NVIDIA Stock Value Climbs Due To Rising Interest in AI Hardware

Financial analysts at HSBC, the largest bank in Europe, have become very excited this week about NVIDIA's stock prospects. They have established that the American multinational technology company is set to grow due to an increased demand globally for hardware relating to artificial intelligence (AI) processing. HSBC's team of analysts have raised the recommendation on Nvidia stock (NASDAQ:NVDA) to "Buy" from "Reduce" - the reason being that AI business segments are on the rise and NVIDIA is well positioned to meet demand which: "more than offsets our previous concerns over a datacenter slowdown and rising inventory levels."

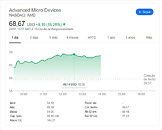

HSBC's price target on NVIDIA stock has more than doubled to $355 per share (from the previous $175), and the analysts claim that their past estimates were wrong and undervalued because of wider market trends in the server business: "We were too focused on the slowdown in datacenters, but what really surprised us was its pricing power on AI chips." Hence the analysts' call to double the NVIDIA stock target, in anticipation of excellent fiscal performance going into 2024. News reports point out an immediate 4.1% jump in stock following HSBC's recommendations. The chipmaker's shares have surged up to 140%, its highest position in a year, from a low period in October 2022.

HSBC's price target on NVIDIA stock has more than doubled to $355 per share (from the previous $175), and the analysts claim that their past estimates were wrong and undervalued because of wider market trends in the server business: "We were too focused on the slowdown in datacenters, but what really surprised us was its pricing power on AI chips." Hence the analysts' call to double the NVIDIA stock target, in anticipation of excellent fiscal performance going into 2024. News reports point out an immediate 4.1% jump in stock following HSBC's recommendations. The chipmaker's shares have surged up to 140%, its highest position in a year, from a low period in October 2022.