Apr 3rd, 2025 04:59 EDT

change timezone

Latest GPU Drivers

New Forum Posts

- Since all gpu's models perform the same, why review dozen of different models? (11)

- RX 9000 series GPU Owners Club (120)

- Help with System Recommendations (9)

- A slightly strange problem with a GPU (11)

- NZXT N9 X870E is out (despite their website still saying: coming soon) (9)

- Mllse 6600s that are locked at 500 mhz. (1)

- Is RX 9070 VRAM temperature regular value or hotspot? (298)

- TechPowerUp Screenshot Thread (MASSIVE 56K WARNING) (4266)

- Windows 11 General Discussion (5917)

- Montech KING 95 - your opinions? (14)

Popular Reviews

- DDR5 CUDIMM Explained & Benched - The New Memory Standard

- Sapphire Radeon RX 9070 XT Pulse Review

- SilverStone Lucid 04 Review

- PowerColor Radeon RX 9070 Hellhound Review

- Sapphire Radeon RX 9070 XT Nitro+ Review - Beating NVIDIA

- ASRock Phantom Gaming B850 Riptide Wi-Fi Review - Amazing Price/Performance

- Palit GeForce RTX 5070 GamingPro OC Review

- Pwnage Trinity CF Review

- AMD Ryzen 7 9800X3D Review - The Best Gaming Processor

- Samsung 9100 Pro 2 TB Review - The Best Gen 5 SSD

Controversial News Posts

- MSI Doesn't Plan Radeon RX 9000 Series GPUs, Skips AMD RDNA 4 Generation Entirely (146)

- Microsoft Introduces Copilot for Gaming (124)

- AMD Radeon RX 9070 XT Reportedly Outperforms RTX 5080 Through Undervolting (119)

- NVIDIA Reportedly Prepares GeForce RTX 5060 and RTX 5060 Ti Unveil Tomorrow (115)

- Over 200,000 Sold Radeon RX 9070 and RX 9070 XT GPUs? AMD Says No Number was Given (100)

- NVIDIA GeForce RTX 5050, RTX 5060, and RTX 5060 Ti Specifications Leak (96)

- Retailers Anticipate Increased Radeon RX 9070 Series Prices, After Initial Shipments of "MSRP" Models (90)

- China Develops Domestic EUV Tool, ASML Monopoly in Trouble (88)

News Posts matching #Earnings

Return to Keyword Browsing

AMD Confirms "Zen 4" on 5nm, Other Interesting Tidbits from Q2-2020 Earnings Call

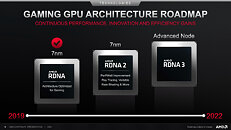

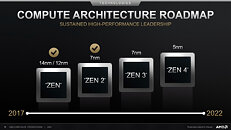

AMD late Tuesday released its Q2-2020 financial results, which saw the company rake in revenue of $1.93 billion for the quarter, and clock a 26 percent YoY revenue growth. In both its corporate presentation targeted at the financial analysts, and its post-results conference call, AMD revealed a handful interesting bits looking into the near future. Much of the focus of AMD's presentation was in reassuring investors that [unlike Intel] it is promising a stable and predictable roadmap, that nothing has changed on its roadmap, and that it intends to execute everything on time. "Over the past couple of quarters what we've seen is that they see our performance/capability. You can count on us for a consistent roadmap. Milan point important for us, will ensure it ships later this year. Already started engaging people on Zen4/5nm. We feel customers are very open. We feel well positioned," said president and CEO Dr Lisa Su.

For starters, there was yet another confirmation from the CEO that the company will launch the "Zen 3" CPU microarchitecture across both the consumer and data-center segments before year-end, which means both Ryzen and EPYC "Milan" products based on "Zen 3." Also confirmed was the introduction of the RDNA2 graphics architecture across consumer graphics segments, and the debut of the CDNA scalar compute architecture. The company started shipping semi-custom SoCs to both Microsoft and Sony, so they could manufacture their next-generation Xbox Series X and PlayStation 5 game consoles in volumes for the Holiday shopping season. Semi-custom shipments could contribute big to the company's Q3-2020 earnings. CDNA won't play a big role in 2020 for AMD, but there will be more opportunities for the datacenter GPU lineup in 2021, according to the company. CDNA2 debuts next year.

