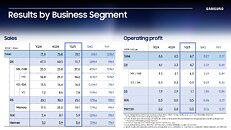

Tariff Effects and China Subsidies Soften 1Q25 Downturn; Foundry Revenue Decline Narrows to 5.4%

TrendForce's latest investigations find that the global foundry industry recorded 1Q25 revenue of US$36.4 billion—a 5.4% QoQ decline. The downturn was softened by last-minute rush orders from clients ahead of the U.S. reciprocal tariff exemption deadline, as well as continued momentum from China's 2024 consumer subsidy program. These factors help offset the typical seasonal slump.

Looking ahead to Q2, the effects of tariff-driven early procurement are expected to fade and lead to a general slowdown. However, continued demand from China's subsidy program, along with pre-launch inventory builds for new smartphone models and stable AI HPC demand, are expected to support capacity utilization and drive a revenue rebound for the top 10 foundries.

Looking ahead to Q2, the effects of tariff-driven early procurement are expected to fade and lead to a general slowdown. However, continued demand from China's subsidy program, along with pre-launch inventory builds for new smartphone models and stable AI HPC demand, are expected to support capacity utilization and drive a revenue rebound for the top 10 foundries.