Friday, May 26th 2017

Rosenblatt Securities: "Buy" Rating to AMD Stock, "Sell" for Intel

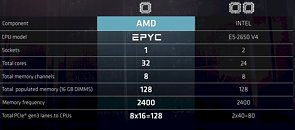

On the back of impressive performance, yield, and cost metric for AMD's market-warping Ryzen and server-shaking EPYC processors, securities firm Rosenblatt Securities' Hans Mosesmann has affirmed a "Buy" rating for AMD's stock, while saddling Intel with a seldom-seen "Sell". All in all, there have been a number of changes in Intel's market ratings; there seems to be a downgrade trend towards either "Hold" or "Sell" scenarios compared to the usual "Buy" ratings given by hedge funds and financial analysts - ratings which are undoubtedly affected (at least in part) by AMD's Ryzen and EPYC execution.Rosenblatt Securities' move stands mainly on two factors: AMD's EPYC single and dual-socket outlooks, with higher core-count and PCIe lanes in their single-socket offerings compared to Intel's dual-socket Xeon, with "half the area, big memory bandwidth and I/O advantages for EPYC." AMD's single-socket is expected to offer around 30% savings in total cost over a comparable Intel dual-socket platform. Mosesmann also mentions Ryzen's wins in die-area compared to Intel (with Ryzen being up to 10% smaller than Intel's platform. Additional news (well, more like rumors at this point, but analysts may have more information than we do) on Ryzen's yields beating expectations, at over 80% for fully-functional 8-core dies, also served to shake this recommendation. This speaks to AMD's current momentum in the high-performance x86 market. Hands and hats down to AMD, Jim Keller and his team, as well as to Lisa Su's leadership, for this momentous fight-back, clawing their way to relevance again.

Sources:

Barrons, NASDAQ, American banking News, SportsPerspectives, NextPlatform, EETimes, Bits and Chips

59 Comments on Rosenblatt Securities: "Buy" Rating to AMD Stock, "Sell" for Intel

How this translates to servers where it'll be running 24/7 plus having beefier I/O & 8 channel mem is anyone's guess, but the fact that they've gone the SoC route sounds really promising atm.

Now if you're still 30% down next year then you can start bitching. But the idea that the stock should only go up isn't a rational one.

You should have bought AMD stocks a year ago, and sell them now before the bubble bursts.

If I'm reading the chart correctly its up over 13x just this year :respect:

They handily beat (sure, with having more cores) 7700k at all but games, but actually beat it at some games too.

How would Intel's own 8 core fare vs 7700k? Oh, also be slower at most games.

8 core vs 8 core they beat Intel cores. (some cool caching stuff kicks in, plus branch predictor seems to be optimized for certain benches, anand's theory also that it will improve in upcoming revisions)

There is clear perf/watt parity (if not to say, AMD is ahead) and that despite inferior fabs. ("stuck on 28nm we learned to do many tricks" was AMD's explanation)

Server chips look like we are in "wipes the floor" area, with some bonus features such as on the fly AES encryption of mem (apparently came from consoles)

Yet people speak about them as if they were somehow flawed.

When applied to 1060 vs 480 gaming benches show that quite a bit of gaming performance gap has to do with nvidia's drivers. (I don't mean that nvidia did that on purpose, it's just buldozers were so far behind nobody cared.)

But you're right about one thing: that investing is a gamble for most people. Surely, if can't be otherwise if people decide to buy AMD stock based on Ryzen benchmarks...

In some countries, it's a bit more challenging, though.

Where I live (Poland, but true for most of Eastern Europe) investing in stock indexes is fairly pointless (they're very risky and usually nowhere near as profitable as SP500).

At this point I'm at 80% in funds (with avg return 8% yearly) - slightly below S&P (and even below the polish Stock Exchange), but a lot safer.

The rest is a fairly small number of stocks (currently 4) that I check on a weekly basis. So on one hand: it kind of works. Historically I'm at around 30% yearly (much better lately). But it does cost me around 10 hours a month. :/

Going back to AMD, I think quite a lot of investors are pretty naive... This discussion is a good example of the problem.

Let's just forget about those that buy AMD because they like the company (nothing to add here...).

We see comments that sales of Ryzen will get the stock to $20 or more... Well, earlier this year it got to $15 based on hopes that - after few months - seemed fairly optimistic.

Also the profit margin on Ryzen is still a great mystery...

The Q1 results were somehow disappointing on both revenue and profit - investors expected better figures after 1 month of Ryzen sales (which includes pre-orders).

For me the biggest problem with AMD is that there's no dividend. Possibly the best thing about investing in US is that almost all large companies share their earnings - often on a quarterly basis (which is almost unheard of in most countries).

AFAIR they said all earning are invested into further R&D.

And this would make total sense. AMD's business model is all about making a big BANG every few years, not stable financial results (like Intel/Nvidia). So paying a dividend would be fairly pointless anyway.

The loser writes a limerick praising the company who's stock won.

Pff. I'm ready to bet that Intel's stock will go up and AMD's will drop. You can up the ante if you wish. ;)

I would bet you quite a lot that Intel will drop within a year, and AMD will be above $15 within 1.5 years. But before we bet, I want to make sure I am not taking money from a 12-year old.

Why do you think Intel is undervalued? I actually want to hear what your supporting arguments are. You really don't seem to get how much AMD has an Architectural advantage over Intel right now...