Samsung Electronics Announces Fourth Quarter and FY 2024 Results

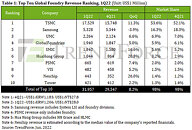

Samsung Electronics today reported financial results for the fourth quarter and the fiscal year 2024. The Company posted KRW 75.8 trillion in consolidated revenue and KRW 6.5 trillion in operating profit in the quarter ended December 31, 2024. For the full year, it reported KRW 300.9 trillion in annual revenue and KRW 32.7 trillion in operating profit.

Although fourth quarter revenue and operating profit decreased on a quarter-on-quarter (QoQ) basis, annual revenue reached the second-highest on record, surpassed only in 2022. Meanwhile, operating profit was down KRW 2.7 trillion QoQ, due to soft market conditions especially for IT products, and an increase in expenditures including R&D. In the first quarter of 2025, while overall earnings improvement may be limited due to weakness in the semiconductors business, the Company aims to pursue growth through increased sales of smartphones with differentiated AI experiences, as well as premium products in the Device eXperience (DX) Division.

Although fourth quarter revenue and operating profit decreased on a quarter-on-quarter (QoQ) basis, annual revenue reached the second-highest on record, surpassed only in 2022. Meanwhile, operating profit was down KRW 2.7 trillion QoQ, due to soft market conditions especially for IT products, and an increase in expenditures including R&D. In the first quarter of 2025, while overall earnings improvement may be limited due to weakness in the semiconductors business, the Company aims to pursue growth through increased sales of smartphones with differentiated AI experiences, as well as premium products in the Device eXperience (DX) Division.