Friday, July 7th 2017

Cryptocurrency Mining Consumes More Power Than 17M Population Country

So, yes, the headline is accurate. We all know that cryptocurrency mining has now reached an all time high, which has affected availability and pricing of most graphics cards from both AMD and NVIDIA. Who doesn't want to make a quick buck here and there? So long as it's profitable, right?

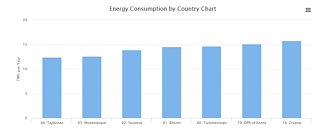

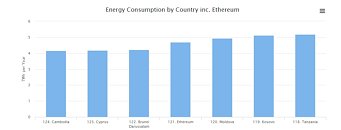

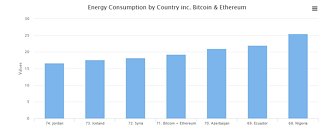

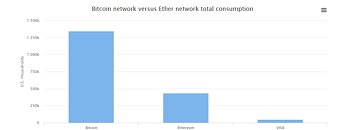

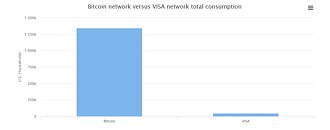

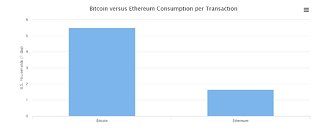

Well, that kind of thinking has already brought the global mining power consumption to unprecedented levels (some might also say demented.) The two top cryptocurrencies right now (by market-cap), Bitcoin and Ethereum, are each responsible for 14.54 TWh and 4.69 TWh power consumption figures. As of now, Ethereum consumes almost as much power as the 120th most power-consuming country, Moldova, which has a population of around 3 million. Bitcoin, on the other hand, stands at 81st on the list, in-between Mozambique and Turkmenistan, the latter of which has a population estimated at 5.17 million people. Combined, Ethereum and Bitcoin consume more power than Syria, which had an estimated 2014 population above 17 million.Ethereum mining consumes more than 8x the power it takes to run the entire VISA network, while Bitcoin consumes almost 27x as much (this shows how much more efficient centralized systems are. This is the cost of transparency and doing away with the trusted third party.) Cryptocurrencies and the blockchain technology in general have come to stay, and they will change the world (I am a staunch believer in that myself.) However, this goes to show that the current Proof of Work (PoW) design is unfeasible in the long-run - especially if blockchain technology does want to achieve a global scale. Proof of Stake anyone?

Sources:

Digiconomist, ETeknix, Moldova Wiki, Turkmenistan Wiki

Well, that kind of thinking has already brought the global mining power consumption to unprecedented levels (some might also say demented.) The two top cryptocurrencies right now (by market-cap), Bitcoin and Ethereum, are each responsible for 14.54 TWh and 4.69 TWh power consumption figures. As of now, Ethereum consumes almost as much power as the 120th most power-consuming country, Moldova, which has a population of around 3 million. Bitcoin, on the other hand, stands at 81st on the list, in-between Mozambique and Turkmenistan, the latter of which has a population estimated at 5.17 million people. Combined, Ethereum and Bitcoin consume more power than Syria, which had an estimated 2014 population above 17 million.Ethereum mining consumes more than 8x the power it takes to run the entire VISA network, while Bitcoin consumes almost 27x as much (this shows how much more efficient centralized systems are. This is the cost of transparency and doing away with the trusted third party.) Cryptocurrencies and the blockchain technology in general have come to stay, and they will change the world (I am a staunch believer in that myself.) However, this goes to show that the current Proof of Work (PoW) design is unfeasible in the long-run - especially if blockchain technology does want to achieve a global scale. Proof of Stake anyone?

101 Comments on Cryptocurrency Mining Consumes More Power Than 17M Population Country

totalbitcoin.org/bitcoin-legal-tender-japan/

Cough

I have to admit that I didn't have enough time to read the actual document (is it even available in English?). I only went through some interpretations and they didn't say that BTC becomes a legal tender, but just a legal methods of payment. This is a totally different thing. But I'll have to check that to be sure.

Other things described in this article are in line with what I've read earlier and... to be honest, I don't fully understand why are you so happy about this act. It's against everything you seem to like about BTC.

1) This act creates something called a "virtual currency", which is neither a real currency nor an electronic payment system. In fact it inherits most properties from commodities, so it's a de facto commodity - like in most other countries already.

2) Where Japan's act differs from those in other countries, is that it is very strict.

It requires bitcoin-trading organizations to fulfill the same requirements that commodity exchanges have to. This includes regular reporting, auditing, robust IT systems, implementing many regulations - generally speaking a proper corporate structure that e.g. a bank has. It also means that the exchange has to store and - if asked - report to the authority all information on transactions (also naming the parties!).

Before this, a few IT guys were able to run a BTC exchange. Now this exchange will have to employ a 100 people just to make it legal. Will this still be profitable? Will anyone - apart from large financial institutions - be able to run a BTC exchange?

