and an up to 30 percent increase in "Average Frames Per Second All Batches" in-game benchmark performance, placing the AMD Ryzen 7 1800X in elite performance levels for the game.

o AMD and Bethesda Softworks formed a multi-title strategic partnership to rapidly advance game technology development, including harnessing the full potential of low-level APIs and maximizing the capabilities of the computing and graphics power of AMD's multicore Ryzen CPUs, Radeon GPUs, and AMD server solutions across Bethesda's existing franchises.

o AMD unveiled that its "Vega"-architecture based GPUs have been selected to power LiquidSky's cloud gaming platform, enabling gamers to enjoy the power of "Vega" from virtually anywhere, and affordably through LiquidSky's low-cost and free subscription models. - Microsoft disclosed new information about its AMD-based "Project Scorpio" console. The new premium game console is expected to be available for holiday 2017 and will be powered by a highly-customized AMD SoC.

AMD's outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

For the second quarter of 2017, AMD expects revenue to increase approximately 17 percent sequentially, plus or minus 3 percent. The midpoint of guidance would result in second quarter 2017 revenue increasing approximately 12 percent year-over-year. For additional details regarding AMD's results and outlook please see the CFO commentary posted at quarterlyearnings.amd.com.

25 Comments on AMD Reports First Quarter 2017 Financial Results - 18% Increased Revenue

I just hope for the company that "Naples" serverchip can deliver, because thats where the money is in the end.

Vega also has to deliver, but actually not that much anyway, since highend GFX for pc's isent that big a deal looking at it from a financial standpoint just execpt bragging rights.

For me it looks like RX480/580 has been a gamechanger, since their GFX devision also has done pretty well.

Can their SOC chip for consoles deliver what is expected in games then they have shot the golden goose, since AMD has 100% of that market and Nvidia has 0%.

APU's made on "Zen" core should also help in the lowend/midend gaming and office sigment.

So to me all looks positive down the line of year 2017.

Sure they have the PS4 and the Xbox but they get penny's.

Hoping over next 6-9 months they will get even at least for our sake.

And Vega not to suck, so that 5xx's sell better.Switch simply isn't playing in the same league as Xbone and PS4.

People buy it for Nintendo exclusives and some indies, most AAAs skip it altogether.

Even Blizzard, who's games run just fine on my ancient notebook with 5 or even 4 series ATI chip, has explicitly stated along "lolwoottooweak"lines:

"Getting OW on the Switch is very challenging for us. But we're always open minded about exploring possible platforms."Exactly how many penny's do they get and if it is penny's what on earth is AMD's semi-custom doing for all that money they get?

That "penny's" talk reminds me nVidia's NaCl about how much faster Titan is, compared to consoles and how they didn't get in Xbone/PS4 cause, oh well, laughable margins. That kind of BS talk stopped only when they got into Nintendo's console that is barely faster than WiiU.

That's a huge wad of cash for "inventory". Does not look like they paid of that much debt.The switch contains a pretty bone-stock Tegra X1. There is probably some decent margins there.

Possibly it was just a coincidence that nvidia got so salty about the whole console busness, who knows.

Bottom line was, consoles aren't interesting, because margins were low.

Surely Nintendo has given up its own margins for them, why wouldn't they, right?

Do we remember, how nvidia got in that PS3 thing, by the way, with all those uninteresting margins?Because there were so many companies one could buy APUs from, right (or anyone would expect separate CPU + GPU configuration to somehow be cheaper)AMD went further red because... of semi-custom sales, right:

as compared to those wonderful computing & graphics figures:

www.anandtech.com/show/11092/amd-announces-q4-2016-earnings

Perhaps it was much different back in 2014, back when:

"AMD’s business was based on the traditional PC industry, and by 2014 it was down to 60%"

?

Oh, and that Jaguar thing (May 2013):

www.anandtech.com/show/6976/amds-jaguar-architecture-the-cpu-powering-xbox-one-playstation-4-kabini-temash/5

Also, I used to agree with your point that AMD was smart to scoop up all 3 console manufacturers to use their chips thinking that this would give them an edge with Developers since most games are made for the consoles and ported to the PC, sometimes very poorly and sometimes a poor port on purpose to maintain some parity between consoles and PC.

But here we are 3 1/2 years after the PS4 and Xbox One release and how many games are running significantly better on AMD hardware? That could change in the future if Vulkan or DX12 takes off but look at the bottom line for Publishers. At this time the breakdown in GPU sales is 70% Nvidia and 30% AMD and that's an improvement for AMD from the near past but if you were a Publisher would you allow your Developers to make games that ran like crap on 70% of your customers PCs?

Nvidia was never truly interested in consoles. They have ALWAYS been pessimistic towards them. Or did you miss the drama between MS and nvidia on the OG XBOX?

The reality is, the margins on consoles are too low for nvidia to bother. Nvidia makes significantly more money on a single 1070 then AMD makes on a 480, and nvidia sells several times more 1070s. Why would nvidia care about consoles? The switch using tegra is likely due to nobody else wanting them, and nvidia seeing a change to unload old stock on something guaranteed to sell at least decently. Make all the arguments you want, the reality is that nvidia still dominates PC gaming, AMD is half-arseing it with the 500 series and the year late VEGA, and no number of consoles is going to change that, especially as nvidia continues to operate on a very healthy profit margin despite not having any consoles under it's wings for years. AMD, with it's console dominance, lost millions at the same time.

