Friday, November 15th 2019

NVIDIA Announces Financial Results for Third Quarter Fiscal 2020

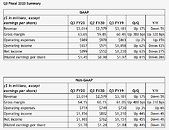

NVIDIA today reported revenue for the third quarter ended Oct. 27, 2019, of $3.01 billion compared with $3.18 billion a year earlier and $2.58 billion in the previous quarter. GAAP earnings per diluted share for the quarter were $1.45, compared with $1.97 a year ago and $0.90 in the previous quarter. Non-GAAP earnings per diluted share were $1.78, compared with $1.84 a year earlier and $1.24 in the previous quarter.

"Our gaming business and demand from hyperscale customers powered Q3's results," said Jensen Huang, founder and CEO of NVIDIA. "The realism of computer graphics is taking a giant leap forward with NVIDIA RTX. "This quarter, we have laid the foundation for where AI will ultimately make the greatest impact. We extended our reach beyond the cloud, to the edge, where GPU-accelerated 5G, AI and IoT will revolutionize the world's largest industries. We see strong data center growth ahead, driven by the rise of conversational AI and inference."NVIDIA will pay its next quarterly cash dividend of $0.16 per share on Dec. 20, 2019, to all shareholders of record on Nov. 29, 2019. The company will return to repurchasing its stock after closing the acquisition of Mellanox Technologies, Ltd. Although discussions with the European Union and China regulatory bodies are progressing and closing the acquisition is possible by the end of this calendar year, the company believes the closing will likely occur in the early part of calendar 2020.

NVIDIA's outlook for the fourth quarter of fiscal 2020 does not include any contribution from the pending acquisition of Mellanox and is as follows:

Since the end of the second quarter of fiscal 2020, NVIDIA has achieved progress in these areas:

Gaming

"Our gaming business and demand from hyperscale customers powered Q3's results," said Jensen Huang, founder and CEO of NVIDIA. "The realism of computer graphics is taking a giant leap forward with NVIDIA RTX. "This quarter, we have laid the foundation for where AI will ultimately make the greatest impact. We extended our reach beyond the cloud, to the edge, where GPU-accelerated 5G, AI and IoT will revolutionize the world's largest industries. We see strong data center growth ahead, driven by the rise of conversational AI and inference."NVIDIA will pay its next quarterly cash dividend of $0.16 per share on Dec. 20, 2019, to all shareholders of record on Nov. 29, 2019. The company will return to repurchasing its stock after closing the acquisition of Mellanox Technologies, Ltd. Although discussions with the European Union and China regulatory bodies are progressing and closing the acquisition is possible by the end of this calendar year, the company believes the closing will likely occur in the early part of calendar 2020.

NVIDIA's outlook for the fourth quarter of fiscal 2020 does not include any contribution from the pending acquisition of Mellanox and is as follows:

- Revenue is expected to be $2.95 billion, plus or minus 2 percent. Strong sequential growth is expected in Data Center, offset by a seasonal decline in GeForce notebook GPUs and SoC modules for gaming platforms.

- GAAP and non-GAAP gross margins are expected to be 64.1 percent and 64.5 percent, respectively, plus or minus 50 basis points.

- GAAP and non-GAAP operating expenses are expected to be approximately $1.02 billion and $805 million, respectively.

- GAAP and non-GAAP other income and expense are both expected to be income of approximately $25 million.

- GAAP and non-GAAP tax rates are both expected to be 9 percent, plus or minus 1 percent, excluding any discrete items. GAAP discrete items include excess tax benefits or deficiencies related to stock-based compensation, which are expected to generate variability on a quarter by quarter basis.

Since the end of the second quarter of fiscal 2020, NVIDIA has achieved progress in these areas:

Gaming

- Announced with Microsoft that Minecraft, the world's most popular computer game, will feature ray tracing.

- Announced SUPER versions of GeForce GTX TM GPUs with GeForce GTX 1650 SUPER, and GeForce GTX 1660 SUPER, successor to GeForce GTX 1060, the world's best-selling GPU.

- Introduced the RTX Broadcast Engine, which uses the AI capabilities of GeForce RTX GPUs to enable virtual greenscreens, filters and AR effects in livestreaming.

- Announced two new models of the SHIELD TV streaming media player, which bring unmatched levels of home entertainment, gaming and AI capabilities to the living room.

- Expanded the reach of GeForce NOW TM game streaming, with the service announced by Taiwan Mobile and Russia's Rostelcom with GFN.ru, which joined Korea's LG U+ and Japan's SoftBank.

- Launched the NVIDIA EGX Intelligent Edge Computing Platform to bring accelerated AI to retail, manufacturing, telecommunications, logistics and other industries, with Walmart, BMW, NTT East, Procter & Gamble and Samsung Electronics among early adopters.

- Collaborated with Microsoft to provide an optimized hybrid-cloud platform combining Microsoft Azure software with NVIDIA EGX powered by NVIDIA T4 GPUs to address edge-computing demand.

- Entered the 5G telecom market, enabling telcos to build high-performing, efficient, virtualized 5G radio access networks using GPUs, in collaboration with Ericsson.

- Announced a collaboration with Red Hat to deliver software-defined 5G RAN using Red Hat OpenShift and GPU-accelerated servers.

- Won the first inference benchmark, MLPerf Inference 0.5, measuring AI workload performance in data centers and at the edge.

- Partnered with VMware to accelerate VMware Cloud on AWS using NVIDIA T4 GPUs and introduced the new NVIDIA vComputeServer software for enterprises to run AI workloads on GPU servers in virtualized environments.

- Announced that the United States Postal Service will use NVIDIA AI technology to improve its package data-processing efficiency.

- Announced that more than 40 creative and design applications, including three from Adobe -- Adobe Dimension, Substance Alchemist and Premiere Pro -- are now accelerated by RTX technology.

- Introduced Jetson Xavier NX, the world's smallest, most powerful AI supercomputer for robotic and embedded computing devices at the edge.

10 Comments on NVIDIA Announces Financial Results for Third Quarter Fiscal 2020

Current pricing clearly works. Results are very good.

If results are the same with increased pricing, then they have sold less cards.

If they had sold they same amount of cards with new pricing, then they would have made more money.

Companies are interested in revenue and profits, not in volume. And the revenue is fine. They also increased gross margin.

And while AMD may be selling more cards, it means Nvidia managed to win the high-end client, while AMD grows in the low-end and APUs.

But this doesn't make Nvidia an "expensive brand" (or "luxurious"), because they still sell more than the competition. They're still mainstream.

Poor Nvidia, no one is buying your products because of ridiculous pricing.

Anytime now Tim will be calling up Jensen for pricing guidance...

They make some pointless proprietary technologies and sell them for prices market will never accept. And RTRT? It's idiotic. No one will use it. It will never become mainstream. NEVEEEER!! AAAAAARRGHH!

In the meantime, another large GPU maker keeps watching the stars hoping for a direction...