Thursday, January 23rd 2020

Where's the Ryzen Effect? Intel posts Record Financials

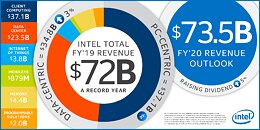

Intel Corporation today reported fourth-quarter and full-year 2019 financial results. The company also announced that its board of directors approved a five percent cash dividend increase to $1.32 per share on an annual basis. The board declared a quarterly dividend of $0.33 per share on the company's common stock, which will be payable on March 1 to shareholders of record on February 7.

"In 2019, we gained share in an expanded addressable market that demands more performance to process, move and store data," said Bob Swan, Intel CEO. "One year into our long-term financial plan, we have outperformed our revenue and EPS expectations. Looking ahead, we are investing to win the technology inflections of the future, play a bigger role in the success of our customers and increase shareholder returns."Intel's collection of data-centric businesses achieved record revenue in the fourth quarter, led by record Data Center Group (DCG) revenue. DCG revenue grew 19 percent YoY in the fourth quarter, driven by robust demand from cloud service provider customers and a continued strong mix of high-performance 2nd-Generation Intel Xeon Scalable processors. Intel acquired Habana Labs in the fourth quarter, strengthening its artificial intelligence portfolio for the data center. Internet of Things Group (IOTG) revenue was up 13 percent on strength in retail and transportation. Mobileye achieved record revenue, up 31 percent YoY on increasing ADAS adoption. Intel's memory business (NSG) was up 10 percent YoY on continued NAND and Intel Optane bit growth. PSG fourth-quarter revenue was down 17 percent YoY.

In the fourth quarter, the PC-centric business (CCG) was up 2 percent on higher modem sales and desktop platform volumes. Major PC manufacturers have introduced 44 systems featuring the new, 10 nm-based 10th Gen Intel Core processors (previously referred to as "Ice Lake"), and momentum continues to build for Project Athena. Project Athena-verified devices have been tuned, tested and verified to deliver fantastic system-level innovation and benefits spanning battery life, consistent responsiveness, instant wake, application compatibility and more. Intel has verified 26 Project Athena designs to date.

"In 2019, we gained share in an expanded addressable market that demands more performance to process, move and store data," said Bob Swan, Intel CEO. "One year into our long-term financial plan, we have outperformed our revenue and EPS expectations. Looking ahead, we are investing to win the technology inflections of the future, play a bigger role in the success of our customers and increase shareholder returns."Intel's collection of data-centric businesses achieved record revenue in the fourth quarter, led by record Data Center Group (DCG) revenue. DCG revenue grew 19 percent YoY in the fourth quarter, driven by robust demand from cloud service provider customers and a continued strong mix of high-performance 2nd-Generation Intel Xeon Scalable processors. Intel acquired Habana Labs in the fourth quarter, strengthening its artificial intelligence portfolio for the data center. Internet of Things Group (IOTG) revenue was up 13 percent on strength in retail and transportation. Mobileye achieved record revenue, up 31 percent YoY on increasing ADAS adoption. Intel's memory business (NSG) was up 10 percent YoY on continued NAND and Intel Optane bit growth. PSG fourth-quarter revenue was down 17 percent YoY.

In the fourth quarter, the PC-centric business (CCG) was up 2 percent on higher modem sales and desktop platform volumes. Major PC manufacturers have introduced 44 systems featuring the new, 10 nm-based 10th Gen Intel Core processors (previously referred to as "Ice Lake"), and momentum continues to build for Project Athena. Project Athena-verified devices have been tuned, tested and verified to deliver fantastic system-level innovation and benefits spanning battery life, consistent responsiveness, instant wake, application compatibility and more. Intel has verified 26 Project Athena designs to date.

77 Comments on Where's the Ryzen Effect? Intel posts Record Financials

What's with the click bait title you put up there? Seems kind of a juvenile move.

www.intc.com/investor-relations/financials-and-filings/sec-filings/sec-filings-details/default.aspx?FilingId=13859776

AMD needs to keep giving away their top tier server CPUs which are head & shoulders above Intel for many years to come to develope their working ecosystem and for the corporate upgrade cycle to kick in.

AMD is doing better now by selling a mostly competitive CPU for a fair price and making profits again instead of losses.

