Thursday, August 15th 2019

NVIDIA Announces Financial Results for Second Quarter Fiscal 2020

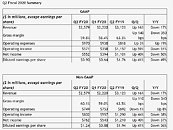

NVIDIA today reported revenue for the second quarter ended July 28, 2019, of $2.58 billion compared with $3.12 billion a year earlier and $2.22 billion in the previous quarter. GAAP earnings per diluted share for the quarter were $0.90, compared with $1.76 a year ago and $0.64 in the previous quarter. Non-GAAP earnings per diluted share were $1.24 compared with $1.94 a year earlier and $0.88 in the previous quarter.

"We achieved sequential growth across our platforms," said Jensen Huang, founder and CEO of NVIDIA. "Real-time ray tracing is the most important graphics innovation in a decade. Adoption has reached a tipping point, with NVIDIA RTX leading the way. "NVIDIA accelerated computing momentum continues to build as the industry races to enable the next frontier in artificial intelligence, conversational AI, as well as autonomous systems like self-driving vehicles and delivery robots," he said.NVIDIA will pay its next quarterly cash dividend of $0.16 per share on September 20, 2019, to all shareholders of record on August 29, 2019. The first priority for the company's cash balance is the purchase of Mellanox Technologies, Ltd. The company will return to repurchasing its stock after the close of the Mellanox acquisition. The regulatory approval process for this acquisition is progressing as expected, and NVIDIA continues to work toward closing the deal by the end of this calendar year.

NVIDIA's outlook for the third quarter of fiscal 2020 is as follows:

Revenue is expected to be $2.90 billion, plus or minus 2 percent.

Since the end of the first quarter of fiscal 2020, NVIDIA has achieved progress in these areas:

Data Center

"We achieved sequential growth across our platforms," said Jensen Huang, founder and CEO of NVIDIA. "Real-time ray tracing is the most important graphics innovation in a decade. Adoption has reached a tipping point, with NVIDIA RTX leading the way. "NVIDIA accelerated computing momentum continues to build as the industry races to enable the next frontier in artificial intelligence, conversational AI, as well as autonomous systems like self-driving vehicles and delivery robots," he said.NVIDIA will pay its next quarterly cash dividend of $0.16 per share on September 20, 2019, to all shareholders of record on August 29, 2019. The first priority for the company's cash balance is the purchase of Mellanox Technologies, Ltd. The company will return to repurchasing its stock after the close of the Mellanox acquisition. The regulatory approval process for this acquisition is progressing as expected, and NVIDIA continues to work toward closing the deal by the end of this calendar year.

NVIDIA's outlook for the third quarter of fiscal 2020 is as follows:

Revenue is expected to be $2.90 billion, plus or minus 2 percent.

- GAAP and non-GAAP gross margins are expected to be 62.0 percent and 62.5 percent, respectively, plus or minus 50 basis points.

- GAAP and non-GAAP operating expenses are expected to be approximately $980 million and $765 million, respectively.

- GAAP and non-GAAP other income and expense are both expected to be income of approximately $25 million.

- GAAP and non-GAAP tax rates are both expected to be 10 percent, plus or minus 1 percent, excluding any discrete items. GAAP discrete items include excess tax benefits or deficiencies related to stock-based compensation, which are expected to generate variability on a quarter by quarter basis.

Since the end of the first quarter of fiscal 2020, NVIDIA has achieved progress in these areas:

Data Center

- Announced breakthroughs in language understanding that allow organizations to enable real-time conversational AI, with record-setting performance in running training and inference on the BERT AI language model.

- Announced that NVIDIA's DGX SuperPOD - which provides the AI infrastructure for the company's autonomous-vehicle development program - was ranked the world's 22nd fastest supercomputer and that its reference architecture is available commercially through partners.

- Set eight records in AI training performance in the latest MLPerf benchmarking tests.

- Announced support for Arm CPUs, providing a new path to build highly energy-efficient, AI-enabled exascale supercomputers.

- Supercharged its GPU lineup with GeForce RTX 2060 SUPER, GeForce RTX 2070 SUPER and GeForce RTX 2080 SUPER, delivering best-in-class gaming performance and real-time ray tracing.

- Announced that new blockbuster titles including Call of Duty: Modern Warfare, Cyberpunk 2077, Watch Dogs: Legion, and Wolfenstein: Youngblood will feature ray tracing, propelling the momentum of RTX technology.

- Unveiled the new NVIDIA Studio platform for the world's tens of millions of online and studio-based creatives, with the introduction of 27 new RTX Studio laptops powered by GeForce RTX and Quadro RTX GPUs.

- Announced the launch of 25 more gaming laptops by major makers fueled by NVIDIA Turing GPUs, bringing the total number of Turing laptops to more than 100.

- Announced that in its first full year, NVIDIA RTX ray tracing has emerged as the new industry standard in product design, architecture, effects and scientific visualization, with the support of more than 40 key applications, including eight introduced at SIGGRAPH.

- Rolled out a full range of Turing architecture-based Quadro GPUs for mobile workstations with global system providers.

