Friday, July 7th 2017

Cryptocurrency Mining Consumes More Power Than 17M Population Country

So, yes, the headline is accurate. We all know that cryptocurrency mining has now reached an all time high, which has affected availability and pricing of most graphics cards from both AMD and NVIDIA. Who doesn't want to make a quick buck here and there? So long as it's profitable, right?

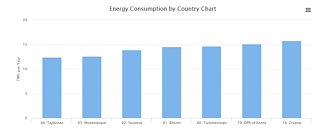

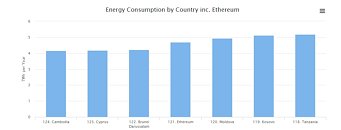

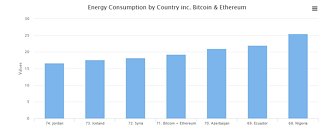

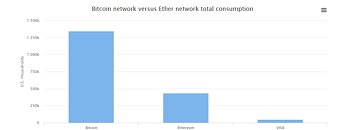

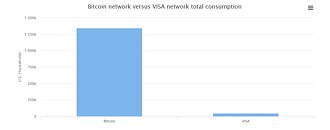

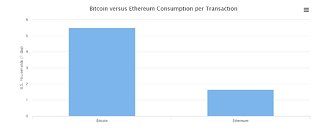

Well, that kind of thinking has already brought the global mining power consumption to unprecedented levels (some might also say demented.) The two top cryptocurrencies right now (by market-cap), Bitcoin and Ethereum, are each responsible for 14.54 TWh and 4.69 TWh power consumption figures. As of now, Ethereum consumes almost as much power as the 120th most power-consuming country, Moldova, which has a population of around 3 million. Bitcoin, on the other hand, stands at 81st on the list, in-between Mozambique and Turkmenistan, the latter of which has a population estimated at 5.17 million people. Combined, Ethereum and Bitcoin consume more power than Syria, which had an estimated 2014 population above 17 million.Ethereum mining consumes more than 8x the power it takes to run the entire VISA network, while Bitcoin consumes almost 27x as much (this shows how much more efficient centralized systems are. This is the cost of transparency and doing away with the trusted third party.) Cryptocurrencies and the blockchain technology in general have come to stay, and they will change the world (I am a staunch believer in that myself.) However, this goes to show that the current Proof of Work (PoW) design is unfeasible in the long-run - especially if blockchain technology does want to achieve a global scale. Proof of Stake anyone?

Sources:

Digiconomist, ETeknix, Moldova Wiki, Turkmenistan Wiki

Well, that kind of thinking has already brought the global mining power consumption to unprecedented levels (some might also say demented.) The two top cryptocurrencies right now (by market-cap), Bitcoin and Ethereum, are each responsible for 14.54 TWh and 4.69 TWh power consumption figures. As of now, Ethereum consumes almost as much power as the 120th most power-consuming country, Moldova, which has a population of around 3 million. Bitcoin, on the other hand, stands at 81st on the list, in-between Mozambique and Turkmenistan, the latter of which has a population estimated at 5.17 million people. Combined, Ethereum and Bitcoin consume more power than Syria, which had an estimated 2014 population above 17 million.Ethereum mining consumes more than 8x the power it takes to run the entire VISA network, while Bitcoin consumes almost 27x as much (this shows how much more efficient centralized systems are. This is the cost of transparency and doing away with the trusted third party.) Cryptocurrencies and the blockchain technology in general have come to stay, and they will change the world (I am a staunch believer in that myself.) However, this goes to show that the current Proof of Work (PoW) design is unfeasible in the long-run - especially if blockchain technology does want to achieve a global scale. Proof of Stake anyone?

