Thursday, October 20th 2016

AMD's Q3 2016 Earnings Call - Revenue is Up, Debt is Down

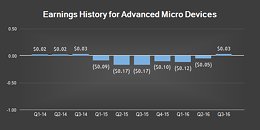

AMD today released their earnings call for 3Q 2016, giving us some interesting tidbits in regards to their financial robustness. The balance of AMD's economics seems to be pending towards better execution, and, coeteris paribus, a much better outlook for the coming quarters, after the monumental missteps in the past that almost threw AMD under the proverbial bus. Reception for the results seems to be a tangled mess, however, with some sides claiming that AMD beat expectations, while others prefer to draw attention to AMD's 2% stock decline since the report was outed.

AMD posted revenue of $1,307 million, up 27% sequentially and 23% year-over-year. This revenue was distributed unevenly through AMD's divisions, though. "Computing and Graphics" segment revenue was $472 million, up 9% from Q2 2016, primarily due to increased GPU sales (where Polaris picked up the grunt of the work, being responsible for 50% of AMD's GPU revenue), offset by lower sales of client desktop processors and chipsets; whereas "Enterprise, Embedded and Semi-Custom" segment revenue was $835 million, up 41% sequentially, primarily due to record semi-custom SoC sales (such as those found in Microsoft's XBOX One and Sony's PS4 and upcoming PS4 Pro).The company's "Computing and Graphics" division still posted an operating loss, though improved to $66 million, compared to an operating loss of $81 million in Q2 2016, primarily due to higher GPU revenue (with Lisa Su saying it registered the highest GPU growth since 2014). Though the "Enterprise, Embedded and Semi-Custom" division picked up the loss and then some, with an operating income of $136 million, up from $84 million in the prior quarter, primarily due to higher revenue.

That said, the thorn on AMD's side this quarter was the amendment for the Waffer Supply Agreement with GLOBALFOUNDRIES, the result of AMD's spin-off of their factory business. The amendment alone is responsible for a $340 million charge on an otherwise impeccable quarter (to which you should add an extra $61 million for debt redemption), which would, without the WSA, be reading green across the board. If you consider only the non-GAAP income (excluding those two special charges), AMD achieved a net income of $27 million, with earnings per share of $0.03, compared to non-GAAP net loss of $40 million, and loss per share of $0.05 in Q2 2016.

In its Q3 earnings conference call, Dr. Lisa Su, AMD president and CEO, referred to AMD's debt re-profiling and reduction as a major cornerstone of this quarter. And considering that AMD managed to liquidate $1.022 billion dollars in outstanding debt ($796 million in principal of outstanding term debt, and an additional pay for $226 million of outstanding ABL balance). Beginning in Q4 2016, AMD will pay $55 million less in interest annually. Non-GAAP operating expenses amounted to $353 million (27% of revenue), up $11 million from the prior quarter's non-GAAP operating expenses. Of these $353 million, non-GAAP R&D was $244 million (19% of revenue) and non-GAAP SG&A was $109 million (8% of revenue).

As a final note, compare AMD's R&D budget with Intel's $5.2 billion (divided between R&D and MG&A (Marketing, General and Administrative), and you can see how much of a colossal fight AMD has on its hands. Much is riding on the back of AMD's ZEN and VEGA, though according to AMD's Lisa Su, the company is poised for success, claiming AMD's 2017 portfolio is going to be the company's best in over a decade. According to her, the best is yet to come.

