Thursday, October 25th 2018

Intel Reports Third-Quarter 2018 Financial Results

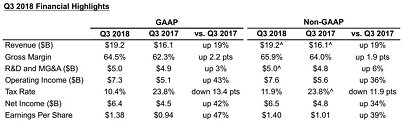

Intel Corporation today reported third-quarter 2018 financial results. Third-quarter revenue of $19.2 billion was an all-time record, up 19 percent YoY driven by broad business strength and customer preference for performance-leading products. The Client Computing Group (CCG), the Data Center Group (DCG), the Internet of Things Group (IOTG), the Non-volatile Memory Solutions Group (NSG) and Mobileye all achieved record revenue. Collectively, data-centric businesses grew 22 percent, led by 26 percent YoY growth in DCG. PC-centric revenue was up 16 percent on continued strength in the commercial and gaming segments. Excellent operating margin leverage and a lower tax rate drove record quarterly EPS.

"Stronger than expected customer demand across our PC and data-centric businesses continued in the third quarter. This drove record revenue and another raise to our full-year outlook, which is now up more than six billion dollars from our January expectations. We are thrilled that in a highly competitive market, customers continue to choose Intel," said Bob Swan, Intel CFO and Interim CEO. "In the fourth quarter, we remain focused on the challenge of supplying the incredible market demand for Intel products to support our customers' growth. We expect 2018 will be another record year for Intel, and our transformation positions us to win share in an expanded $300 billion total addressable market."In the third quarter, the company generated approximately $8.8 billion in cash from operations, paid dividends of $1.4 billion and used $2.7 billion to repurchase 50 million shares of stock.Business Unit Summary

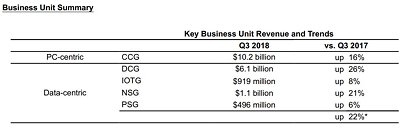

In the third quarter, Intel achieved growth in every business segment. The PC-centric business (CCG) delivered record revenue, up 16 percent on continued strong demand for Intel's performance-leading products and strength in commercial and gaming. CCG launched new U and Y-series 8th Gen Intel Core processors enabling faster connectivity speeds, better performance and longer battery life for thin, light laptops and 2 in 1 devices. We also recently introduced the Intel Core i9-9900K processor, the world's best gaming processor.

Collectively, Intel's data-centric businesses grew 22 percent YoY led by 26 percent growth in the Data Center Group (DCG). DCG achieved record quarterly revenue driven by strong demand from cloud and communications service providers investing to meet the explosive demand for data and to improve the performance of data-intensive workloads like artificial intelligence. In Q3, DCG shipped the first Intel Optane DC Persistent Memory for revenue, and Intel Xeon Scalable set 95 new performance world records as adoption continued.

The Internet of Things Group (IOTG) also achieved record revenue. Excluding Wind River, which Intel divested in the second quarter, IOTG revenue was up 19 percent YoY on broad business strength. Record revenue in Intel's memory business (NSG) was up 21 percent YoY.

Intel's Programmable Solutions Group (PSG) revenue grew 6 percent YoY with continued strength in the data center and strong organic growth. PSG expanded its product line with the acquisition of eASIC and the introduction of the new Intel Programmable Acceleration Card (PAC) with Intel Stratix 10 SX FPGA. Mobileye also achieved record quarterly revenue of $191 million, up approximately 50 percent YoY as customer momentum continued. Mobileye won 8 new design at major US and global automakers in Q3, bringing its year-todate design win total to 20.

Business Outlook

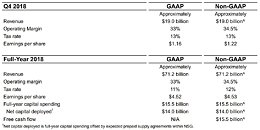

Intel's guidance for the fourth-quarter and full-year 2018 include both GAAP and non-GAAP estimates. Reconciliations between these GAAP and non-GAAP financial measures are included below.

Intel's Business Outlook does not include the potential impact of any business combinations, asset acquisitions, divestitures, strategic investments and other significant transactions that may be completed after October 25, 2018. Actual results may differ materially from Intel's Business Outlook as a result of, among other things, the factors described under "Forward-Looking Statements" below.

"Stronger than expected customer demand across our PC and data-centric businesses continued in the third quarter. This drove record revenue and another raise to our full-year outlook, which is now up more than six billion dollars from our January expectations. We are thrilled that in a highly competitive market, customers continue to choose Intel," said Bob Swan, Intel CFO and Interim CEO. "In the fourth quarter, we remain focused on the challenge of supplying the incredible market demand for Intel products to support our customers' growth. We expect 2018 will be another record year for Intel, and our transformation positions us to win share in an expanded $300 billion total addressable market."In the third quarter, the company generated approximately $8.8 billion in cash from operations, paid dividends of $1.4 billion and used $2.7 billion to repurchase 50 million shares of stock.Business Unit Summary

In the third quarter, Intel achieved growth in every business segment. The PC-centric business (CCG) delivered record revenue, up 16 percent on continued strong demand for Intel's performance-leading products and strength in commercial and gaming. CCG launched new U and Y-series 8th Gen Intel Core processors enabling faster connectivity speeds, better performance and longer battery life for thin, light laptops and 2 in 1 devices. We also recently introduced the Intel Core i9-9900K processor, the world's best gaming processor.