101 Comments on Cryptocurrency Mining Consumes More Power Than 17M Population Country

None of these decentralized blockchain based cryptocurrencies are scalable, both in terms of transaction count, processing speed and reliability, and in terms of energy consumtion. To apply a misused word, they simply are not sustainable in the long run as currencies. Bitcoin was originally intended to be a currency "no one" could manipulate or speculate in, instead it has become nearly a pure speculation object which none of the qualities of a currency. It's never going to be fast and reliable enough for people to use as a currency in stores, coffee shops, etc.Yes, all the lefties using ideology to argue for cryptocurrencies have never looked at the sustainability of such systems. There is not enough energy in the world to make it an universal currency.

Not that it really matters. An organization could proliferate the market with machines so they become trusted then use those very same machines to destroy the blocks they come in contact with. The damage can be so widespread and prolific that legitimate nodes won't be able to distinguish the correct transactions from the destructive transactions. Think of it as a cryptocurrency black hole that grows until the entire currency is swallowed. Because there's no centralization, there's no way to stop that ball rolling once it is set in motion.

Once a cryptocurrency unit is captured and destroyed, it's gone forever. This would increase the value of exiting units initially but greed would quickly turn to fear and the value would plummet to virtually nothing. The currency is effectively dead.Actually, I suspect the opposite is true: only a small fraction of TPU users are mining and of those, most are only doing it casually.

What survey? Digieconomics isn't a surveying organization, it's an analytics organization.And extremely effective. If a country bans cryptocurrencies, they would have to be traded in a country that accepts them. Then they'd have to trade whatever currency they trade in for the currency of the country that you live in. Any country that facilitates that exchange is going to want to take a cut off the top (read: taxes and fees).

Either way, you should read my recent editorial. I think you'd find my views on the present landscape surprising.I said "everyone mining," not implying that most here mine, only that none mine bitcoin direct here and thus would never be counted.Blockchains are not really inherently inefficient, it comes down to node count. Reducing it helps loads, exponentially really, thus my proposal in my editorial.

It was never supposed to make you rich, just pay the energy bill.

Oh, and "lefties" made me chuckle. Crypto is more like the libertarian frontier, my good man. It's as far from left as you can get.

Any blockchain payment technology is ultimately doomed, but cryptography certainly will be a part of the solution to online payment. Many banks have recently started using some kind of token system for two-factor authentication, usually with some 6-8 digit codes, these systems are not cryptographically secure. Many banks also use some kind of chip-and-pin system, which actually opens up the card to remote exploits, and since all such systems can easily be bypassed using their fallback mode, they are just a type of false security. Google, Apple, Facebook, etc. and many banks have their own online/mobile payment systems. But we are still in the early days of this technology, and there are still no widely adapted secure standards. A secure solution would have to include some public/private key encryption with signing of banks, similar to how SSL works.

Actually, it's looking into being done:

www.google.com/search?q=government+blockchain&ie=utf-8&oe=utf-8

"Raped" by mining. I'm glad people like you think so. Then there's less competition for me looking to score a killer deal on a used graphics card being sold at a massive loss by a miner just looking to get a little quick cash for something he no longer has any use for. So yeah. Don't buy second-hand graphics cards that have been used at all for mining. No matter how cheap they are. They're no longer good for anything. Avoid them at all costs. Please do. At least until I've bought all the ones I want. ;)

BTC value lies in the fact that you can use is in online stores and this can be easily blocked.

When that happens BTC will drop to a couple USD and the whole mining phenomenon will be over in matter of days.

"Taking things with it" - like what?

BTC is not very well utilized. It's not important. It has advantages, but nothing fantastic - nothing we can't live without.

Think about PayPal - a giant when it comes to online payments. And what would happen if PayPal suddenly vanished? Pretty much nothing, maybe just a small shock at first.

We don't need cryptocurrencies. Of course they are very useful, so they will stay in our lives, but the ones we have today (like BTC) simply create way too many problems.

One of bitcoin aims (if not the most important one) was to popularize the idea of blockchain. And it succeeded for sure - soon blockchain will become an important idea of many systems (not just in finance). But open cryptocurrencies mined with private GPUs? Oh come on.