Sunday, December 18th 2016

AMD's Stock Edges Upwards of $10; NVIDIA's Soars Past the $100 Mark

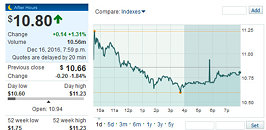

AMD has definitely been on the upswing in recent times, with CEO Lisa Su having seemingly conducted a frail, collapsing company through the muddiest waters in its history. The general sentiment towards the company seems to now be leaning towards the "bullish" side of the equation, which translated into a cool $10.66 per stock at Friday's closing time (having increased, after hours, towards the $10.80 mark. This is great news for a company which has essentially increased their stock value by a factor of four in the last year alone.

Shares of AMD's rival Nvidia, however, have risen 60% in the past three months and nearly 200% in the past year. NVIDIA's share value closed last Friday at a historic $100.41 (having since declined towards $99.55), over a strong bullish sentiment towards the company, which has recently signed a Warrant Termination Agreement with Goldman Sachs for a $63 million value. This basically shows investors that the company has sufficient cash so as not to allow them to see their share value diluted by the sudden entry in circulation of $63 million of shares, should Goldman Sachs exercise their (now terminated) warrant.AMD's recent showings of strength in both the CPU (with their recent Ryzen announcement and performance figures against their rival Intel's parts) and GPU space (with the company having increased their market share through an aggressive mid-range push with their RX 480, RX 470, and RX 460 graphics products, as well as ever increasing VEGA showcases) seem to have increased investor confidence in the company's stocks. Expectations are high regarding AMD's ability to deliver, though all of the company's hard-work can potentially be undone by a repeat of their Bulldozer architecture debut.

NVIDIA, on the other hand, has been cementing its position in the AI and compute segments, particularly in the automotive segment, whilst consistently delivering their product line-ups and performance expectations in all market segments. Also, their latest design win with Nintendo's next-generation Switch console (which will make use of a Maxwell-based Tegra chip) and their recent Warrant Termination Agreement with Goldman Sachs have sat well with investors, increasing the company's standing as a bullish investment.

It really does go to show, though, how much of an uphill battle AMD has cut out for itself in the segments it competes on: on the CPU side, the gigantic, black-hole like Intel Corporation, with more funds available for R&D than AMD has in total market value; and on the graphics and computing side of the equation, NVIDIA, with a market capitalization ten times greater than the little, mean, red team. Whether you love or you hate the company, it can't really be denied that AMD has, for the past few years, been the technological manifestation of David, throwing some respectable (if sometimes underwhelming) punches with the Golias' of the tech world.

Sources:

MarketWatch AMD, MarketWatch NVIDIA

Shares of AMD's rival Nvidia, however, have risen 60% in the past three months and nearly 200% in the past year. NVIDIA's share value closed last Friday at a historic $100.41 (having since declined towards $99.55), over a strong bullish sentiment towards the company, which has recently signed a Warrant Termination Agreement with Goldman Sachs for a $63 million value. This basically shows investors that the company has sufficient cash so as not to allow them to see their share value diluted by the sudden entry in circulation of $63 million of shares, should Goldman Sachs exercise their (now terminated) warrant.AMD's recent showings of strength in both the CPU (with their recent Ryzen announcement and performance figures against their rival Intel's parts) and GPU space (with the company having increased their market share through an aggressive mid-range push with their RX 480, RX 470, and RX 460 graphics products, as well as ever increasing VEGA showcases) seem to have increased investor confidence in the company's stocks. Expectations are high regarding AMD's ability to deliver, though all of the company's hard-work can potentially be undone by a repeat of their Bulldozer architecture debut.

NVIDIA, on the other hand, has been cementing its position in the AI and compute segments, particularly in the automotive segment, whilst consistently delivering their product line-ups and performance expectations in all market segments. Also, their latest design win with Nintendo's next-generation Switch console (which will make use of a Maxwell-based Tegra chip) and their recent Warrant Termination Agreement with Goldman Sachs have sat well with investors, increasing the company's standing as a bullish investment.

It really does go to show, though, how much of an uphill battle AMD has cut out for itself in the segments it competes on: on the CPU side, the gigantic, black-hole like Intel Corporation, with more funds available for R&D than AMD has in total market value; and on the graphics and computing side of the equation, NVIDIA, with a market capitalization ten times greater than the little, mean, red team. Whether you love or you hate the company, it can't really be denied that AMD has, for the past few years, been the technological manifestation of David, throwing some respectable (if sometimes underwhelming) punches with the Golias' of the tech world.

14 Comments on AMD's Stock Edges Upwards of $10; NVIDIA's Soars Past the $100 Mark

AMD lost around 0.8% market share for desktop discrete GPUs last quarter but look at the overall gain from last year. A 10.3% gain in desktop discrete GPU market share. That's pretty impressive.

www.jonpeddie.com/press-releases/details/add-in-board-market-increased-in-q316-amd-lost-market-share-while-nvidia-gaActually Nvidia's Market Cap is about 54 billion and AMD's Market Cap is about 10 billion so Nvidia has about 5 1/2 times the Market Cap as AMD, not ten times.

www.msn.com/en-us/money/stockdetails/fi-126.1.NVDA.NAS

www.msn.com/en-us/money/stockdetails/fi-126.1.AMD.NAS?symbol=AMD&form=PRFISB

I feel like Nvidia is in a PR spin cycle of vomiting BS in hopes it becomes true.

I feel that NVDA is overvalued and realistically it should probably 30% to 40% lower. Then again, a big portion of the market operates on feeling rather than reality. Likewise AMD should be around $8 a piece right now but next year, who knows...? 13 to 15?

And all of the new Tesla self-driving cars will use Drive PX 2.

Also, I'm the new superman, I can totally fly, lazer that shit, and am amazing beyond belief, totally.

But in reality, I want some of what you are smoking. A few tesla cars out and now everyone has autonomous vehicles that do everything including making the coffee right?

www.marketwatch.com/investing/stock/amd/insideractions

So, lets see what their Annuals say in a couple weeks before we know what shape they are in.

www.amd.com/en-us/press-releases/Pages/press-release-2016oct20.aspx

From AMD's Q3 2016 Financial Report

AMD will be tested first. If the Ryzen is far from what they where hyping or they manage to have availability problems, it will take a nose dive, before recovering, if it could recover a disappointment of this type. Even a perfect Vega will not be enough.

Nvidia is more complicated. The problem here is that Nvidia this period seems to be playing alone in almost ALL markets. That can rapidly change in the next 2-5 years.

Nvidia is seen, as the King of the GPU business, the company that will manage to take the majority of revenue from VR, as the company that will drive GPUs in the data centers, the company that will lead in Artificial Intelligence, the company that will be piloting out autonomous cars. And of course we have the Nintendo Switch deal. No wonder it is skyrocketing. Also there seems to be no dangers in the coming future.

Well, if AMD recovers and Ryzen is a success, that means more money in R&D. High performing APUs will make GPUs under $150 irrelevant, much more GPU models in the future GPU series, covering not just the mainstream, but also the hi end, and the professional market and the AI and the VR. That could keep Nvidia's revenue lower than what some investors dream. On autonomous cars companies like Intel and Mediatek are saying that they are going to create their own solutions. And I am not forgeting Qualcomm after buying NXP has become the Godzilla in the room. As for the Nintendo Switch, an underclock Tegra X1 will have a tough time convincing gamers and could have the opposite results for Nvidia that it is trying to convince the market that it can also be in a console.