Friday, July 7th 2017

Cryptocurrency Mining Consumes More Power Than 17M Population Country

So, yes, the headline is accurate. We all know that cryptocurrency mining has now reached an all time high, which has affected availability and pricing of most graphics cards from both AMD and NVIDIA. Who doesn't want to make a quick buck here and there? So long as it's profitable, right?

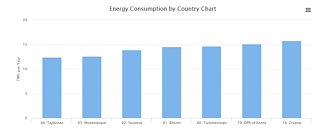

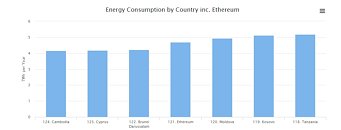

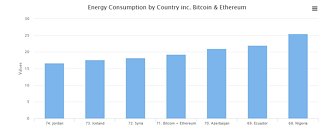

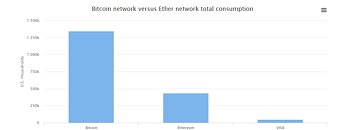

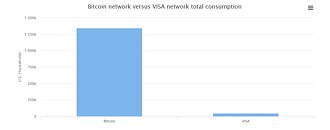

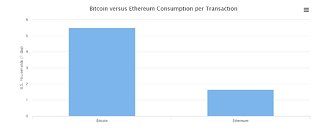

Well, that kind of thinking has already brought the global mining power consumption to unprecedented levels (some might also say demented.) The two top cryptocurrencies right now (by market-cap), Bitcoin and Ethereum, are each responsible for 14.54 TWh and 4.69 TWh power consumption figures. As of now, Ethereum consumes almost as much power as the 120th most power-consuming country, Moldova, which has a population of around 3 million. Bitcoin, on the other hand, stands at 81st on the list, in-between Mozambique and Turkmenistan, the latter of which has a population estimated at 5.17 million people. Combined, Ethereum and Bitcoin consume more power than Syria, which had an estimated 2014 population above 17 million.Ethereum mining consumes more than 8x the power it takes to run the entire VISA network, while Bitcoin consumes almost 27x as much (this shows how much more efficient centralized systems are. This is the cost of transparency and doing away with the trusted third party.) Cryptocurrencies and the blockchain technology in general have come to stay, and they will change the world (I am a staunch believer in that myself.) However, this goes to show that the current Proof of Work (PoW) design is unfeasible in the long-run - especially if blockchain technology does want to achieve a global scale. Proof of Stake anyone?

Sources:

Digiconomist, ETeknix, Moldova Wiki, Turkmenistan Wiki

Well, that kind of thinking has already brought the global mining power consumption to unprecedented levels (some might also say demented.) The two top cryptocurrencies right now (by market-cap), Bitcoin and Ethereum, are each responsible for 14.54 TWh and 4.69 TWh power consumption figures. As of now, Ethereum consumes almost as much power as the 120th most power-consuming country, Moldova, which has a population of around 3 million. Bitcoin, on the other hand, stands at 81st on the list, in-between Mozambique and Turkmenistan, the latter of which has a population estimated at 5.17 million people. Combined, Ethereum and Bitcoin consume more power than Syria, which had an estimated 2014 population above 17 million.Ethereum mining consumes more than 8x the power it takes to run the entire VISA network, while Bitcoin consumes almost 27x as much (this shows how much more efficient centralized systems are. This is the cost of transparency and doing away with the trusted third party.) Cryptocurrencies and the blockchain technology in general have come to stay, and they will change the world (I am a staunch believer in that myself.) However, this goes to show that the current Proof of Work (PoW) design is unfeasible in the long-run - especially if blockchain technology does want to achieve a global scale. Proof of Stake anyone?

101 Comments on Cryptocurrency Mining Consumes More Power Than 17M Population Country

I buy my cards on forums when I buy used cards.

Just proves how completely stupid this all is now doesnt it.

Dont get me wrong its sorta cool and shit but its going to get out of hand if it hasnt already and shits going to hit the fan.

Sure, you don't have to write how the card was used in your sale offers. But will you reveal that to the buyer if he asks?

It can be called an "alternative currency", but that doesn't change the fact that when you use BTC in a transaction, you're not actually paying for a product (like you would with money), but you're exchanging products, like you would in a barter.

No offense, but this is not our first discussion about cryptocurrencies and each time I get the impression that you've never really bothered to learn something about the concept. Why is that?

You setup rigs, you check the cashflows and as long as it seems profitable, you're fine. If money stops, you'll quit. Simple as that, right? :)

I have done enough research into what bitcoin mining is and how it works and furthermore I am not mining bitcoin I am mining other cryptoCURRENCY.