For starters, there was yet another confirmation from the CEO that the company will launch the "Zen 3" CPU microarchitecture across both the consumer and data-center segments before year-end, which means both Ryzen and EPYC "Milan" products based on "Zen 3." Also confirmed was the introduction of the RDNA2 graphics architecture across consumer graphics segments, and the debut of the CDNA scalar compute architecture. The company started shipping semi-custom SoCs to both Microsoft and Sony, so they could manufacture their next-generation Xbox Series X and PlayStation 5 game consoles in volumes for the Holiday shopping season. Semi-custom shipments could contribute big to the company's Q3-2020 earnings. CDNA won't play a big role in 2020 for AMD, but there will be more opportunities for the datacenter GPU lineup in 2021, according to the company. CDNA2 debuts next year.

EA Confirms its Games Will Receive Free Patches for PlayStation 5, Xbox Series X Compatibility

EA has confirmed that it's existing games for Xbox One and Playstation 4 will receive free patches to upgrade them for next-generation consoles. The PS5 and Xbox Series X both feature ways to play current-generation games, both consoles will attempt to automatically boost games up to 4k resolution. While these options ensure broad inter-generation compatibility issues can arise from game limitations, this is where manual patches come in allowing developers to take advantage of the extra performance and radically overhaul their games.

Electronic Arts CFO Blake Jorgensen confirmed in a recent earnings call that EA would not charge consumers for these patches. "As usual, we have presented the quarterly phasing of our net bookings in our earnings presentation. Note that this year, the phasing includes the effect of revenue recognition from the games we are launching for the current generation of consoles that can also be upgraded free for the next generation."

Electronic Arts CFO Blake Jorgensen confirmed in a recent earnings call that EA would not charge consumers for these patches. "As usual, we have presented the quarterly phasing of our net bookings in our earnings presentation. Note that this year, the phasing includes the effect of revenue recognition from the games we are launching for the current generation of consoles that can also be upgraded free for the next generation."

Xbox Game Pass Surpasses 10 Million Subscribers

During Microsoft's Q3 2020FY Earnings call, it was confirmed that Xbox Live was seeing record levels of engagement with over 90 million monthly users. On top of this, Microsoft announced that Xbox Game Pass had surpassed 10 million subscribers for the video game subscription service. Xbox Game Pass is available for Xbox One and PC giving users access to a library with hundreds of games including many large recent games such as Gears Tactics, Halo Master Chief Collection, and Shadow of the Tomb Raider. This makes Xbox Game Pass the largest game subscription service far outnumbering EA Access and Origin Access. Microsoft also noted that interest in Project xCloud the experimental game streaming service was high with "hundreds of thousands" of active users.

Samsung Electronics Announces First Quarter 2020 Results

Samsung Electronics today reported financial results for the first quarter ended March 31, 2020. Total revenue was KRW 55.33 trillion, a decrease of 7.6% from the previous quarter mainly due to weak seasonality for the Company's display business and Consumer Electronics Division and partially due to effects of COVID-19. From a year earlier, revenue rose 5.6% due to increasing demand for server and mobile components.

Operating profit was lower by KRW 0.7 trillion quarter-on-quarter to KRW 6.45 trillion, affected by the same factors that weighed on revenue with a corresponding decrease in operating margin, even though memory earnings were higher. Compared with a year earlier, operating profit increased by KRW 0.2 trillion with an improved product mix in the mobile business and additional diversification of the Company's customer base in mobile OLED.

In the quarter, foreign exchange movements had little impact on the overall operating profit as the positive effects from a stronger U.S. dollar and euro against the won - felt mainly in the component business - were offset by weakness in currencies in major emerging markets.

Operating profit was lower by KRW 0.7 trillion quarter-on-quarter to KRW 6.45 trillion, affected by the same factors that weighed on revenue with a corresponding decrease in operating margin, even though memory earnings were higher. Compared with a year earlier, operating profit increased by KRW 0.2 trillion with an improved product mix in the mobile business and additional diversification of the Company's customer base in mobile OLED.

In the quarter, foreign exchange movements had little impact on the overall operating profit as the positive effects from a stronger U.S. dollar and euro against the won - felt mainly in the component business - were offset by weakness in currencies in major emerging markets.

