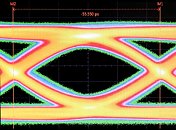

Rambus Achieves Industry-Leading GDDR6 Performance at 18 Gbps

Rambus Inc., a premier silicon IP and chip provider making data faster and safer, today announced it has achieved industry-leading 18 Gbps performance with the Rambus GDDR6 Memory PHY. Running at the industry's fastest data rate of 18 Gbps, the Rambus GDDR6 PHY IP delivers peak performance four-to-five times faster than current DDR4 solutions and continues the company's longstanding tradition of developing leading-edge products. The Rambus GDDR6 PHY pairs with the companion GDDR6 memory controller from the recent acquisition of Northwest Logic to provide a complete and optimized memory subsystem solution.

Increased data usage in applications such as AI, ML, data center, networking and automotive systems is driving a need for higher bandwidth memory. The coming introduction of high-bandwidth 5G networks will exacerbate this challenge. Working closely with our memory partners, the Rambus GDDR6 solution gives system designers more options in selecting the memory system that meets both their bandwidth and cost requirements.

Increased data usage in applications such as AI, ML, data center, networking and automotive systems is driving a need for higher bandwidth memory. The coming introduction of high-bandwidth 5G networks will exacerbate this challenge. Working closely with our memory partners, the Rambus GDDR6 solution gives system designers more options in selecting the memory system that meets both their bandwidth and cost requirements.