Friday, May 26th 2017

Rosenblatt Securities: "Buy" Rating to AMD Stock, "Sell" for Intel

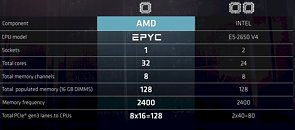

On the back of impressive performance, yield, and cost metric for AMD's market-warping Ryzen and server-shaking EPYC processors, securities firm Rosenblatt Securities' Hans Mosesmann has affirmed a "Buy" rating for AMD's stock, while saddling Intel with a seldom-seen "Sell". All in all, there have been a number of changes in Intel's market ratings; there seems to be a downgrade trend towards either "Hold" or "Sell" scenarios compared to the usual "Buy" ratings given by hedge funds and financial analysts - ratings which are undoubtedly affected (at least in part) by AMD's Ryzen and EPYC execution.Rosenblatt Securities' move stands mainly on two factors: AMD's EPYC single and dual-socket outlooks, with higher core-count and PCIe lanes in their single-socket offerings compared to Intel's dual-socket Xeon, with "half the area, big memory bandwidth and I/O advantages for EPYC." AMD's single-socket is expected to offer around 30% savings in total cost over a comparable Intel dual-socket platform. Mosesmann also mentions Ryzen's wins in die-area compared to Intel (with Ryzen being up to 10% smaller than Intel's platform. Additional news (well, more like rumors at this point, but analysts may have more information than we do) on Ryzen's yields beating expectations, at over 80% for fully-functional 8-core dies, also served to shake this recommendation. This speaks to AMD's current momentum in the high-performance x86 market. Hands and hats down to AMD, Jim Keller and his team, as well as to Lisa Su's leadership, for this momentous fight-back, clawing their way to relevance again.

Sources:

Barrons, NASDAQ, American banking News, SportsPerspectives, NextPlatform, EETimes, Bits and Chips

59 Comments on Rosenblatt Securities: "Buy" Rating to AMD Stock, "Sell" for Intel

rejzor, hopefully Vega will be decent as well. We really don't have enough solid information yet to judge it. I'd love to see NVIDIA put in their place with decent competition.

A Vega based APU will go a long way to bring AMD back into the notebook fold, APU is where the real fight is & I bet Intel will have to lower their prices in the segment, unlike HEDT or high(er) end i5/i7 lineup.

On the other hand we have AMD and Nvidia. As long as GPU is looking like the future for many new compute tasks, Nvidia is a money maker and AMD a probable fortune maker. Of course things can change rapidly in just one day, that's how it is with technology.

What would you rather have:

A 4/8 CPU at 5.0Ghz or 4.1Ghz

A 8/16 CPU at 4.5Ghz or 4.1Ghz

I chose AMD and opted for the 8/16 but it is only at a 95% stable 3.9Ghz. I could shortly buy a base clocked Skylake-E at 4Ghz base clock (if rumours are true).

The only thing that keeps AMD alive is their cheaper pricing for a slightly inferior CPU. If they had frequency and performance parity with INtel, AMD chips probably wouldn't be as cheap. Both companies might well meet in the middle. I look forward to Ryzen+ so i can use my existing mobo and get 10% better clocks.

And it's not always >=90% of the performance either. Ryzen has the habit of losing in benchmarks in many apps you normally use at home, because they're not heavily multithreaded. Choosing the right CPU these days is a bitch. Still, it's better to have options other than "intel if you want performance, amd if you're on a budget".

AMD is now Performance and Budget and Value choice not HEDT. they've already improved massively.!

But if you want the best....

And look at Fury X. It was good enough to match stock 980ti's at the higher resolutions and it was pitched at the same price. AMD have no option but to be cheaper because the CPU isn't as good. Yet.

Also these guys have it backwards, now is the time for intel to strike back since they have had time to get their bearings after the Ryzen release. Buying AMD and Selling Intel on the eve of Core i9 releases is about the dumbest thing I've ever heard.

I've made some serious money off AMD, but there is no way now is the time to buy unless you're buying put options.

That said, Computex is basically a hype-show, so you may be right.