AMD CEO Lisa Su Talks About 3rd Gen Ryzen Boost Issue in Q3 Earnings Call

AMD CEO Dr Lisa Su in response to a question, spoke about 3rd generation Ryzen processor boost issue. Dr. Su was responding to a question by Mitch Steves of RBC Capital on whether she had comments on "the software side" of 3rd gen Ryzen, and articles in the press still popping up about them despite AMD's fix. This was interpreted by the AMD CEO as a question specific to the Precision Boost controversy surrounding 3rd gen Ryzen chips, in which processors would seldom/never hit the advertised maximum boost frequency. AMD tried to address this by issuing updates to its processor microcode under AGESA Combo 1.0.0.3 ABBA, distributed through motherboard BIOS updates. The new microcode is supposed to increase the maximum turbo clock-speeds for "the vast majority" of users.

In her response, Dr. Su began by stating that the company is pleased with the sales of these processors. She then mentioned that AMD is working with its motherboard partners and ODM partners to "improve the optimization of the maximum boost frequency." She notes that the issue has been "largely addressed over the last couple of weeks" (referring to 1.0.0.3 ABBA). She goes on to state that AMD sees its response to the boost issues as more of an "optimization," rather than a "major update," possibly trying to allay investor fears that AMD is firefighting a costly problem with its products. "We're going to continue to improve the platform," she adds, possibly referencing the upcoming AGESA 1.0.0.4 Patch B microcode that's beginning to ship out by motherboard vendors. The earnings call can be accessed here. The specific question can be found at 47:00.

In her response, Dr. Su began by stating that the company is pleased with the sales of these processors. She then mentioned that AMD is working with its motherboard partners and ODM partners to "improve the optimization of the maximum boost frequency." She notes that the issue has been "largely addressed over the last couple of weeks" (referring to 1.0.0.3 ABBA). She goes on to state that AMD sees its response to the boost issues as more of an "optimization," rather than a "major update," possibly trying to allay investor fears that AMD is firefighting a costly problem with its products. "We're going to continue to improve the platform," she adds, possibly referencing the upcoming AGESA 1.0.0.4 Patch B microcode that's beginning to ship out by motherboard vendors. The earnings call can be accessed here. The specific question can be found at 47:00.

TSMC Revises Financial Outlook, Accounts for January Chemical Contamination and Lost Silicon

TSMC has revised its financial outlook following the recent contamination of its 14 B Gigafab, which saw between 10,000 and 30,000 wafers affected. It seems that TSMC has needed to scrap a higher number of wafers than it had initially calculated (no word on where exactly on those 10,000-30,000 spectrum that number is). This has resulted in an expected, lowered first-quarter 2019 revenues by about US$550 million, gross margin by 2.6%, operating margin by 3.2%, and EPS (Earnings Per Share) by NT$0.42, the foundry house said.

TSMC said it expects to deliver these chips in the second quarter, making up for most of the lost revenue - it's not so much of a loss, but more of a delay in earnings. As it comes to the actual, final impact of the event on TSMC's operating profits, the company estimates a reduced gross margin by 0.2%, operating margin by 0.2%, and EPS by NT$0.08. TSMC said that it has been in constant conversation with customers, and has already scheduled replacement deliveries - surprising absolutely no one.

TSMC said it expects to deliver these chips in the second quarter, making up for most of the lost revenue - it's not so much of a loss, but more of a delay in earnings. As it comes to the actual, final impact of the event on TSMC's operating profits, the company estimates a reduced gross margin by 0.2%, operating margin by 0.2%, and EPS by NT$0.08. TSMC said that it has been in constant conversation with customers, and has already scheduled replacement deliveries - surprising absolutely no one.

Following Crypto Bust, GIGABYTE May Hit the Red Line in Earnings

GIGABYTE, like most manufacturers of graphics cards, bet hard in the crypto craze to fuel demand for their graphics card solutions - an easy deal, considering the company is an AIB to both AMD and NVIDIA, which means they would cater to all of the cryptocurrency mining market. According to DigiTimes, market watchers are aware of the inventory buildup on GIGABYTE's watch, and cite the recent production issues with NVIDIA's latest RTX 2080 Ti graphics cards as reasons for the company to leave the black and cross the profit threshold towards a loss on the Q4.

GIGABYTE's Q3 was already reported as being a close cut in the earnings department, where the company didn't post losses simply because of non-operating incomes - meaning that inventory sold wasn't enough to offset all costs associated with bringing their products to market.