AMD posted revenue of $1,307 million, up 27% sequentially and 23% year-over-year. This revenue was distributed unevenly through AMD's divisions, though. "Computing and Graphics" segment revenue was $472 million, up 9% from Q2 2016, primarily due to increased GPU sales (where Polaris picked up the grunt of the work, being responsible for 50% of AMD's GPU revenue), offset by lower sales of client desktop processors and chipsets; whereas "Enterprise, Embedded and Semi-Custom" segment revenue was $835 million, up 41% sequentially, primarily due to record semi-custom SoC sales (such as those found in Microsoft's XBOX One and Sony's PS4 and upcoming PS4 Pro).The company's "Computing and Graphics" division still posted an operating loss, though improved to $66 million, compared to an operating loss of $81 million in Q2 2016, primarily due to higher GPU revenue (with Lisa Su saying it registered the highest GPU growth since 2014). Though the "Enterprise, Embedded and Semi-Custom" division picked up the loss and then some, with an operating income of $136 million, up from $84 million in the prior quarter, primarily due to higher revenue.

That said, the thorn on AMD's side this quarter was the amendment for the Waffer Supply Agreement with GLOBALFOUNDRIES, the result of AMD's spin-off of their factory business. The amendment alone is responsible for a $340 million charge on an otherwise impeccable quarter (to which you should add an extra $61 million for debt redemption), which would, without the WSA, be reading green across the board. If you consider only the non-GAAP income (excluding those two special charges), AMD achieved a net income of $27 million, with earnings per share of $0.03, compared to non-GAAP net loss of $40 million, and loss per share of $0.05 in Q2 2016.

In its Q3 earnings conference call, Dr. Lisa Su, AMD president and CEO, referred to AMD's debt re-profiling and reduction as a major cornerstone of this quarter. And considering that AMD managed to liquidate $1.022 billion dollars in outstanding debt ($796 million in principal of outstanding term debt, and an additional pay for $226 million of outstanding ABL balance). Beginning in Q4 2016, AMD will pay $55 million less in interest annually. Non-GAAP operating expenses amounted to $353 million (27% of revenue), up $11 million from the prior quarter's non-GAAP operating expenses. Of these $353 million, non-GAAP R&D was $244 million (19% of revenue) and non-GAAP SG&A was $109 million (8% of revenue).

As a final note, compare AMD's R&D budget with Intel's $5.2 billion (divided between R&D and MG&A (Marketing, General and Administrative), and you can see how much of a colossal fight AMD has on its hands. Much is riding on the back of AMD's ZEN and VEGA, though according to AMD's Lisa Su, the company is poised for success, claiming AMD's 2017 portfolio is going to be the company's best in over a decade. According to her, the best is yet to come.

23 Comments on AMD's Q3 2016 Earnings Call - Revenue is Up, Debt is Down

Provisionally good news then

But yeah, long term, this is good news (if short of great). But if VEGA (and especially ZEN) fail to deliver, investors will lose most of the confidence and goodwill... And that won't be pretty.

although if Zen cant live up expectation

AMD pretty much is doomed

Something important to note is that AMD is paying down debt not due to profitability but due to selling 80 million new shares of stock.

www.investopedia.com/stock-analysis/090816/amd-sinks-stock-and-convertible-debt-offering-amd.aspx

This will dilute the value of existing shares but it will do something critically important for AMD and that is paying down some of the crippling debt that has been plaguing AMD for years. I think this was a smart move by AMD. Their debt was over 2 billion dollars and the interest that they were paying was well over 100 million dollars annually. Some of that money being paid out as interest can now be used within the company to invest in their future.

causing all hype built turn into huge disappointment

They never sold that CPU as well for business market. It was rather a gimmick and a design error hoping that the future would become more and more multithreaded. AMD's bet was on the wrong side.

In DX12 games or DX11 GPUs bound games, the FX 8 cores perfoms like an i7, single threaded games are the past.

That is why the bulldozer kind of failed. With Jim keller, they straight went to a better IPC per core and SMT, which improves and accelerates their CPU's drasticly.

Back in the days, AMD dominated intel with the Athlon starting from XP up to X64. There was no Pentium 4 able to compete with their CPU's. But Intel did very nasty tricks to prevent AMD from coming into the mainstream computer sellers by offering huge discounts when selling Intel platforms.

then you know what its mean to AMD

I can't wait for Zen; its going to be my next gaming rig. I'm not too stoked about Vega though, my 980Ti is doing just fine for now.