3) The act also changes the requirements for traders - that's you. You can still mine cryptocurrencies freely, but to exchange them for money in Japan you have to legalize your activity, i.e. sign a contract with a broker.

Checks are instructions to banks to exchange funds on your behalf.Reasons not to blockchain:

-computational cost is astronomical/inefficient

-nodes can still exploit the network fabricating debts for illgotten profit

-there's no authority to fix a problem. Case in point, if a vulnerability is discovered in Bitcoin's hashing algorithms (e.g. a collision), the entire chain will come crashing down.

-Bitcoin only handles maybe a quarter million transactions per day: a country like the USA has billions. Centralization means conservation of resources--no more redundancy in the system than is necessary.

-Looking at the statistics, it almost appears that doing more than a quarter million transactions per day is impossible because of the amount of overhead required to accomplish it.

TL;DR: Blockchains only work in confined situations where distributing a database is preferable to maintaining one--where the costs of creating an authority outweigh the needs of the project. If the project grows too much, blockchains become a liability.

Edit: ~$25/transaction right now. That's very expensive.

Edit: Similar list (and far more thorough) to what I compiled above: letstalkpayments.com/the-cost-of-saving-the-world-with-blockchain/

Many countries in the world are already preparing for cashless reality.

I'm not surprised at all that Japan is the first country with solid bitcoin regulation. They were always leading the electronic payment innovation and implementation.It doesn't have to be. Current cryptocurrencies are designed this way, but it's not a must.What exactly do you mean?Again, this is stemming from how bitcoin is designed. A closed, bank-run blockchain doesn't have such issues. Only the bank will do hashing.But you're talking about issues of Bitcoin, not blockchain in general.

This can be all addressed by a more specialized, well-designed blockchain solution.

Also keep in mind that even without blockchain the financial system is very demanding computation-wise. Blockchain is not going to be an addition. It will replace some currentlu used technologies.

On the other hand, we have to remember, frankly, banking technology hasn't evolved much during the last decade.

Compare today to the pre-crisis times in 2007. There are not many more humans (+15%) and they have similar financial needs. The number of traded stocks and other financial instruments didn't grow either. The instruments are not getting more complicated and 10 years ago we already had things like high speed algorithmic trading.

So what has changed? The computers did: they're 20-30 times faster.

Also don't worry about profitability of this idea. People mining at home are often not rational. They can't forecast properly, they can't estimate risk - financial institutions can.

Most of US transactions do occur cashlessly.It does because it's peer-to-peer. Cryptography is what creates the "trust" mechanisms.51% attack. Fool the network into believing your data is legitimate and it has no way of knowing differently.Again, peer-to-peer. If banks are going to be doing it exclusively then there's absolutely no reason to blockchain in the first place. Blockchains are just decentralized databases.No, cryptocurrencies add a crapload of computational and network overhead compared to traditional databases. There's no getting around that fact.Never took accounting classes? Financial transaction systems are very foundationally simple. Right now, it really boils down to five data points: source routing number, source account number, destination routing number, destination account number, amount. At each bank, it's a simple floating point addition or subtraction. This is why it is not difficult for banks to process billions of these transactions in a day. It really requires very little in terms of hardware. There's also hardware out there specifically designed to process these kinds of transactions in databases (e.g. SPARC).

I think you're generally thinking too much about financial applications - they're fairly difficult to understand.

There are many initiatives to use blockchain in logistics. Example:

www-03.ibm.com/press/us/en/pressrelease/51712.wssI assure you it's not that simple. There's a lot more to accounting systems than just tracking how much money is on a particular account.

And of course I didn't take any accounting classes. Accounting is pretty boring. :-D

From what I'm reading from you Ford, you need to seriously advance your understanding of how this works before debating further. No offense meant. You raised some good philosophical issues of which I even conceeded to a few, but your technical understanding of blockchain appears more driven by bias than knowledge.

In particular, I suggest you study proof of work and diffilculty, which is where the vast exponential majority of energy goes (and ironically, has almost nothing to do with validating transactions, and so could be removed).

EDIT: Or are you assuming ford someone breaches the mining network and floods it with hashrate to 51% it? Unlikely, given it is probably IPSEC'd if not airgapped.

Checks work the same way (they have faith in you that the check won't bounce). If it bounces, they can use the information on the check to get what their owed.Consumers have a right to privacy. Decentralized databases are not fast. Near instant transfers can already be accomplished via ACHs but we choose not to for buyer and seller protection.You're pushing for a software solution to a problem that addressed by many moving parts (namely, there's a lot of people involved in the financial industry).Banks are always looking for ways to increase profit (cut costs). Of course they're going to take a look at it. Doesn't mean it will go beyond prototyping or be confined to minor networks like ATMs....or the software that runs on all of them. Or the hardware. Or the kernel. The smaller the network, the more vulnerable it is. Still makes more sense to have eight traditional databases that update each other. You know, like the fed already does.