GIGABYTE's Q3 was already reported as being a close cut in the earnings department, where the company didn't post losses simply because of non-operating incomes - meaning that inventory sold wasn't enough to offset all costs associated with bringing their products to market.

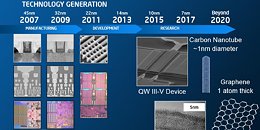

Intel Stuck with 14nm Processors Till Holiday 2019

Wrap your head around this: at some point in 2019, AMD will be selling 7 nm processors while Intel sells 14 nm processors. That how grim Intel's 10 nanometer silicon fabrication process development is looking. In the Q&A session of its Q2-2018 Earnings Call, Intel stated that the first products based on its 10 nm process will arrive only by Holiday 2019, making 14 nm micro-architectures hold the fort for not just the rest of 2018, but also most of 2019. In the client-segment, Intel is on the verge of launching its 9th generation Core "Whiskey Lake" processor family, its 5th micro-architecture on the 14 nm node after "Broadwell," "Skylake," "Kaby Lake," and "Coffee Lake."

It's likely that "Whiskey Lake" will take Intel into 2019 after the company establishes performance leadership over 12 nm AMD "Pinnacle Ridge" with a new round of core-count increases. Intel is also squeezing out competitiveness in its HEDT segment by launching new 20-core and 22-core LGA2066 processors; and a new platform with up to 28 cores and broader memory interface. AMD, meanwhile, hopes to have the first 7 nm EPYC processors out by late-2018. Client-segment products based on its architecture, however, will follow the roll-out of these enterprise parts. We could see a point in 2019 when AMD launches its 7 nm 3rd generation Ryzen processors in the absence of competing 10 nm Core processors from Intel. Posted below is an Intel slide from 2013, when the company was expecting 10 nm rollout by 2015. That's how much its plans have derailed.

It's likely that "Whiskey Lake" will take Intel into 2019 after the company establishes performance leadership over 12 nm AMD "Pinnacle Ridge" with a new round of core-count increases. Intel is also squeezing out competitiveness in its HEDT segment by launching new 20-core and 22-core LGA2066 processors; and a new platform with up to 28 cores and broader memory interface. AMD, meanwhile, hopes to have the first 7 nm EPYC processors out by late-2018. Client-segment products based on its architecture, however, will follow the roll-out of these enterprise parts. We could see a point in 2019 when AMD launches its 7 nm 3rd generation Ryzen processors in the absence of competing 10 nm Core processors from Intel. Posted below is an Intel slide from 2013, when the company was expecting 10 nm rollout by 2015. That's how much its plans have derailed.

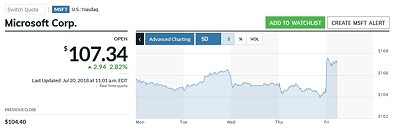

Riding on Strong Azure Performance, Microsoft Crushes Estimates, Jumps 4% in Stock Valuation

Following Microsoft's Earnings report last Thursday, the company enjoyed a smooth uphill with its stock value in after-hours trading. Riding on the strong of greater than expected Microsoft Azure Cloud earnings, Microsoft beat all estimates by a margin: earnings per share were announced at $1.14, versus $1.08 expected (GAAP), and revenue was declared at $30.1 billion, versus $29.2 billion expected. That's an extra billion dollars in revenue for all intents and purposes - and stock pricing increased by more than the additional revenue did, with investors expressing confidence on "strong guidance".

Productivity and Business Processes, with Microsoft Office, was up 13% from the year-ago period, to $9.7 billion. Intelligent Cloud, which encompasses the Microsoft Azure cloud-computing platform and related technologies, was up 23%, to $9.6 billion. And More Personal Computing, which includes Windows, the Xbox, and the Surface hardware business, was up 17%, to $10.8 billion (7% up in the Windows business alone). The Azure folder was the one with the most growth, by far: it saw revenue growth of 89% from the same period in 2017. LinkedIn revenue went up 37% from the same time last year, and gaming revenue saw a 39% increase - a boost not related to hardware, but Xbox software and services, which accounted for 36% of that figure. The Surface business is up 25% from this time last year, something Microsoft credits to both a strong hardware lineup this year and a less than stellar 2017 performance.

