Friday, April 27th 2018

Intel Reports First Quarter 2018 Financial Results

Intel Corporation today reported first-quarter 2018 financial results. "Coming off a record 2017, 2018 is off to a strong start. Our PC business continued to execute well and our data-centric businesses grew 25 percent, accounting for nearly half of first-quarter revenue," said Brian Krzanich, Intel CEO. "The strength of Intel's business underscores my confidence in our strategy and the unrelenting demand for compute performance fueled by the growth of data."

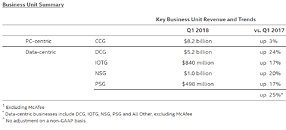

"Compared to the first-quarter expectations we set in January, revenue was higher, operating margins were stronger and EPS was better," said Bob Swan, Intel CFO. "Our data-centric strategy is accelerating Intel's transformation, and we're raising our earnings and cash flow expectations for the year." In the first quarter, the company generated approximately $6.3 billion in cash from operations, paid dividends of $1.4 billion and used $1.9 billion to repurchase 41 million shares of stock.In the first quarter, Intel saw strong performance from data-centric businesses, which accounted for approximately half (49%) of Intel's revenue, an all-time high. The Data Center Group (DCG) achieved growth in all market segments and saw increasing adoption of Intel Xeon Scalable processors, including for artificial intelligence workloads. Non-Volatile Memory Solutions Group (NSG) revenue grew 20 percent as strong demand for storage continued. The Programmable Solutions Group (PSG) won new designs with server OEMs adding Intel's field programmable gate array (FPGA) acceleration to their data center offerings, and strong demand from retail and video customers drove first-quarter growth in the Internet of Things Group (IOTG).

The Client Computing Group (CCG) continued its strong execution and introduced a new lineup of high-performance mobile products including the 8th Gen Intel Core i9 processor and a new Intel Core platform extension that brings together the benefits of 8th Gen Intel Core processors with Intel Optane memory. We continue to make 14 nm process optimizations and architectural innovations in both data center and client products that will be coming this year. Intel is currently shipping low-volume 10 nm product and now expects 10 nm volume production to shift to 2019.

In autonomous driving, Mobileye continued momentum with automotive customers and recently won a high-volume design for EyeQ*5. The company also began operating autonomous vehicle test cars in Israel with plans to expand the fleet to other geographies.

Business Outlook

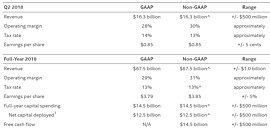

Intel's guidance for the second-quarter and full-year 2018 includes both GAAP and non-GAAP estimates. Reconciliations between these GAAP and non-GAAP financial measures are included below.Intel's Business Outlook does not include the potential impact of any business combinations, asset acquisitions, divestitures (except as noted below), strategic investments and other significant transactions that may be completed after April 26, 2018. Actual results may differ materially from Intel's Business Outlook as a result of, among other things, the factors described under "Forward-Looking Statements" below. Our guidance above reflects the divestiture of Wind River, which we expect to close during the second quarter of 2018.

"Compared to the first-quarter expectations we set in January, revenue was higher, operating margins were stronger and EPS was better," said Bob Swan, Intel CFO. "Our data-centric strategy is accelerating Intel's transformation, and we're raising our earnings and cash flow expectations for the year." In the first quarter, the company generated approximately $6.3 billion in cash from operations, paid dividends of $1.4 billion and used $1.9 billion to repurchase 41 million shares of stock.In the first quarter, Intel saw strong performance from data-centric businesses, which accounted for approximately half (49%) of Intel's revenue, an all-time high. The Data Center Group (DCG) achieved growth in all market segments and saw increasing adoption of Intel Xeon Scalable processors, including for artificial intelligence workloads. Non-Volatile Memory Solutions Group (NSG) revenue grew 20 percent as strong demand for storage continued. The Programmable Solutions Group (PSG) won new designs with server OEMs adding Intel's field programmable gate array (FPGA) acceleration to their data center offerings, and strong demand from retail and video customers drove first-quarter growth in the Internet of Things Group (IOTG).

The Client Computing Group (CCG) continued its strong execution and introduced a new lineup of high-performance mobile products including the 8th Gen Intel Core i9 processor and a new Intel Core platform extension that brings together the benefits of 8th Gen Intel Core processors with Intel Optane memory. We continue to make 14 nm process optimizations and architectural innovations in both data center and client products that will be coming this year. Intel is currently shipping low-volume 10 nm product and now expects 10 nm volume production to shift to 2019.

In autonomous driving, Mobileye continued momentum with automotive customers and recently won a high-volume design for EyeQ*5. The company also began operating autonomous vehicle test cars in Israel with plans to expand the fleet to other geographies.

Business Outlook

Intel's guidance for the second-quarter and full-year 2018 includes both GAAP and non-GAAP estimates. Reconciliations between these GAAP and non-GAAP financial measures are included below.Intel's Business Outlook does not include the potential impact of any business combinations, asset acquisitions, divestitures (except as noted below), strategic investments and other significant transactions that may be completed after April 26, 2018. Actual results may differ materially from Intel's Business Outlook as a result of, among other things, the factors described under "Forward-Looking Statements" below. Our guidance above reflects the divestiture of Wind River, which we expect to close during the second quarter of 2018.

17 Comments on Intel Reports First Quarter 2018 Financial Results

Even if there's massive breach or whatever hell happens.. Nobody can do anything to intel.

Since there are the only major option..whether anybody likes it or not..

Intel Vs AMD, its like Qualcomm vs Mediatek.

No threat for the monopoly whatsoever..

I don't know whether to laugh or cry.

Exactly what they were saying all of these wealthy companies would do with their Republican corporate tax cuts.

AMD had a tremendous sucess in the GPU department with their 200 series , what came after that much less and this is purely because of Raja's wrong decisions . AMD is where it is today in the CPU department because clever architectural decisions have been made ( infinity fabric etc ) , had Raja been able to make some clever decisions on the GPU side , RTG would had been in a much better position limited resources or not !

IMHO they should have taken that exploded marketing budget and use it to raise finances for proper evolution of GCN.

I mentioned marketing budget to make a point. My point was do you realy believe that AMD/RTG is going to put that much money in their marketing if they have no money to make evolve their architecture ? It doesn't make sense at all , and if that is realy the case then i let you guess who's to be blamed for that !

How could we measure accompanying risk though? How about using unit called 'everything' ... and when you can't throw more money at it to reduce risk ... also budget issue... you could call this budget allocation issue :laugh: you see where I'm going ... there is always an angle: more could have been done with different budget/allocation. I can't really argue how much of a deciding factor it was.