I'm getting the distinct impression neither of you looked at that link I gave you. TL;DR: blockchain will not be used for financial transactions in the USA any time soon, if ever.

Oh, and the power grid... heh:

en.wikipedia.org/wiki/Northeast_blackout_of_2003

Not entirely relevant, but good reading.

And I don't understand why you mention privacy. Blockchain (distributed database) won't change anything from how this works currently (i.e. on local databases).It's already being implemented in industry (it can be used in basically any system where something is moving between parties). It will take longer for banks because of all the regulation, but it's almost inevitable.

TL;DR: banks are causing the delays, not ACH itself.The local databases aren't transparent. They're behind lock and key only subject to view of a very limited number of people.

This article states that 1-2 days are considered fast, 3-4 is slow.

I have to say: the times mentioned here are just sad. A transfer between different countries in Europe used to take 2 days for a while now. A transfer to the same country is under 1 day - even few hours if you do it in the morning.

Later this year a new system for transfers within EU is expected to launch (SEPA, covering few non-EU countries as well). It will offer instant transfers (10 seconds), but full clearance will still take a bit more. Similar systems already exist in particular countries. In Poland an "express transfer" takes under 15 minutes and is works 24/7 (unlike Mon-Fri for normal transfers). But there is a premium for this, while normal "1-day" transfers usually are free.

You can easily identify fast transfer systems that don't do full clearance within the transfer time: they have low upper limits for the payment amount. :-)

Before state-organized fast transfers were launched in Poland, there was even a private company offering such a product. How? Intra-bank transfers are instant, so it had an account in each major bank with a significant sum of money (~$250k) and money went through them. It wasn't perfect, but still a very nice concept. :-)And so will be the blockchain-based system. What exactly don't you understand? :-)

Or this could be because of cheques, i.e. because they take so long to confirm, banks slow down the electronic transfers as well. Otherwise a bank that sends transfers "physically" would have an advantage.

Once again: in Europe transfers used to take a day, often less. It's most likely similar in other developed areas.A side note: it does look a bit like if you were advocating ACH in this discussion - even though the whole transfer system in US clearly seems fairly outdated and ineffective.. Why is that? You've written some of the code or what? :-P

Because you're quite happy with bashing banks, so it's clearly not a general fondness for the financial sector. :DIt's not the whole database from banks' point of view. It's just the part about transactions. It can't, for example, allow an identification of a client - this will only be possible in the bank that operates this client's account.Most likely not. My impression is that a lot of home-miners can't calculate the expected profit properly. They, so to speak, go with the flow.Of course it has: speed, transparency, potentially lower maintenance cost - things like that hold. They're even improved by closing the blockchain, since it can use simpler hashing algorithms.

ACH could clear transactions much faster but the delay is intentional....which every check points directly at (routing and account number). In other words, you hand a check to someone, you're also handing them everything they need to find every blockchain-recorded transaction you've ever made.Local databases are much faster than distributed databases. Transparency violates privacy. Maintenance is only lower cost if it is being farmed out to someone else (in which case, the cost is hidden and still not cheaper).

I don't get your logic. Can you give an example of a situation where this becomes important?No, because my name is not in the blockchain. There are only some IDs that just the bank can translate.

I think you still misunderstand how this works. Bank-created blockchain will not be available to me to pay for, for example, Steam games. The thing we're talking about now is just for inter-bank transfers. It's replacing one technology with another.

If banks decide to make a blockchain for clients, it'll work just like bitcoin - with all its pros and cons - apart of one: it'll have a stable value (most likely a constant one).Maintenance will be lower because this will be a cooperation of banks, so the cost will spread. Also there will be no additional cost of the interface. Today banks pay the "transfer hubs" (like ACH in your case). With blockchain they won't have to.

BTW: just from a rational POV - if you're right and distributed ledger has no advantages and won't reduce cost, why are banks so interested?

Why is this happening? en.wikipedia.org/wiki/R3_(company)

Any theory?

TL;DR: Bank/credit union ledgers shouldn't be distributed.

Debit card has multiple security measures: PIN, SMS password, transaction limit.

In EU your liability for use of stolen card (or another electronic payment device) is limited to 150 EUR (50 EUR for contactless operations). Of course this is for the period before you report you lost the card.

You can also get insurance that will cover these 150 EUR. This is an awful bad idea, but banks usually force you to buy it anyway. It costs around 0.5 EUR/month in Poland.But this will only be possible to check from inside your bank and by a limited group of employees. It's exactly the same today.Null value? :-/

You're still looking at this from perspective of mining bitcoin. This is a totally different thing. This will be an inter-bank transaction unit. No mining, no speculation, no variability in value.www.coindesk.com/goldman-sachs-leaves-r3cev/

"According to The Wall Street Journal, the bank has left the group, but notably intends to continue developing blockchain projects on its own. (Goldman Sachs is an investor in blockchain technology startups Circle and Digital Asset Holdings)."

I think you really don't get the concept. And you clearly have a huge fondness for cheques and ACH. Let's end this here - the dialog is getting boring by now.