Thursday, January 23rd 2020

Where's the Ryzen Effect? Intel posts Record Financials

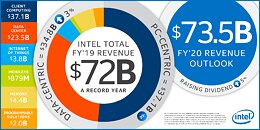

Intel Corporation today reported fourth-quarter and full-year 2019 financial results. The company also announced that its board of directors approved a five percent cash dividend increase to $1.32 per share on an annual basis. The board declared a quarterly dividend of $0.33 per share on the company's common stock, which will be payable on March 1 to shareholders of record on February 7.

"In 2019, we gained share in an expanded addressable market that demands more performance to process, move and store data," said Bob Swan, Intel CEO. "One year into our long-term financial plan, we have outperformed our revenue and EPS expectations. Looking ahead, we are investing to win the technology inflections of the future, play a bigger role in the success of our customers and increase shareholder returns."Intel's collection of data-centric businesses achieved record revenue in the fourth quarter, led by record Data Center Group (DCG) revenue. DCG revenue grew 19 percent YoY in the fourth quarter, driven by robust demand from cloud service provider customers and a continued strong mix of high-performance 2nd-Generation Intel Xeon Scalable processors. Intel acquired Habana Labs in the fourth quarter, strengthening its artificial intelligence portfolio for the data center. Internet of Things Group (IOTG) revenue was up 13 percent on strength in retail and transportation. Mobileye achieved record revenue, up 31 percent YoY on increasing ADAS adoption. Intel's memory business (NSG) was up 10 percent YoY on continued NAND and Intel Optane bit growth. PSG fourth-quarter revenue was down 17 percent YoY.

In the fourth quarter, the PC-centric business (CCG) was up 2 percent on higher modem sales and desktop platform volumes. Major PC manufacturers have introduced 44 systems featuring the new, 10 nm-based 10th Gen Intel Core processors (previously referred to as "Ice Lake"), and momentum continues to build for Project Athena. Project Athena-verified devices have been tuned, tested and verified to deliver fantastic system-level innovation and benefits spanning battery life, consistent responsiveness, instant wake, application compatibility and more. Intel has verified 26 Project Athena designs to date.

"In 2019, we gained share in an expanded addressable market that demands more performance to process, move and store data," said Bob Swan, Intel CEO. "One year into our long-term financial plan, we have outperformed our revenue and EPS expectations. Looking ahead, we are investing to win the technology inflections of the future, play a bigger role in the success of our customers and increase shareholder returns."Intel's collection of data-centric businesses achieved record revenue in the fourth quarter, led by record Data Center Group (DCG) revenue. DCG revenue grew 19 percent YoY in the fourth quarter, driven by robust demand from cloud service provider customers and a continued strong mix of high-performance 2nd-Generation Intel Xeon Scalable processors. Intel acquired Habana Labs in the fourth quarter, strengthening its artificial intelligence portfolio for the data center. Internet of Things Group (IOTG) revenue was up 13 percent on strength in retail and transportation. Mobileye achieved record revenue, up 31 percent YoY on increasing ADAS adoption. Intel's memory business (NSG) was up 10 percent YoY on continued NAND and Intel Optane bit growth. PSG fourth-quarter revenue was down 17 percent YoY.

In the fourth quarter, the PC-centric business (CCG) was up 2 percent on higher modem sales and desktop platform volumes. Major PC manufacturers have introduced 44 systems featuring the new, 10 nm-based 10th Gen Intel Core processors (previously referred to as "Ice Lake"), and momentum continues to build for Project Athena. Project Athena-verified devices have been tuned, tested and verified to deliver fantastic system-level innovation and benefits spanning battery life, consistent responsiveness, instant wake, application compatibility and more. Intel has verified 26 Project Athena designs to date.

77 Comments on Where's the Ryzen Effect? Intel posts Record Financials

Intel’s pending layoffs will hit multiple business groups, Oregon workers

Did I mention notebooks, would be quite the spectacle when AMD goes full throttle with zen2 APU :D

They do break the results down to business units and PCG results are quite noticeably down :)

As for AMD the question is if they can make as many CPUs as they want, or if there isn't such demand as everyone was expecting. It makes me wonder if those super high performing EPYC CPUs that cost a third compared to a equivalent dual CPU setup of top Xeon CPUs where enough to get more market share in the server market. Maybe AMD is giving those away, for prices that look like a steal, because it sees that big corporations and IT managers still prefer to pay extra for insecure, old tech CPUs from the top player, than top performing, modern, secure and much cheaper CPUs from the second player.

I guess we will find out soon. Of course we could see what most are saying. That the PC/X86 market is growing rapidly and all three major companies in my minds, Intel, Nvidia and AMD, will report record revenue.

How is that a "record"?

From what I've found, they're actually up from 2018 (+2%).

Not that it matters. 2% workforce fluctuation is nothing special.You say then don't break it down, but you seem very confident about your ideas. Source?Intel sells as much as it can. And they're increasing production capacity. And they're keeping the very high margins.

It's not exactly my definition of "being in trouble". :)Not everyone. ;)Exactly. AMD will likely show what is expected: +50% revenue Y/Y. Margins is another story completely.

As you said: market is growing. All companies sell more. Obviously, AMD is starting from a position that can give them absurdly high growth.

But while AMD's expansion is expected (and in their stock price...), Intel's results should have been more flat. It's a bit shocking...

One probable factor: they're killing the low-end models (Pentiums, entry i3), which used to compete with cheap pre-Ryzen stuff from AMD.

I suppose we can see some trends out of that statement down on the page under - SUPPLEMENTAL PLATFORM REVENUE INFORMATION.

Comparing the volumes and average prices gives us a few hints on what is going on.

Intel is down in volume YoY -6% in desktops, -5% in notebooks and -3% in servers. You can find the info in SUPPLEMENTAL PLATFORM REVENUE INFORMATION.

If anything, it's even better...

It was a very good year for Intel. End of story.

Numbers don't lie, but anti-Intel crowd will be nitpicking like they usually do. And of course they're allowed to do so. :)

I don't believe the title is misleading since I bet that's how their press release reads as well. Also, as seen, it triggers fanboys and grabs investors' attention on both sides.

This is what I have said before: being 10x larger than your opponent gives you the ability to take punishment. Intel didn't crumble in the days of AthlonXP/64, they won't crumble because of Zen.

this decrease will compensate the loss so by magic they can report record financials

how can they do it, may you ask; easy, cut down employees bonuses as they wish without affecting wages is the most common one f.ex. the more employees you have the more you save

Their servers you can choose between Intel or Intel.

I have seen estimates that AMD has doubled their market share in the server market but their market share is still extremely low.

articles2.marketrealist.com/2019/08/will-amd-or-intel-gain-mobile-and-server-market-share/#

Basically, until the big PC manufacturers start pushing more AMD CPUs in their business and home PCs and servers then AMD will only make modest gains in market share and Intel will remain the colossus in the CPU market.

I thought your earlier post suggested they're reporting understated costs, i.e. they're artificially increasing their margins.

It's fairly easy to hide income (report lower net profit) and most companies do that, but it's very difficult to hide costs.

It's even harder for Intel, who does almost everything in-house.