Productivity and Business Processes, with Microsoft Office, was up 13% from the year-ago period, to $9.7 billion. Intelligent Cloud, which encompasses the Microsoft Azure cloud-computing platform and related technologies, was up 23%, to $9.6 billion. And More Personal Computing, which includes Windows, the Xbox, and the Surface hardware business, was up 17%, to $10.8 billion (7% up in the Windows business alone). The Azure folder was the one with the most growth, by far: it saw revenue growth of 89% from the same period in 2017. LinkedIn revenue went up 37% from the same time last year, and gaming revenue saw a 39% increase - a boost not related to hardware, but Xbox software and services, which accounted for 36% of that figure. The Surface business is up 25% from this time last year, something Microsoft credits to both a strong hardware lineup this year and a less than stellar 2017 performance.

Samsung Electronics Announces Fourth Quarter and FY 2017 Results

One of the industry's giants is having a strong showing, with a grand total of $64.17 billion in revenue and $14 billion in profits for Q4 2017. These results were buoyed by earnings increases across almost all of Samsung's sectors: the Consumer Electronics, Device Solutions, and Display Panel sectors registered strong growth. The only outlier was IT & Mobile Communications, where the company fell short for the second consecutive quarter (likely has something to do with splash damage from Samsung's still too close for comfort, exploding failures).

Samsung is expecting stable NAND demand alongside increased DRAM demand for datacenters. Samsung is citing "strong market conditions" for its semiconductor revenue (particularly considering DRAM pricing and volume), and says that what would be, under normal circumstances, a slow quarter due to low seasonality of its semiconductor business was somewhat compensated by Samsung's acquisition of new China clients (I wonder if this has anything to do with mining ASICs...) There's also no mention of Samsung's entry into the OLED TV market, with the company instead choosing to focus on its Quantum Dot technology, higher resolution panels, and higher diagonals as the method of choice to attract new buyers. The full press release follows.

Samsung is expecting stable NAND demand alongside increased DRAM demand for datacenters. Samsung is citing "strong market conditions" for its semiconductor revenue (particularly considering DRAM pricing and volume), and says that what would be, under normal circumstances, a slow quarter due to low seasonality of its semiconductor business was somewhat compensated by Samsung's acquisition of new China clients (I wonder if this has anything to do with mining ASICs...) There's also no mention of Samsung's entry into the OLED TV market, with the company instead choosing to focus on its Quantum Dot technology, higher resolution panels, and higher diagonals as the method of choice to attract new buyers. The full press release follows.

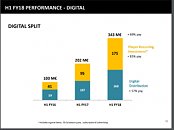

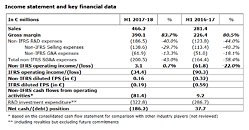

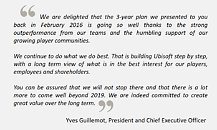

Ubisoft's Microtransactions Surpass Digital Games Sales in Earnings

Ubisoft has announced on its latest Q2 financials that earnings from microtransactions have exceeded proceeds from digital game sales. Digital revenue increased by a very respectable 69%, but Ubisoft says that Player Recurring Investment (PRI), or the sale of in-game items, DLC, season passes, and subscriptions, increased by a staggering 83% year-over-year, being responsible for €175 million (~$202.6 million) earned during the first two quarters of the year. This amounts to a cool 51% of total digital income, which means that actual digital games sales earned less than DLCs and microtransactions.

Total sales across both Q1 and Q2 came in at €466.2 million (~$539.9 million), up 60% year-over-year, but that's hardly the key point to this story. The key point here is that while a company that heavily focuses on linear, story-driven, single player games has just announced a 25% reduction in its workforce, Ubisoft has just announced tremendous games seemingly on the back of microtransactions and DLC, or, as the company puts it, Player Recurring Investment. We can say what we will regarding the chronicle of an announced death for story-driven single player games, but one fact remains: players love microtransactions, even as there's a universal understanding of loathing towards them.

Total sales across both Q1 and Q2 came in at €466.2 million (~$539.9 million), up 60% year-over-year, but that's hardly the key point to this story. The key point here is that while a company that heavily focuses on linear, story-driven, single player games has just announced a 25% reduction in its workforce, Ubisoft has just announced tremendous games seemingly on the back of microtransactions and DLC, or, as the company puts it, Player Recurring Investment. We can say what we will regarding the chronicle of an announced death for story-driven single player games, but one fact remains: players love microtransactions, even as there's a universal understanding of loathing towards them.

