Nanya Kicks Off Construction of US$10 Billion Fab in New Taipei City

Nanya Technology, part of the Formosa Plastics Group, which is one of the largest conglomerates in Taiwan, will hold a ground-breaking ceremony for its new 12-inch fab that will be built in New Taipei City later this week. It'll be the biggest investment Nanya has done in the past decade, as the company is investing US$10.1 billion into building the new fab. This is obviously a lot less than TSMC is investing, but DRAM is made on different nodes to those that TSMC makes its customers products on, since DRAM doesn't benefit as much from node shrinking as other types of semiconductors.

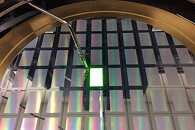

The new fab will be located near one of Nanya's current fabs, in the Taishan district. Mass production is scheduled to start some time in 2025 and the fab is said to have a monthly capacity of around 45,000 wafers. Right now it's scheduled for a 10 nm technology node, but this might change by the time that the fab is up and running, especially considering that Nanya is already producing a range of 10 nm based products in some of its current fabs. Nanya's goal is to develop its next generation of 10 nm DRAM independently from other DRAM makers, as to avoid having to pay patent licence fees to its competitors.

The new fab will be located near one of Nanya's current fabs, in the Taishan district. Mass production is scheduled to start some time in 2025 and the fab is said to have a monthly capacity of around 45,000 wafers. Right now it's scheduled for a 10 nm technology node, but this might change by the time that the fab is up and running, especially considering that Nanya is already producing a range of 10 nm based products in some of its current fabs. Nanya's goal is to develop its next generation of 10 nm DRAM independently from other DRAM makers, as to avoid having to pay patent licence fees to its competitors.