Collectively, Intel's data-centric businesses grew 22 percent YoY led by 26 percent growth in the Data Center Group (DCG). DCG achieved record quarterly revenue driven by strong demand from cloud and communications service providers investing to meet the explosive demand for data and to improve the performance of data-intensive workloads like artificial intelligence. In Q3, DCG shipped the first Intel Optane DC Persistent Memory for revenue, and Intel Xeon Scalable set 95 new performance world records as adoption continued.

The Internet of Things Group (IOTG) also achieved record revenue. Excluding Wind River, which Intel divested in the second quarter, IOTG revenue was up 19 percent YoY on broad business strength. Record revenue in Intel's memory business (NSG) was up 21 percent YoY.

Intel's Programmable Solutions Group (PSG) revenue grew 6 percent YoY with continued strength in the data center and strong organic growth. PSG expanded its product line with the acquisition of eASIC and the introduction of the new Intel Programmable Acceleration Card (PAC) with Intel Stratix 10 SX FPGA. Mobileye also achieved record quarterly revenue of $191 million, up approximately 50 percent YoY as customer momentum continued. Mobileye won 8 new design at major US and global automakers in Q3, bringing its year-todate design win total to 20.

Business Outlook

Intel's guidance for the fourth-quarter and full-year 2018 include both GAAP and non-GAAP estimates. Reconciliations between these GAAP and non-GAAP financial measures are included below.

Intel's Business Outlook does not include the potential impact of any business combinations, asset acquisitions, divestitures, strategic investments and other significant transactions that may be completed after October 25, 2018. Actual results may differ materially from Intel's Business Outlook as a result of, among other things, the factors described under "Forward-Looking Statements" below.

22 Comments on Intel Reports Third-Quarter 2018 Financial Results

Wintel can't be stopped, kids. Not anytime soon at least.

Even with AMD in their asses they keep doing records over records.

Ouch.

Even if AMD manages to claw away a good chunk of Intel's server share, it's not going to be hurting Intel a whole lot any time soon. I guess the good news is that there is plenty of business to go around.

You can't win against stupidity, even with excellent products offering vastly superior value and in some cases, performance. It's the Apple thing, basically. I've spoken to countless people IRL that won't even consider Ryzen, and they will blindly throw more money at an inferior Intel product - and example is someone buying an i3-8100 for twice the price of the Ryzen 3 2200G (intel CPU prices are insane ATM). Even with those prices 50% higher than MSRP, they are still selling like hot-cakes.

What gives? Is AMD's brand image still tainted by Bulldozer? Probably. I'm proud not to have an overpriced Intel CPU in my PC; I didn't pay the 'Intel Tax' and I got significantly more performance, features and upgradability. (show me an equal Intel product at £150 that represents better value - oh, and don't give me the whole "buh buh the i3 is faster in gaymez" thing, I don't just play games on my PC, and even if I did, the 2600 doesn't stutter like a Potato 8100 would). "Gamers" are the worst. They are literally stupid. Let's say 2700X gets 115FPS and 8700K gets 125fps: "RYZEN SUCKS FOR GAMING!" and "PLAYABILITY DOESN'T MATTER!" - true quote from someone I used to talk to online.

Ugh, sorry about the Rant.

tl;dr:

It's not an Apple thing btw. There's a stark difference in the poor price/performance ratio they offer compared to anything with Intel vs AMD. Apple is on absurd levels of gypping people.

If AMD doesn't get EPYC 2 flying of the shelves and into racks... it will be grim.AMD wasn't able to get 50% market share in both CPU and GPU space even when they had a vastly superior product. If the ignorance of the end user is not to blame, I don't know what is.

I would also like to see a lappy top with Zen/Vega/Navi and see how that does.

"We are thrilled that in a highly competitive market, customers continue to choose Intel"

When you have the dozens of times more money for marketing (even considering things like the case with PT) and you only hear to buy Intel - even if it has a marginal ~10-12% advantage in gaming with a high end card in FHD, a combination 99,9% of the high end GPU owners will never use, and on 1440P it narrows to 5-6% and on 4K it completely disappears; and anyway, when we take the most common combinations (1060-RX570/580 in FHD, 1070 with 1440P/FHD, 1080 in 1440P, 1080Ti in 4K/1440P, etc.), you usually get around zero performance jump with an Intel CPU against a Ryzen - that's the result. Same goes for GPU. There is a product against every NV card up until the 1080. Vega56 is able for the same price as the 1070 while being ~10% faster, around the 1070Ti. RX 570-580 is somewhat faster than the 1060 3-6GB while being cheaper and having more VRAM. NV driver quality have fallen in the past 2 years or so, while AMD got much better since the late Catalyst era - releasing drivers more frequently.

AMD had basically no publicity at all for years, monst people simply does not know AMD exists, let alone specific products like the FX-series.

And as for AMD sales, it will be up to OEMs to do the right thing. They are the ones to blame and not the typical consumer alone. These OEMs are the internal customers and they are the ones failing to make the right choices here. Hopefully they habe learned their lesson now after years of Intel insane prices, lack of innovation, and the current supply issues. In my opinion; as long as they create well built AMD machines, consumers will buy them just fine.Yes i second this. If anything; i am yet to meet a non computer enthusiast who knows anything about bulldozer or coffee lake or any cpu architecture for that matter

It's just a fact though that Intel is fine. They aren't going anywhere. People need to cope better.

In any case, I don't think I'm one of the people attached too strongly either way. I just think the doom n gloom crap surrounding Intel is retarded. They aren't going anywhere.

All the trolls and blind fanatics will stop there because they are banned from all other places.