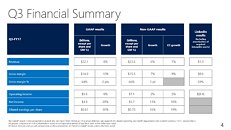

Microsoft Releases FY17 Q3 Earnings - Azure Revenue Increases 93%

Microsoft just reported earnings for the last quarter, with the company reporting non-GAAP revenue of $23.6 billion and non-GAAP earnings per share of $0.73. YoY, Microsoft reported increased earnings per share of $0.11, from $0.62 in last year's quarter. Microsoft's "Intelligent Cloud" business hit $6.8 billion this quarter, up 11 percent from last year's $6.1 billion, and on its way to Microsoft's estimated $20 billion run rate by 2018. Azure revenue was up a staggering 93 percent, driven both by increased demand for the core Azure compute services as well as Azure's premium services. Azure's annual run rate is now $15.2 billion, which puts it on track to hit the $20 billion run rate Microsoft expects to achieve by 2020.

Intel Announces Q4 2016 and Full-Year Revenues - Record Q4, YOY

Intel today announced their quarterly earnings for Q4 of the 2016 fiscal year. The company set a new record for revenue for this quarter, coming in at $16.4 billion (up 10% from a year ago, which stood at $14.9B). For the year, Intel brought in $59.4 billion, up 7% from their 2015 results. Intel's gross margin fell, though, by 1.7 points down to a still hugely respectable 60.9%, with operating income of $12.9 billion, down 8% from a year ago. Net income was down 10% to $10.3 billion, and earnings per share fell 9% to $2.12. Intel announced a record annual cash flow from operations of $21.8 billion, with solid earnings with GAAP net income of $10.3 billion, and non-GAAP net income of $13.2 billion.

Leaving the corporate numbers talk behind us for a moment, this means that Intel managed to have another astounding year, with solid execution and even more solid margins and revenues. However, take a peek under the hood, and Intel's wins are based on consumer losses: lower volumes in almost all channels were offset by higher average selling prices (ASP), meaning that Intel is (like any company on the top would) keeping its revenue streams up by charging more for its products.

Leaving the corporate numbers talk behind us for a moment, this means that Intel managed to have another astounding year, with solid execution and even more solid margins and revenues. However, take a peek under the hood, and Intel's wins are based on consumer losses: lower volumes in almost all channels were offset by higher average selling prices (ASP), meaning that Intel is (like any company on the top would) keeping its revenue streams up by charging more for its products.

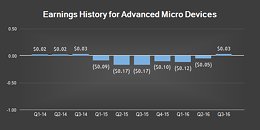

AMD's Q3 2016 Earnings Call - Revenue is Up, Debt is Down

AMD today released their earnings call for 3Q 2016, giving us some interesting tidbits in regards to their financial robustness. The balance of AMD's economics seems to be pending towards better execution, and, coeteris paribus, a much better outlook for the coming quarters, after the monumental missteps in the past that almost threw AMD under the proverbial bus. Reception for the results seems to be a tangled mess, however, with some sides claiming that AMD beat expectations, while others prefer to draw attention to AMD's 2% stock decline since the report was outed.

AMD posted revenue of $1,307 million, up 27% sequentially and 23% year-over-year. This revenue was distributed unevenly through AMD's divisions, though. "Computing and Graphics" segment revenue was $472 million, up 9% from Q2 2016, primarily due to increased GPU sales (where Polaris picked up the grunt of the work, being responsible for 50% of AMD's GPU revenue), offset by lower sales of client desktop processors and chipsets; whereas "Enterprise, Embedded and Semi-Custom" segment revenue was $835 million, up 41% sequentially, primarily due to record semi-custom SoC sales (such as those found in Microsoft's XBOX One and Sony's PS4 and upcoming PS4 Pro).

AMD posted revenue of $1,307 million, up 27% sequentially and 23% year-over-year. This revenue was distributed unevenly through AMD's divisions, though. "Computing and Graphics" segment revenue was $472 million, up 9% from Q2 2016, primarily due to increased GPU sales (where Polaris picked up the grunt of the work, being responsible for 50% of AMD's GPU revenue), offset by lower sales of client desktop processors and chipsets; whereas "Enterprise, Embedded and Semi-Custom" segment revenue was $835 million, up 41% sequentially, primarily due to record semi-custom SoC sales (such as those found in Microsoft's XBOX One and Sony's PS4 and upcoming PS4 Pro).