I would say, if anything, that it is AMD's headquarters that doesnt understand their market. Nvidia seems to be pretty fine HQ wise, seeing how much more $ they make and their unfettered dominance in the mid range on up.This, right here.

AMD fans need to stop the "consoles/DX12/Mantle?Vulkan/ece will save AMD" argument. They have been spewing it for years, yet AMD still hasnt recovered. They need to build competitive hardware, or they stand to possibly loose the console market in a generation or so simply due to nvidia railroading ahead with a superior architecture that will be too good to pass up. Heck, AMD has yet to beat the now 3 year old maxwell, despite being on 14nm.

It's not that AMD wanted to gain a programming advantage through consoles, it's that they didn't want to be at a disadvantage. Nvidia is bigger than Radeon and has WAYYYY more money. It will always be nearly impossible for AMD to ever reach 50% marketshare, and in fact 40% GPU marketshare would be a mega win.

Thus AMD got into the console market so developers couldn't ignore them (And to make lots of money, they are in fact making money on every console sold). Consider BF, Theif, Sniper Elite, Dragon Age, and many other games used mantle. Do you think they would have considered working extra hard on 22% of the market?! No, but Mantle was close to what PS4 uses and so it wasn't a problem.

P.S. Also consider that MS/Sony likely went to AMD, not the other way around. APU's are a logical choice for consoles.

Mantle didnt save AMD. They are still suffering because while they were screwing around with new APIs trying to beat MS to market, nvidia was focusing on making great hardware. And now, AMD doesnt compete in more then half the market for GPUs, while nvidia rakes it in with pascal. all so that AMD could get a dozen games, most of which were from EA, to run their own API.

As you said, AMD has much less money then nvidia. They shouldnt be wasting it on forgotten API junk. That money should have gone into their GPU hardware.

I'll be happy for them when they stop running at an overall loss.

Mantle HEAVILY influenced DX12, and Vulkan is just an enhanced version of Mantle. That is a MASSIVE advantage that has kept AMD's cards far more competitive than they would be if Nvidia got its way and made every game a half-working Gamesworks game.

As for hardware, AMD releases a new flagship every 1.5 - 2 years. They don't drop small 20% performance increases every 8 months like Nvidia does. Let's see how Vega pans out before we say anything lol

Cheer up gents - AMD just took marketshare from a company 10x its size even with having supply shortages. 12 and 16 core Ryzen is on the way, and Vega should get Radeon to 35-40% gpu marketshare. Can't climb Everest in 1 day!

Intel and especially Nvidia are crazy overvalued...

also while AMD did not release new flagship every year but they still fill the gap with boat loads of rebrands. and if you look closely AMD and nvidia performance increase over the year is pretty much the same. the jump from one flagship to another might be big for AMD product but in the end that flagship still perform around the same performance as nvidia flagship for the year.

1) Expectations were that they would do much better (they must, to go solid green)

2) AMD burnt $300 million (I have no idea on what)Well, no, that's not what really happened. (and all but nintendo sell consoles at nearly even/loss point. It also has to do with the fact that many of nintendo console buyers are much less likely to buy more games, whereas PS/Xbox owners get 2-3 games per year on average)

When doing PS3 development, Sony was the king of consoles, with insanely successful PS2.

They actually SEEKED ways to do something "very different", so that ports would not be possible.

Cell development cost them a fortune. Original plan was to have no GPU whatsoever, but after major backlash they had to include it.

Oh, and if you seriously mean that they sold PS3 at a loss to give nVidia higher margins, you'd need to explain, why Sony could not have picked ATI/AMD for PS3.

Reality is rather simpler, really, the "oh, console are not interesting to us, because margins are too low" is BS.That's a good question, but it's from "how successful a strategy it was, after all".

I can't name exact numbers as I simply don't know them. What I am sure about, though, is that for multi-plat games (majority of the games on the market are) if there are optimizations happening, because game doesn't perform fast enough, they go around Jaguar's 8 weak cores (first 6 and now 7 are available to games) and 7870-ish GPU that is in consoles now, while how things run on weak nvidia GPUs is mostly irrelevant (even for nVidia, which would rather have you pay exorbitant prices for its mid/high end)I hope you aren't Huang or working for N and if so, no need to butthurt about it, mate.

Financial effect of AMD console business is clearly visible on the images I've posted above.Right. Switch ain't a console after all, it's, dunno, "portable", so it doesn't count. Or Nintendo decided to bend over and give up all its margins to nvidia, just to interest it.

Sounds reasonable.

(2014)

Nvidia: Golden Days of Consoles Are Over, So Many Other Ways To Enjoy Games

wccftech.com/nvidia-golden-days-consoles-over-other-ways/

RBC Capital Markets analyst Mitch Steves predicts Nvidia’s top line may see a boost of $300 million-$400 million in fiscal 2018 just from sales of the Nintendo Switch

finance.yahoo.com/news/heres-much-nvidia-will-make-off-nintendo-switch-200925921.html

For reference, AMD makes about 500 million per quarter (did 835 in Q3 2016):

www.anandtech.com/show/11092/amd-announces-q4-2016-earnings