Thursday, January 23rd 2020

Where's the Ryzen Effect? Intel posts Record Financials

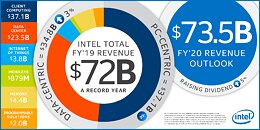

Intel Corporation today reported fourth-quarter and full-year 2019 financial results. The company also announced that its board of directors approved a five percent cash dividend increase to $1.32 per share on an annual basis. The board declared a quarterly dividend of $0.33 per share on the company's common stock, which will be payable on March 1 to shareholders of record on February 7.

"In 2019, we gained share in an expanded addressable market that demands more performance to process, move and store data," said Bob Swan, Intel CEO. "One year into our long-term financial plan, we have outperformed our revenue and EPS expectations. Looking ahead, we are investing to win the technology inflections of the future, play a bigger role in the success of our customers and increase shareholder returns."Intel's collection of data-centric businesses achieved record revenue in the fourth quarter, led by record Data Center Group (DCG) revenue. DCG revenue grew 19 percent YoY in the fourth quarter, driven by robust demand from cloud service provider customers and a continued strong mix of high-performance 2nd-Generation Intel Xeon Scalable processors. Intel acquired Habana Labs in the fourth quarter, strengthening its artificial intelligence portfolio for the data center. Internet of Things Group (IOTG) revenue was up 13 percent on strength in retail and transportation. Mobileye achieved record revenue, up 31 percent YoY on increasing ADAS adoption. Intel's memory business (NSG) was up 10 percent YoY on continued NAND and Intel Optane bit growth. PSG fourth-quarter revenue was down 17 percent YoY.

In the fourth quarter, the PC-centric business (CCG) was up 2 percent on higher modem sales and desktop platform volumes. Major PC manufacturers have introduced 44 systems featuring the new, 10 nm-based 10th Gen Intel Core processors (previously referred to as "Ice Lake"), and momentum continues to build for Project Athena. Project Athena-verified devices have been tuned, tested and verified to deliver fantastic system-level innovation and benefits spanning battery life, consistent responsiveness, instant wake, application compatibility and more. Intel has verified 26 Project Athena designs to date.

"In 2019, we gained share in an expanded addressable market that demands more performance to process, move and store data," said Bob Swan, Intel CEO. "One year into our long-term financial plan, we have outperformed our revenue and EPS expectations. Looking ahead, we are investing to win the technology inflections of the future, play a bigger role in the success of our customers and increase shareholder returns."Intel's collection of data-centric businesses achieved record revenue in the fourth quarter, led by record Data Center Group (DCG) revenue. DCG revenue grew 19 percent YoY in the fourth quarter, driven by robust demand from cloud service provider customers and a continued strong mix of high-performance 2nd-Generation Intel Xeon Scalable processors. Intel acquired Habana Labs in the fourth quarter, strengthening its artificial intelligence portfolio for the data center. Internet of Things Group (IOTG) revenue was up 13 percent on strength in retail and transportation. Mobileye achieved record revenue, up 31 percent YoY on increasing ADAS adoption. Intel's memory business (NSG) was up 10 percent YoY on continued NAND and Intel Optane bit growth. PSG fourth-quarter revenue was down 17 percent YoY.

In the fourth quarter, the PC-centric business (CCG) was up 2 percent on higher modem sales and desktop platform volumes. Major PC manufacturers have introduced 44 systems featuring the new, 10 nm-based 10th Gen Intel Core processors (previously referred to as "Ice Lake"), and momentum continues to build for Project Athena. Project Athena-verified devices have been tuned, tested and verified to deliver fantastic system-level innovation and benefits spanning battery life, consistent responsiveness, instant wake, application compatibility and more. Intel has verified 26 Project Athena designs to date.

77 Comments on Where's the Ryzen Effect? Intel posts Record Financials

But lower unit volume in an expanding market does not bold well for Intel.

Intel won more despite decreasing prices because they sold more. It is that simple.

Anyway, we're moving around that 10% of Intel's you mentioned.

But as for earnings (GAAP)...

Intel made $21 bln.

Market consensus for AMD is around $0.3 bln. That's 1.4%.If you buy your own product - which is quite normal, especially when you're a top manufacturer - you can boost some indicators ("popularity", "market share"), but it doesn't impact earnings.

When Intel buys a $300 CPU, that results in +$300 as revenue and -$300 as operating expenses.

Of course Intel isn't using DIY PCs/servers, so most CPUs (sold to OEMs and "bought back" in computers) are included in revenue. Nothing wrong with that, right?

When Intel makes a chip for internal needs (like testing or an in-house manufacturing device) it isn't sold and is not shown in revenue nor cost of sales. It goes directly to operating expenses (the actual cost of manufacturing, not MSRP etc).As I already said: hiding earnings (lowering reported earnings) often makes sense and many companies try.

Boosting earnings (lowering reported costs) is extremely difficult and... pointless. Why would Intel want that? They're paying a dividend. They'll have to give most of that to their shareholders.

You have many theories, so maybe you can give a sensible reason? :)It sounds quite funny when you call @btarunr an Intel fanboy.

I believe the topic, being clickbait or not, is quite honest. I'm sure he (like many people here) expected Intel to show much worse results.

The only "teaser" they had was around power consumption.

That being said, I'd prefer Intel to actually have a competent GPU offering.I have read dubious "570 tickets bought online, but nobody has shown up" stories, but financial aspect makes... hard to believe.Intel's margines barely dropped.

AMD is what it is today because they didn't have a choice but to risk and have low prices. It is not an act of kindness.Ryzen DIY segment is a drop in the ocean. Peanuts compared to the TAM. So stop believing that bragging on reddit with new AMD builds means Intel doesn't sell anything, cause it is just not true.