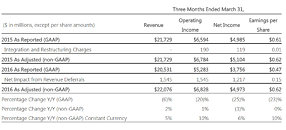

Microsoft Reports $20 Billion in Revenue for Q3 of FY2016

Microsoft Corp. today announced the following results for the quarter ended March 31, 2016:

- Revenue was $20.5 billion GAAP, and $22.1 billion non-GAAP

- Operating income was $5.3 billion GAAP, and $6.8 billion non-GAAP

- Net income was $3.8 billion GAAP, and $5.0 billion non-GAAP

- Earnings per share was $0.47 GAAP, and $0.62 non-GAAP

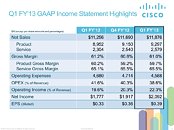

Cisco Reports First Quarter Earnings

Cisco, the worldwide leader in networking that transforms how people connect, communicate and collaborate, today reported its first quarter results for the period ended October 27, 2012. Cisco reported first quarter net sales of $11.9 billion, net income on a generally accepted accounting principles (GAAP) basis of $2.1 billion or $0.39 per share, and non-GAAP net income of $2.6 billion or $0.48 per share.

"We delivered record results this quarter -- with revenue growth of 6 percent and strong earnings per share growth -- demonstrating our vision and strategy are working," said John Chambers, chairman and chief executive officer, Cisco. "Our innovation engine, operational discipline and on-going evolution are enabling us to differentiate in the market."

"We delivered record results this quarter -- with revenue growth of 6 percent and strong earnings per share growth -- demonstrating our vision and strategy are working," said John Chambers, chairman and chief executive officer, Cisco. "Our innovation engine, operational discipline and on-going evolution are enabling us to differentiate in the market."

Samsung Electronics Announces Third Quarter 2012 Earnings Results

Samsung Electronics Co., Ltd. today announced revenues of 52.18 trillion Korean won on a consolidated basis for the third quarter ended September 30, 2012, a 26-percent increase year-on-year. For the quarter, the company's consolidated operating profit reached an all-time high of 8.12 trillion won, representing a 91-percent increase year-on-year. Consolidated net profit for the July-September period was 6.56 trillion won.

In its earnings guidance disclosed on October 5, Samsung estimated third quarter consolidated revenues would reach approximately 52 trillion won with consolidated operating profit of approximately 8.1 trillion won. Samsung's solid performance is mainly attributed to increased sales of handheld phones and stronger demand for display panels. The Mobile Communications Business posted 26.25 trillion won in revenue for the quarter, accounting for more than half of Samsung's total revenue. As for the display panel segment, increased shipments of Organic Light-Emitting Diode (OLED) and Liquid Crystal Display panels used in tablets and smartphones, as well as TVs drove up profitability.

In its earnings guidance disclosed on October 5, Samsung estimated third quarter consolidated revenues would reach approximately 52 trillion won with consolidated operating profit of approximately 8.1 trillion won. Samsung's solid performance is mainly attributed to increased sales of handheld phones and stronger demand for display panels. The Mobile Communications Business posted 26.25 trillion won in revenue for the quarter, accounting for more than half of Samsung's total revenue. As for the display panel segment, increased shipments of Organic Light-Emitting Diode (OLED) and Liquid Crystal Display panels used in tablets and smartphones, as well as TVs drove up profitability.

Samsung Electronics Announces First Quarter 2012 Earnings Results

Samsung Electronics Co., Ltd. today announced revenues of 45.27 trillion Korean won on a consolidated basis for the first quarter ended March 31, 2012, a 22-percent increase year-on-year.

For the quarter, the company's consolidated operating profit reached an all-time high of 5.85 trillion won representing a 98-percent increase year-on-year. Consolidated net profit for the January-March period was 5.05 trillion won.

Despite a decrease in sales of semiconductor chips and TVs due to seasonal factors, an increase in profitability in display panels and mobile phones pushed up quarterly operating profit margins by 1.7 percentage points to 12.9 percent.

For the quarter, the company's consolidated operating profit reached an all-time high of 5.85 trillion won representing a 98-percent increase year-on-year. Consolidated net profit for the January-March period was 5.05 trillion won.