The main problem AMD faces is getting more market share from the big PC manufacturers and I have no idea how they can do this but reducing prices too much and going back to taking huge losses didn't work before and I see no reason why it would work now.

Screenshots from said source:

and I actually misread the numbers of employee's - they have increased, which is nice.

The corporate world looks for stability first, and a long time between upgrade cycles. What I'm saying is AMD needs to keep up this pace and staying ahead of Intel for many years to come while keeping prices que low to start being considered in upgrade cycles and for OEMs to dedicate enough resources to build options.

On the desktop, the market has much faster upgrade cycles and malleable PR as we can experience.

It's human nature to buy what has worked well in the past and what they see the vast majority of other people are buying as well.

I don't work in IT and I don't know what pull they have over the CFO where I work but I doubt the CFO knows much about PC hardware. He just looks at the deals we have made with Dell buying hundreds of PCs at a time and using Intel CPUs for the last 15 years and approves the purchase based on that.

The point here is that businesses are conservative - they want to stick with what is proven to work. Intel of late is not really working - the part shortages being the major thing in the OEM space, leading to direct financial losses - and AMD has through three generations of Ryzen shown that they are once again a contender in most market segments while having no supply issues. So while there have been few Ryzen SKUs in any kind of prebuilt segment up until now, the numbers are increasing rapidly. Chances are that the "Ryzen effect" (to adopt a very silly term) will start being truly visible next year. It still won't amount to any more than slight drops in various segments for Intel, but it will be there.

This will be the year for us to see what Intel will bring to the GPU market. If they deliver a competitive stack at a reasonable price and proper driver support and there aren't major shortages causing retailers to price gouge then we may see Intel revenue and profit continue to climb.

You're looking at operating income. It's not the "income" a company actually earns. You should look at NET INCOME (or at least income before tax).

Operating income is lower because of higher cost of sales (manufacturing costs). This is fully mitigated by gains in equity investments.

These may be connected. I can tell you later when I check the full statement. :)Thing is: top server chips don't matter as much as some think. AMD has a huge advantage in the 32+ core range. But it's actually quite even down the line.

Intel asks more, but gives more in return (in support, software, supply stability etc).

Once put in a large server, the price difference becomes less significant.

AMD will win customers that can benefit from high core density: supercomputers, some datacenters etc. It's already visible.

But if you're in a market for a typical 2 x 10-20 core rack, Intel remains the better (safer) choice.Just because you're fascinated with PC hardware doesn't mean everyone else has to be. You having "lesser opinion" of them doesn't matter. And is just sad, really.

Yes, most computers are bought by people who don't give a rats ass about things like IPC.

Currently AMD has small market share and they're fully focused on "enthusiasts" and "gamers". This may work for 20% market share in PCs.

If they want to grow further, they'll have to sell to other groups as well.

There's a big difference between ignorant and stupid.

And btw I don't find PC hardware fascinating. I'm not even a tech enthusiast. I just keep up with what I think is important for a gaming rig.

Everything else makes no sense, as they had to slash prices by half to counter AMD, sell actually less actual volume of SKUs due to supply-constrains while even expanding their fabs' production-volume (which doesn't come free of charge, right?) and at the same time spending +13B on buybacks again to stabilise their stock.

Its either this, or something else we don't know right now (and probably won't anytime soon) of how they print money by actually selling less for half the money.

It's like they invented some money printing machine elsewhere … Magic!

Smartcom

Server chips didn't drop that much (they sell everything anyway).

Mobile SoCs probably haven't moved a bit (up, if anything).?

Supply-constrains mean they can't make enough CPUs. In other words: they sold at least as much as before - in wafers.

Volumes are down because they had to move to larger chips.

E.g. a 6-core Coffee-lake is roughly 20% larger than 4-core, i.e. you're making roughly 17% dies less (and you lose a bit more because of wafer shape and quality control).I'm not sure what you mean here...?

EPYC Pressure: Intel Discontinues Some Cascade Lake Xeon Models, Slashes Pricing on OthersAs compared to what exactly, don't think anyone has answered that from Intel? We know Intel artificially limited the supply in DIY market to boost their presence & commitments in the OEM, enterprise pace. They could just be doing some accounting BS to peddle this notion that their products are still in high demand & supply constrained.Yes & yields, because they're also moving to 10nm. I bet no one had any idea how supply constraints could have anything to do with that :laugh:

Live & learn I guess :ohwell:

Also, it did occur to me that something may not be as obvious as I though.