--------------------

Now, my own opinion on this is split into multiple parts:

1. Intel is a much better know name/brand, whereas AMD is still seen as the cheap, hot and slow variant. Mentalities change very slowly. Some hundred posts on reddit are nothing.

2. Intel still has a lot of succes with OEMs and a LOT better and more support for them.

3. Skylake based products are still pretty good (for gaming still the best), even if they are beaten on price and power.

4. Using a 5 year old, proven process for making your products that are still competitive is something unheard of in the CPU industry. You usually have to continously invest in a new process which means lower profits, but since Intel is still using 14nm to this day, their total expenses are probably very low compared to what AMD needs to pay for a 7nm CPU.

So as an example, if 9900K and 3700x would cost the same, Intel has much higher margins on its product compared to AMD who needs to pay TSMC.

5. Much better marketing.

As a sane person, I wouldn't hate Intel. I would just wish them to come back and kicking with amazing new products, with inovation. AMD current products are indeed amazing compared to Intel ones, but this is just because Intel is still using 5 year old process, 5 year old uArch which is within a few percents of IPC compared to latest Zen 2 core. I would say this is pretty awesome and shows just how good these Skylake based products were in 2015. If it were for Intel to not have fab problems, I doubt Zen 2 would have been the same succes as it is today.

Intel is focusing on power consumption, because their key market are laptops. In other words: if they're ever going to make gaming/workstation GPUs, they have to work in notebooks first, desktops second.They did, but looking at history, it's within statistical fluctuations.

If we see a gross margin of 50% at some point, that would be clearly coming from competition. But it would be better for this market, if AMD's margins went up, not Intel went down. Of course that would be better for AMD as well. Their net profit is just sad.

Two players doesn't mean much competition either, ideally I'd like to see about a dozen of them. But we have to be realistic here, the entry barrier is just too high for that to ever happen. Too bad the likes of Cyrix and VIA couldn't keep up.

They had almost 10% market share in PC CPUs (both desktops and laptops), which basically doubled in the Zen era. But having 10% of something as important and (theoretically) lucrative as x86 processors is hardly a thing to ignore.

On the GPU side they have even higher share, albeit here growth potential is smaller even with 7nm Navi (because Polaris was relatively less ancient than pre-Zen CPUs were).

And they dominate in consoles.

The only segment where they're going "from nothing to something" are servers. But here they currently have roughly 5% market, which is lower than what silly looking FXes managed in 2016.

And to be honest this results are only a surprise to those that just gamers and people that don't actually follow these companies.

When you see all the products and services intel offers in area's outside of desktop cpu's these numbers are not a surprise.

But if you asked anyone a year ago, it was natural to expect AMD will take more of the market.

Instead, AMD just halted in 2019. Maybe 2020 will be better (it is expected to be).

Other markets were in line with expectations. Stable datacenter and big growth in new businesses.

The whole Intel is big and other divisions is true, but it has little weight in this discussion, the numbers simply don't lie. Things don't happen overnight, just think of your own way of purchasing systems. We research, analyze the market too and consider what the best purchase might be, and many people, if the time isn't right and if they are informed, can and will wait if they need to. Look at how long we've sat on our quad cores... There were options faster than that. But out of our reach / not realistic and also not exactly necessary.

The real moment of truth is when Intel actually comes up with something radically new that they are supposed to iterate on again; if AMD can waltz over thát, then they will get the market share in a big way.

Revenue fluctuates, with spikes after new Zen launches. And if you look at Zen users on this forum, many of them had CPUs from all three generation. Some openly said a 3700X is temporary and they're going to go for 3950X when it is available / price drops.

So it would be interesting to see how AMD copes with a different kind of client - one that replaces a PC every 3-5 years.

And of course AMD can't keep this momentum in performance gains. They'll slow down and start iterating just like Intel.

This should already become visible with Zen 3 - the first Zen generation for which they won't have a strong external factor boosting potential.

In case of Intel this is a lot more obvious. Their only real problem is 10nm capacity. If they were able to make all their CPUs on denser node (like AMD does), we wouldn't have this discussion.

And they'll have to sacrifice the HEDT segment, which is an important PR loss, but nothing directly significant for sales.You should definitely look into mobile image editors. Give Snapseed a chance.

community.amd.com/thread/241220#comment-294042195°C is almost the point where 200w tower coolers are not held back by the interface thermal paste. Being able to boost thereabouts is where coolers make up for the most of overclocked cooling capacity.

Zen came out after years of negligence. It seemed a bit half-baked, but delivered a massive boost over FX lineup.

Zen+ was a proper launch, making Zen more robust and faster (if only this could be done with VBIOS!).

Zen2 benefits from 7nm.

We'll see what Zen3 turns out to be. If it's just a "Zen+" kind of polishing, this won't be as impressive as some think - simply because Zen2 isn't as bad as Zen was.

It's the same architecture, similar node, the same socket, with the same number of cores. So we'll see how much AMD team can really give us in a simple architecture iteration.

Exciting times in any case :)

In an interesting way, Intel is following AMD's playbook. Sunny Cove (Ice Lake) uses larger caches among other things that play a role in increased performance. Willow Cove (Tiger Lake) supposedly has additional cache size increases and improved frontend. Since Intel's execution stage is somewhat narrower and should be more prone to compute execution bottlenecks, both also widen the execution stage, largely with store ports but their powerful execution port allocation was also reworked a bit for Ice Lake and probably will get some more work done for Willow Cove.