Thursday, June 17th 2021

Secondary Market GPU Pricing in Downtrend, Better Times to be a Gamer May be Ahead

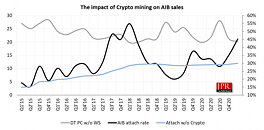

Millions of bytes have been written regarding the current GPU market conditions already, which pairs strained logistics channels due to COVID-19 with increased quarantine-fueled demand by gamers - while also throwing in semiconductor manufacturing woes, miners, and scalpers. All in all, it seems that miners and scalpers managed to get their hands on roughly 25% (around 700,000) of distributed current-gen graphics cards during Q1 2021 which, for some reason, seems much lower than the general perception on their impact on this market.

With that said, Reddit user @gregable aggregated daily pricing for GPUs on Ebay and then calculated the GPU's $/hashrate for Ethereum mining. With hashrates remaining steady for graphics cards, this effectively establishes a price trend for GPUs. The news are good, for once: prices are falling, with the average $ cost per MH falling from $26 on May 16th down to $20 as of yesterday. The move is supported mostly by price drops on high hash-rate graphics cards such as the RTX 3090 (a 32% price drop during this period) and RTX 3080/RTX 3070 graphics cards (which dropped by 25%).That these are the cards being flipped the most at this point in time makes sense for two reasons: ETH 2.0 being around the corner, which will render Ethereum mining obsolete, and the relative improvement in graphics cards' availability, which helps bring prices further down. Since these are the costliest graphics cards, and present the greatest investment risk should their cost not be recouped via mining, miners are offloading these first, in an attempt to make up for their investment and/or to still get some $ in while pricing is still high. Summer might bring in added demand from the consumer market for GPUs, and then there's the backlog of orders that still have to be served and which will keep availability lower than usual, but it seems things are generally improving for the average gamer.

Source:

Tom's Hardware

With that said, Reddit user @gregable aggregated daily pricing for GPUs on Ebay and then calculated the GPU's $/hashrate for Ethereum mining. With hashrates remaining steady for graphics cards, this effectively establishes a price trend for GPUs. The news are good, for once: prices are falling, with the average $ cost per MH falling from $26 on May 16th down to $20 as of yesterday. The move is supported mostly by price drops on high hash-rate graphics cards such as the RTX 3090 (a 32% price drop during this period) and RTX 3080/RTX 3070 graphics cards (which dropped by 25%).That these are the cards being flipped the most at this point in time makes sense for two reasons: ETH 2.0 being around the corner, which will render Ethereum mining obsolete, and the relative improvement in graphics cards' availability, which helps bring prices further down. Since these are the costliest graphics cards, and present the greatest investment risk should their cost not be recouped via mining, miners are offloading these first, in an attempt to make up for their investment and/or to still get some $ in while pricing is still high. Summer might bring in added demand from the consumer market for GPUs, and then there's the backlog of orders that still have to be served and which will keep availability lower than usual, but it seems things are generally improving for the average gamer.

45 Comments on Secondary Market GPU Pricing in Downtrend, Better Times to be a Gamer May be Ahead

I'd have to save for a year (maybe longer) to get one.

GTFO

Oh and i sold my 1070 on ebay for $400. POGCHAMP

One thing is certain though, mining has made it a lot worse.

complete with cpu,ram,mobo,ssd, psu, case .... if anybody wanting an upgrade to their systems, its a good time to buy.

theres quite a few 10,11th gen i7's and amd 5600x 5800x systems..

So it has always been with every new generation that launched, the first month or two you would see stock disappear fast, unfortunately, this time, the launch coincided with the crypto bull market, making the problem 100x times worse.

It's not just me saying so. The evidence is there if you want to look, don't look at what nVidia's chart says, look at where the cards are actually at, an example? Okay, this is just 1x person, in his home... this isn't even the countless other warehouses that are also owned by only one person, that have thousands of cards in them, THOUSANDS.

EtherMining/comments/nfppnv

We are but gamers, some of us at least, can't tell anymore these days, we only buy 1x card, maybe two if there was still SLi / Crossfire.

See, you aren't entirely wrong, I'd just word it differently. Probably my former journalist trying to correct myself still... lol.