- Volvo Group announced that it is using the NVIDIA DRIVE end-to-end autonomous driving platform to train networks in the data center, test them in simulation and deploy them in self-driving vehicles, targeting freight transport, refuse and recycling collection, public transport, construction, mining, forestry and more.

19 Comments on NVIDIA Announces Financial Results for Second Quarter Fiscal 2020

Thank god, Q1 was even worse.I think it depends on how you rate current offerings.

200$ rebate on the 2080 to become 2070 SUPER : that's the normal price

Seams strange to blurt out such nonsense when your selling 1660's etc , he shouldnt sometimes sound like he's sweating , as a CEO i mean.

by 2023 i May HAVE to get an RTX card , i'll bite sooner no doubt but now is not that time.

I don't see nVidia sweating until their market share slips.... right now there are more 1060s in use than all AMD cards combined.

AMD doesn't have a card in the Top 10

AMD has just 2 cards in the Top 25 (11th and 25th)

Both Vega's *combined* have only 0.28% of the market after 24 months

The 1660 has 0.40% (5 months)

The 1660 Ti has 0.63% (6 months)

The 2060 has 1.03% (7 months)

The 2070 has 1.20% (12 months)

The 2080 has 0.75% (11 months)

The 2080 Ti has 0.41% (11 months)

Since March, the 580s market share has gone up 0.28%

Since March, the 570s market share has gone up 0.36%

Since March, the 1660 Tis market share has gone up 0.63%

Since March the 2070s market share has gone up 0.55%

Since May, the 1660s market share has gone up 0.40%

Since May, the 2080 Tis market share has gone up 0.40%

Since May, the 2060s market share has gone up 0.76%

Yes, AMD has greatly reduced the performance deficit in several market niche's ... but the "silver medal" doesn't get ya picture on a Wheaties box. They need to get a win ... and they can't hurt themselves launching a Radeon VII in February for (still proced at $700) runs neck and neck with the 2070 ($425) and then come out with $430 - $450 AIB 5700 XT cards in June are nipping at its heels. However, having done what they've done efficiency wise with the latest launch, I think the next launch might just be sonmething woirth crowing about.

That way ,the educated amongst us can discount your statement without comment , as is your implications that this is absolute fact and generally accepted as the way is defective, Many argue against such definitely arguable statistics that point to many using intel to game on, a feat I've yet to witness Anybody doing(though I except my first world perspective isn't the only one).

And you realise that 2080 probably got reduced when the supers demonstrated perfectly that nvidia Knew they were gouging and went for reflashing cards to downgrade them to supers so they might actually sell them at a price closer to what they are worth for binned slightly defective chips.

there are certain things we can look to though, patterns that do matter. right now I am impressed my Lisa Su and her ability to have rallied a failing company. morale on the battlefield is perhaps the most important thing even if outnumbered, it similar in corporations. if I worked for Intel, I would not give 110%, because Intel is the status quo, the steady salary, the come home to your fenced in yard. AMD I would give 110% if I worked there while working in a single bedroom apartment, a message of privacy, security, risks of the future if we let monopolies take over, open source king, Lisa Su being an engineering doctorate herself and not a corporate shill, and so on and so forth.

I would however, ask Lisa Su to hire more engineers for the graphics driver side of things... it's so close... but no cigar. Maybe the rx 5800 XT will change my outlook, time to be patient one more time.

Never despair, always be patient. Time is on our side, as always, it's not our paycheck after all :)

Nvidia has made the mistake of releasing a gen that is only favorable to those who didn't buy into their last price hike for Pascal on the 1080 and upwards. And then introduced a feature that can only be enjoyed on the cards that aren't interesting. Turing is really only worth it if you've been sitting at GTX 1060~1070 or lower performance. So really, both GPU vendors are serving the low and midrange this round. Even with Super cards, the best offer is a 1080ti equivalent and the rest can safely be ignored.

If you want to compare things, compare what's comparable. It's like comparing a multi-socket Xeon with an i7.

Thus, if you look at numbers, you'll see that Nvidia shifted the whole thing :

Now you can compare prices ! And oh surprise, the 1080Ti successor is at 500$ MSRP ! You can even use 600$ if you're picky.

Now they match AMD perf/price on these cards (2060 S /2070 S/2080 S).

Yes there previous prices was awful, but not the "SUPER" cut on prices. I bought my 2070 for 389€ less than a week ago. and not 500$ as it's original price was.

Still, the 2070 SUPER/2080 is @600€ around, for 10% more FPS (any resolution), so for +30% in price, it's not worth it even if it's still Nvidia pricing. It always has been on very high-end cards.

Example : www.techpowerup.com/gpu-specs/geforce-rtx-2060.c3310

Look the difference between cards.

1060 => 2060 +50% in performance

1070 => 2070 +33% in performance

1080 => 2080 +33% in performance

So I was gentle with my 15%. remember there's no shrink, no new design, nothing. Just more silicon and higher clocks.

1060 = 4.4B transistors

2060 = 11B transistors ...

You can't expect, at the same node, a GPU twice bigger, at the price.