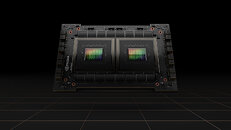

NVIDIA Unveils Grace CPU Superchip with 144 Cores and 1 TB/s Bandwidth

NVIDIA has today announced its Grace CPU Superchip, a monstrous design focused on heavy HPC and AI processing workloads. Previously, team green has teased an in-house developed CPU that is supposed to go into servers and create an entirely new segment for the company. Today, we got a more detailed look at the plan with the Grace CPU Superchip. The Superchip package represents a package of two Grace processors, each containing 72 cores. These cores are based on Arm v9 in structure set architecture iteration and two CPUs total for 144 cores in the Superchip module. These cores are surrounded by a now unknown amount of LPDDR5x with ECC memory, running at 1 TB/s total bandwidth.

NVIDIA Grace CPU Superchip uses the NVLink-C2C cache coherent interconnect, which delivers 900 GB/s bandwidth, seven times more than the PCIe 5.0 protocol. The company targets two-fold performance per Watt improvement over today's CPUs and wants to bring efficiency and performance together. We have some preliminary benchmark information provided by NVIDIA. In the SPECrate2017_int_base integer benchmark, the Grace CPU Superchip scores over 740 points, which is just the simulation for now. This means that the performance target is not finalized yet, teasing a higher number in the future. The company expects to ship the Grace CPU Superchip in the first half of 2023, with an already supported ecosystem of software, including NVIDIA RTX, HPC, NVIDIA AI, and NVIDIA Omniverse software stacks and platforms.

NVIDIA Grace CPU Superchip uses the NVLink-C2C cache coherent interconnect, which delivers 900 GB/s bandwidth, seven times more than the PCIe 5.0 protocol. The company targets two-fold performance per Watt improvement over today's CPUs and wants to bring efficiency and performance together. We have some preliminary benchmark information provided by NVIDIA. In the SPECrate2017_int_base integer benchmark, the Grace CPU Superchip scores over 740 points, which is just the simulation for now. This means that the performance target is not finalized yet, teasing a higher number in the future. The company expects to ship the Grace CPU Superchip in the first half of 2023, with an already supported ecosystem of software, including NVIDIA RTX, HPC, NVIDIA AI, and NVIDIA Omniverse software stacks and platforms.