Despite a decrease in sales of semiconductor chips and TVs due to seasonal factors, an increase in profitability in display panels and mobile phones pushed up quarterly operating profit margins by 1.7 percentage points to 12.9 percent.

Microsoft Announces Quarterly Earnings Release Date and Notes Upcoming Events

Microsoft Corp. will release fiscal year 2009 second-quarter financial results after the close of the market on Thursday, Jan. 22, 2009. A live webcast of the earnings conference call will be made available at 2:30 p.m. Pacific Time on the Microsoft Investor Relations Website.

The company will also host the following event for the financial community:

Financial Analyst Briefing at the 2009 International CES Conference

Thursday, January 8, 2009, 3:00 p.m. PST, Robbie Bach, president, Entertainment and Devices Division

Interested parties can listen to a webcast of this event on Microsoft's Investor Relations Website.

The company will also host the following event for the financial community:

Financial Analyst Briefing at the 2009 International CES Conference

Thursday, January 8, 2009, 3:00 p.m. PST, Robbie Bach, president, Entertainment and Devices Division

Interested parties can listen to a webcast of this event on Microsoft's Investor Relations Website.

Intel Posts Record Third-Quarter Revenue of $10.2 Billion

Intel Corporation today announced record third-quarter revenue of $10.2 billion along with operating income of $3.1 billion, net income of $2 billion and earnings per share (EPS) of 35 cents.

"Intel delivered the best third-quarter revenue in its history," said Paul Otellini, Intel president and CEO. "We were solidly profitable, with operating income of over $3 billion, reflecting strong across-the-board execution and best-of-class products."

To read the complete earnings release, click here.

"Intel delivered the best third-quarter revenue in its history," said Paul Otellini, Intel president and CEO. "We were solidly profitable, with operating income of over $3 billion, reflecting strong across-the-board execution and best-of-class products."

To read the complete earnings release, click here.

Apr 3rd, 2025 04:59 EDT

change timezone

Latest GPU Drivers

New Forum Posts

- Since all gpu's models perform the same, why review dozen of different models? (11)

- RX 9000 series GPU Owners Club (120)

- Help with System Recommendations (9)

- A slightly strange problem with a GPU (11)

- NZXT N9 X870E is out (despite their website still saying: coming soon) (9)

- Mllse 6600s that are locked at 500 mhz. (1)

- Is RX 9070 VRAM temperature regular value or hotspot? (298)

- TechPowerUp Screenshot Thread (MASSIVE 56K WARNING) (4266)

- Windows 11 General Discussion (5917)

- Montech KING 95 - your opinions? (14)

Popular Reviews

- DDR5 CUDIMM Explained & Benched - The New Memory Standard

- Sapphire Radeon RX 9070 XT Pulse Review

- SilverStone Lucid 04 Review

- PowerColor Radeon RX 9070 Hellhound Review

- Sapphire Radeon RX 9070 XT Nitro+ Review - Beating NVIDIA

- ASRock Phantom Gaming B850 Riptide Wi-Fi Review - Amazing Price/Performance

- Palit GeForce RTX 5070 GamingPro OC Review

- Pwnage Trinity CF Review

- AMD Ryzen 7 9800X3D Review - The Best Gaming Processor

- Samsung 9100 Pro 2 TB Review - The Best Gen 5 SSD

Controversial News Posts

- MSI Doesn't Plan Radeon RX 9000 Series GPUs, Skips AMD RDNA 4 Generation Entirely (146)

- Microsoft Introduces Copilot for Gaming (124)

- AMD Radeon RX 9070 XT Reportedly Outperforms RTX 5080 Through Undervolting (119)

- NVIDIA Reportedly Prepares GeForce RTX 5060 and RTX 5060 Ti Unveil Tomorrow (115)

- Over 200,000 Sold Radeon RX 9070 and RX 9070 XT GPUs? AMD Says No Number was Given (100)

- NVIDIA GeForce RTX 5050, RTX 5060, and RTX 5060 Ti Specifications Leak (96)

- Retailers Anticipate Increased Radeon RX 9070 Series Prices, After Initial Shipments of "MSRP" Models (90)

- China Develops Domestic EUV Tool, ASML Monopoly in Trouble (88)