Friday, May 26th 2017

Rosenblatt Securities: "Buy" Rating to AMD Stock, "Sell" for Intel

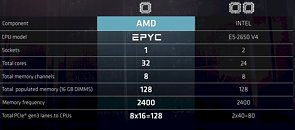

On the back of impressive performance, yield, and cost metric for AMD's market-warping Ryzen and server-shaking EPYC processors, securities firm Rosenblatt Securities' Hans Mosesmann has affirmed a "Buy" rating for AMD's stock, while saddling Intel with a seldom-seen "Sell". All in all, there have been a number of changes in Intel's market ratings; there seems to be a downgrade trend towards either "Hold" or "Sell" scenarios compared to the usual "Buy" ratings given by hedge funds and financial analysts - ratings which are undoubtedly affected (at least in part) by AMD's Ryzen and EPYC execution.Rosenblatt Securities' move stands mainly on two factors: AMD's EPYC single and dual-socket outlooks, with higher core-count and PCIe lanes in their single-socket offerings compared to Intel's dual-socket Xeon, with "half the area, big memory bandwidth and I/O advantages for EPYC." AMD's single-socket is expected to offer around 30% savings in total cost over a comparable Intel dual-socket platform. Mosesmann also mentions Ryzen's wins in die-area compared to Intel (with Ryzen being up to 10% smaller than Intel's platform. Additional news (well, more like rumors at this point, but analysts may have more information than we do) on Ryzen's yields beating expectations, at over 80% for fully-functional 8-core dies, also served to shake this recommendation. This speaks to AMD's current momentum in the high-performance x86 market. Hands and hats down to AMD, Jim Keller and his team, as well as to Lisa Su's leadership, for this momentous fight-back, clawing their way to relevance again.

Sources:

Barrons, NASDAQ, American banking News, SportsPerspectives, NextPlatform, EETimes, Bits and Chips

59 Comments on Rosenblatt Securities: "Buy" Rating to AMD Stock, "Sell" for Intel

Intel's stock is going down at the moment and I would stick to this as an indicator. I'm sure it will go up again since that's how stock market works. Up and downs but up for Intel within month is a huge exaggeration.

Intel is a juggernaut and while doesn't automatically mean better products, it means they can and will respond to anything (a few illegal discounts were all it took for them to stave off Athlon64, then they unleashed Core and AMD was left to recover for a decade). Maintaining a competitive advantage against intel requires threading very, very carefully.

I'm hoping AMD has learned its lessons this time, but they're still the one fighting uphill.

Why do you want to wait for the launch?

It's not like we'll be surprised by the performance. It's just two 8-core Ryzens glued together, so it's upper limited.Pfff. If I wanted to bet money on this, I'd just buy an option.

But we can drop the limerick idea, if you feel better with other form of poetry. :-)Fundamentals, mostly. :)

I know financial statements aren't as fun to read as CPU reviews, but they tend to give a better stock forecast. :P

If not, you should shut up. This argument always makes me laugh. Money is incredibly important.

But you know what is more important than money? Time.

It will take time for Intel to design a new arch from the ground up (One that likely utilizes a CCX-ish setup). All the money in the world will not buy a new arch in 1 month. Only a handful of genius can even design this stuff buddy.

There is a very good reason why weather forecasts are good up to 2-3 days.

But stocks? Stocks are simple as long as you can live with the volatility. Again, in case of companies like Intel: large, stable, paying dividend and with high physical assets, this is less of a problem. Intel has huge potential, huge R&D and huge free cash. You look at their balance sheet and it's pretty much perfect.

AMD is all about the know-how, as fixed capital is tiny (much like any form of diversification). There's not much to value beside future expectations.

For people that don't like balance sheets and boring valuation, here are some pretty graphs: :-)

simplywall.st/compare/NasdaqGS:INTC-NasdaqCM:AMD

2 most important things to look at: share price vs expected future cashflows and balance sheet structure.

Intel is priced below cashflows, so it's expected to grow, if nothing extraordinary happens.

AMD is priced WAY above cashflows, so investors already expect a big change in sales and profit margin. It's being verified by reality.

Keep in mind that lately AMD stock is growing on rumors and goes down on actual data (e.g. first Ryzen benchmarks, 2017Q1 results etc).Threadripper is not a server CPU...

You're way to concentrated on "playing stock" (why not analyze instead of playing? :)).

Sure, there are many variables, but it's still just a dynamical system. It can be analyzed, quantified and forecasted just like anything else.

Stock investing is not easy, but it's still just a job: people can be trained to do it - just like they're trained to make pasta or design CPUs.

So going back to the Intel/AMD thing.

In a very general case, you have 3 components of a price time series: a background (general market or segment condition), fundamental trend of the company and noise coming from trading.

1) Unless you're interested in day-trading, you want to exclude the "noise" part (and you learn how to do that during your math studies).

2) Then there's the backgound. Intel and AMD make similar products, are registered in the same country and are listed on the same stock market. The key difference is in manufacturing. Intel makes their chips and it's mostly done in USA (a bit in Israel). AMD outsources production to companies outside US (Germany and Taiwan) - this sometimes can have an effect on the stock, but nothing dramatic.

3) And now we get to the trend. Honestly, there are many ways to analyze this (fundamental and technical), but this is simply the value of the company, i.e. a present value (PV) of future cashflows.

If you look at the simplywall.st link I've posted earlier, you'll see that AMD is priced well above PV at this point. In other words: it'll need something extraordinary to reach these expectations (e.g. getting +10% market share in server CPUs). This may happen or not. Personally, I try not to bet my saving on "may happen", so I'd at least wait until they release Naples and it delivers what they promised.

Also think about scale. AMD and Intel fight for the same amound of sales in CPU markets. But since Intel is 15x larger, the price changes will be 15x smaller (more or less).

Looking at the last year (since June 2016) Intel is +14%, AMD is +160%. Without Zen hype, Intel stock could get to +20%, but this was still a great year for Intel investors, as they're "just" +44% over last 5 years.

As an investor I'm simply not ready to take the risk of buying AMD at this point.

If Naples performs under expectations (in sales, not in benchmarks), the stock will go down by maybe 20%.

If total Zen sales (including consumer stuff) are poor, the stock could be down 50% or more.

Just think about the scenarios that could make Intel stock drop by 50%: III World War, end of Internet, proof that semiconductors cause unwanted pregnancy, AMD CPUs work without power supply.

I can live with that. ;-)