You do understand that companies offer discounts to sell more, right? :)I seriously don't understand that sentence (the OEM idea).

Also, Intel isn't "artificially limiting supply". Intel is a private company. They can sell as much as they want. If they think that selling fewer items for more money will provide higher profit, that's what they will do (and what they should do). And, clearly, it worked.And what would be the reason to do that? Assuming their CPUs haven't been in high demand (which we know from the results to be false), why would they want to convince us it's the opposite? What was there to gain? Last time I checked, CPUs weren't collector items.Yes, and yields. This is likely one of the reasons for higher cost of sales (but not a dominant one).

But than again: I doubt they made that many 10nm CPUs in 2019. Mainstream Ice Lake laptops arrived in November.

They have a presence in OEM & Enterprise space not only because of their superior support, which I admit AMD cannot match at this point, but also because of the rebates & $ they spend on marketing & promotions. Basically they've been paying for their sales, now more than ever.How do you suppose we can explain the discrepancy in the demand in DIY market, which has plummeted whether you agree with it or not, & the total consumer segment sales? Yes, notebooks are a thing but over the last year or two I've seen more Atoms (Pentium Silver, Bronze?) as well as Pentiums & Celerons being sold than the previous years. Way more in fact, the number of devices I've seen spring up over here is substantial & did I mention they come with HDD :shadedshu:

IIRC their volumes are down across large segments & they're compensating for it by selling the i9 - which are still popular in the desktop space - besides the high(er) end i7 in the notebook market. I know I'm upgrading to an i7 or R7 next up & there are quite a few people I know who've taken to gaming laptops, in part because DIY parts aren't so cheap over here.You misunderstand, I'm saying the (10nm) yields plus the move to larger dies, is creating an artificial scarcity of chips - which they're peddling as "greater" demand than ever before!

Yes, AMD is cracking the whip on Intel, and I personally hope that it goes on for a good, long time.

But I can't see Intel rolling over and playing dead either. Look for plenty of innovation and competition in the future.

We have the official results. Clearly: revenue is stable, ASP is at least stable if not up. There's really nothing to discuss here.Well yes, they prefer to sell to OEMs. What's wrong with that? It's a more stable and cheaper channel.

You seem to think DIY is some dream market that they should cherish and pat on the back. If it's not profitable, they'll give more of it to AMD. Simple as that.

Also, I still don't understand why Intel is bashed for rebates and AMD is praised for break even pricing (even cheered to try dumping just to get traction :))Honestly, I think we're losing contact. I have no idea what you're talking about.

I don't know what you mean by "you've seen". For example: Atoms are almost extinct.

DIY community is a small part of Intel's customers. You can't extrapolate DIY trends to their whole business.

And I love the "notebooks are a thing" part. :)

You absolutely can manipulate earnings. A known criminal isn't trustworthy in any respect.

Source

However it hurts them, in a plethora of numbers you can easily drown the under-performing division. Between March and June it'll be certainly more visible. Especially if AMD floods the market with Ryzen laptops. That was the stalwart, monopoly market for Intel for decades and if AMD can dislodge Intel here (with clearly superior processors) it'll hurt the bottom line. Make no mistake. Moves from companies like Dell or HP which were officially fed-up with Intel lack of supplies for IS and switched to AMD exclusively that's another. It's to early to really notice these shifts. It takes time. By the end of June I'm sure we'll see something. You can't take losses on such scale and hope that creative accountancy will solve all problems.

Intel surely are seething deep down... and it serves them well for stifling the market/innovation. In CPU space they simply have nothing worth looking at compared to competition. I wouldn't be surprised if AMD even pulled some low-power, low core count EPYC for mobile workstations. Why not? Reds just steamrolled Blues in 2019 and 2020 looks about the same in this regard.

IMHO Intel really missed the train of 3647 for HEDT. Instead resurrecting dead X299 platform they should've switched HEDT to 3647. There was plenty of potential. Me personally I don't need 28 core 5GHz Xeon 1kW CPU. But at stock that 28 core is very good chip. Push it to 10nm, work a bit on thermals, triple L3 cache, cut unnecessary server bits, cut the QPI links and convert them into PCIe lanes, lower the PRICE and it would sell easily. So yeah... Intel really were at sixes and sevens during 2019, will see if they have anything to respond in 2020.