Wednesday, February 28th 2018

"Where Are My Graphics Cards?" - 3 Million Sold to Cryptocurrency Miners in 2017

The title of this piece is both question and answer, though users that keep up with PC-related news knew the answer already. Jon Peddie Research, in a new report, pegs the number of total graphics cards sold to miners at a pretty respectable 3 million units (worth some $776 million). That's some 3 million gamers that could be enjoying video games on their PCs right now, or which would be able to enjoy them at a much lower price that they had to recently pay to have the privilege.

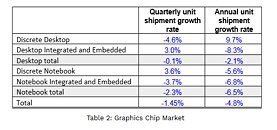

AMD has been the primary benefactor here - its GPU market share went up by 8.1%, while NVIDIA's dropped by 6% and Intel's by 1.9% (the fact that Intel's graphics processing units come embedded in the company's processors helps keep that number stable). As it is, attachment rates of GPUs to systems was over 100% at 136%, the result of miners buying more cards per system in an effort to maximize profits. Jon Peddie thinks that gaming will still be the key player to drive GPU sales, though "augmented by the demand from cryptocurrency miners." The firm also expects demand for GPUs to slacken, coeteris paribus, due to "increasing utilities costs and supply and demand forces that drive up AIB prices." However, for those looking for prices to drop before upgrading their system, the news aren't rosy: the article states that pricing will not drop in the foreseeable future, so owners of GPUs that can actually mine already are being encouraged to mine while not gaming, so as to try and offset the markups in the current GPU offerings.Overall GPU shipments in the fourth quarter of 2017 actually decreased 1.5% from the previous quarter, though JPR said that was due to normal seasonal activity. But even with miners' help to drive sales, overall GPU market shipments declined 4.8 percent - the only actual positive trend in that market were the actual discrete desktop GPUs.Some key highlights JPR calls attention to are as follows:

Sources:

JPR, via PC Gamer

AMD has been the primary benefactor here - its GPU market share went up by 8.1%, while NVIDIA's dropped by 6% and Intel's by 1.9% (the fact that Intel's graphics processing units come embedded in the company's processors helps keep that number stable). As it is, attachment rates of GPUs to systems was over 100% at 136%, the result of miners buying more cards per system in an effort to maximize profits. Jon Peddie thinks that gaming will still be the key player to drive GPU sales, though "augmented by the demand from cryptocurrency miners." The firm also expects demand for GPUs to slacken, coeteris paribus, due to "increasing utilities costs and supply and demand forces that drive up AIB prices." However, for those looking for prices to drop before upgrading their system, the news aren't rosy: the article states that pricing will not drop in the foreseeable future, so owners of GPUs that can actually mine already are being encouraged to mine while not gaming, so as to try and offset the markups in the current GPU offerings.Overall GPU shipments in the fourth quarter of 2017 actually decreased 1.5% from the previous quarter, though JPR said that was due to normal seasonal activity. But even with miners' help to drive sales, overall GPU market shipments declined 4.8 percent - the only actual positive trend in that market were the actual discrete desktop GPUs.Some key highlights JPR calls attention to are as follows:

- AMD's overall unit shipments increased 8.08% quarter-to-quarter, Intel's total shipments decreased -1.98% from last quarter, and Nvidia's decreased -6.00%.

- The attach rate of GPUs (includes integrated and discrete GPUs) to PCs for the quarter was 134% which was down -10.06% from last quarter.

- Discrete GPUs were in 36.88% of PCs, which is down -2.67%.

- The overall PC market increased 5.93% quarter-to-quarter, and decreased -0.15% year-to-year.

- Desktop graphics add-in boards (AIBs) that use discrete GPUs decreased -4.62% from last quarter.

- Q4'17 saw no change in tablet shipments from last quarter.

117 Comments on "Where Are My Graphics Cards?" - 3 Million Sold to Cryptocurrency Miners in 2017

And lol @ using a tweet as a source (of the PIRATE PARTY no less)... he obviously hasn't seen the fully staffed mining farms. They use more staff than an equivalent datacenter. This is bringing far more money into iceland than this guy will ever imagine...The payment network. That's the product.

If they pass the tax proposals for them (data miner) they will. If not they will continue to leach their green energy resources and cry about it later when they pack up and leave or their lease is up.Motherboard - One Bitcoin Transaction Now Uses as Much Energy as Your House in a Week

But here the payment network is self-feeding it's own business. When transactions slow (as perhaps a minor loss in value have people sit on it hoping it rebound) so do the folk working the transitions (less Bitcoins moving around). You see less return (harder to generate coin) to the point when cost to operate is not adding cryptocurrency and spiral even more.

Bitcoin issues at the same rate regardless of how many mine. Most cryptos operate that way.Sorry, it's not and never will be, no matter who does it. A random set of words does not make an actual researched position.You post that like I'm some kind of bitcoin advocate.

I've maintained bitcoin is a dying beast for a very long time.

Crypto mining keeps the network going, its like its own internet. Without the huge datacenters around the world there would be no internet.

I mean, really. I do.

Or the many many other viral challenge videos going around, I guess the newest one that the media is trying to popularize is the lemon challenge.

The world must know!

*source PCMagazine

30.1 Terrawatts (Energy used for Bitcon a year and growing)

*source WIRED

In 2010, I was using maybe 2 kilo/w per day of power, today I use 10-11.5 kilo/w per hour.

You can even toss in Facebook at 1.8 TWH for 2016 which combine with Google your talking about an estimated 70% of the internet traffic going through their services according to Newsweek article.

1.8 + 5.7 = 7.5 TwH - 30.1 = 22.6 TwH that 1 cryptocurrency (Just Bitcoin) is using over what Google & Facebook use who are responsible for 70% of the internets traffic.

Let that sink in...

I was being mostly ironic at any rate, as my main point was that humanity powers many useless things for CO2 and noone bats an eyelash until they suddenly lose something that means something to them (GPUs). That is a fact.

My miner uses 500W for fun. That is less than 10 lightbulbs. I was kind enough to compensate for my energy increase elsewhere and my bill actually dropped when I started mining.

Also a fact.I have mined when it was not profitable. I'll likely be doing it again soon. How exactly do you explain that one?Also lol @ this "fact." How does electricity usage = internet trafic. Simply a leap of logic there, and not a good one.

With facts like that, you sure have a lot of faith.

I've never denied bitcoin is an energy pig. I've actually said bitcoin needs to die on numerous occasions. Bitcoin is a prototype of what cryptocurrency has/can become, and not a good one either.