Legal tender has a very specific scope in law where currency is a more broad, casual word. Case in point: Monopoly comes with currency but it is not legal tender.

I used Bitcoin in the example above because it is the most prominent. Can substitute any cryptocurrency in there.

www.irs.gov/uac/newsroom/irs-virtual-currency-guidance

Also, bitcoin doesn't fulfill the requirements to be a currency (as it is usually defined). There are at least 3 big problems:

1) It's not commonly accepted and thus not easy to exchange (use).

I know you could argue with this and instantly give me 10 names of huge online stores that do, but that's not called "common acceptance". Try paying with BTC in a grocery store.

Far more sellers will accept a commodity like gold (and it doesn't make it a currency), many will prefer a simple barter.

2) Stemming from the above: BTC is not a stable store of value.

And I don't mean the (obvious) instability in time. I mean stability "in space", so to speak.

A widely accepted currency has similar value to everyone, but BTC doesn't. That is: if someone's needs are not covered by stores that accept BTC, he'll have to sell it to someone else first. And it might even be that he doesn't have a BTC wallet, so he'll have to create one. That's all additional cost, implying a lower value.

3) Bitcoin transactions are way to slow.

Blockchain is an excellent technology for things that today need long confirmation. For example if you're making a simple, ordinary bank transfer, it has to go through a very complicated system of confirmation and booking (it usually takes a day). Replacing that with bitcoin's 10 minutes would be a revolution.

But imagine paying with BTC in Walmart or for train tickets at the counter. That would be fun to watch.So you've done research on how a bitcoin is created and maintained - the technical stuff. It has nothing to do with how money works. Learning how dollar banknotes are printed doesn't tell you anything about what USD currency is.

And the fact that it has a "currency" in name doesn't make it a currency. I mean, it could also be written like this: CRYPTocurrency. So what?Bitcoin is legal in many countries, but it's not a legal tender. I'm also including the wiki link (like @FordGT90Concept did) in case you get bored with flashing mining BIOS etc. :pIt's not a currency in EU as well. It's either a commodity or a unidentified object. :)

The wiki article you've linked only mentions a ruling by a Court of Justice of the European Union. Two issues:

1) it's not a court in a way you're used to. It's an institution that interprets Union's law and rules whether state legislation is in line with it. It never ruled that BTC is a currency, nor it has this kind of competence (since EU law doesn't precisely say what cryptocurrency is). Also, EU doesn't use a common law system (like US or UK), so a court ruling does not become a law rule (no precedent).

2) EU is not a federal union like US. EU legislation is not automatically in effect in all member states - they have very high autonomy. Even if EU decided to name Bitcoin a currency, it would take years for member states to accept it. In fact even euro - the official currency of EU - is a legal tender in just 19 out of 28 member states.

Because every time you'll click "pay by transfer" and be taken to your bank website, the actual thing transfer will be a blockchain-based value. You'll see USD and the other party will see USD, but banks will see a "coin". And the transfer will be almost instant - similar to that of a credit card.

As for the cryptocurrencies we have today - I doubt they will ever be illegalized. And they won't become a legal tender either - surely not before they become a lot more stable (but how could that be forced?).

Making a stable, robust and easier to use alternative will kill bitcoin and all the smaller variants anyway.

Enjoy some light reading:

www.depositaccounts.com/blog/how-ach-transfers-work.htmlAgain, cryptocurrencies are solutions looking for a problem.

If I understand correctly, this is just a system for electronic transfers between banks and it's considered fast, because of how popular cheques are in US, right?

It's well known that Americans are very traditional when money and banking are concerned.*

You must remember that this is not how banking looks outside US. I think this is one of the reasons why bitcoin as a form of payment is not that impressive here.

But going back to how electronic transactions work and how blockchain can be useful.

Of course each bank has a different system for booking, so there are special institutions that provide the interface between them (I'll use the word "hub"). If I understand correctly, that's what Automated Clearinghouse Services is doing.

Thing is though, these transactions between banks are organized not in real time, but always in sessions (there are just some workarounds that can simulate real-time confirmation).

Blockchain could potentially replace this idea. It can provide secure transactions between banks in matter of seconds.

*) I've just opened a wiki page which states that cheques are still used for transaction between banks i.e. you make an electronic transfer to someone in another bank, but your bank actually prints a cheque and posts it. Weird.

I'm still fairly surprised by the slow adoption of chip cards and contact-less payments in US, but this cheque thing is just mind-blowing. :o